© 2026 Followme

Liked

Liked

Liked

Liked

Liked

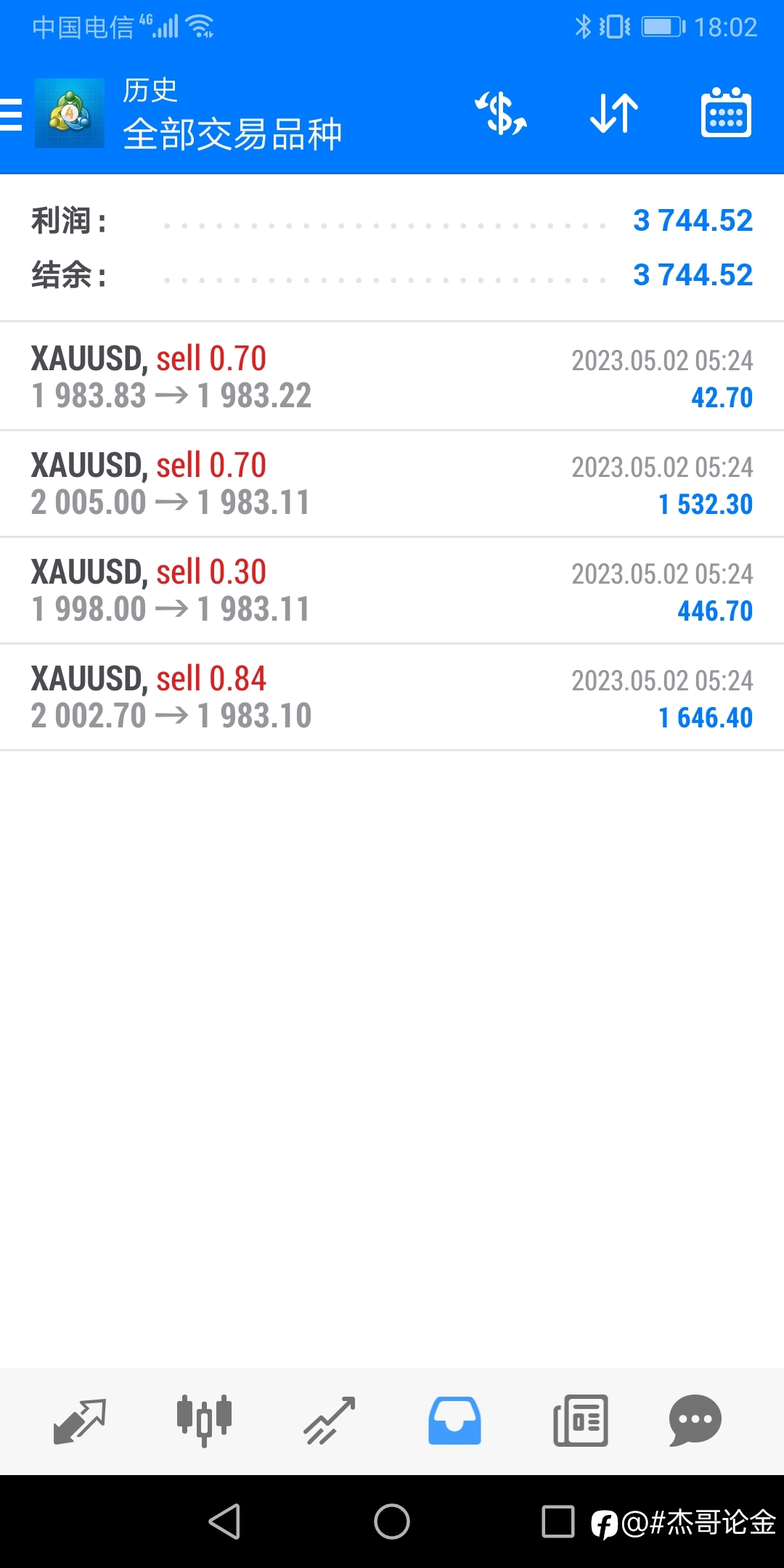

- 长期野心控制短期欲望 :有钱人就是不一样

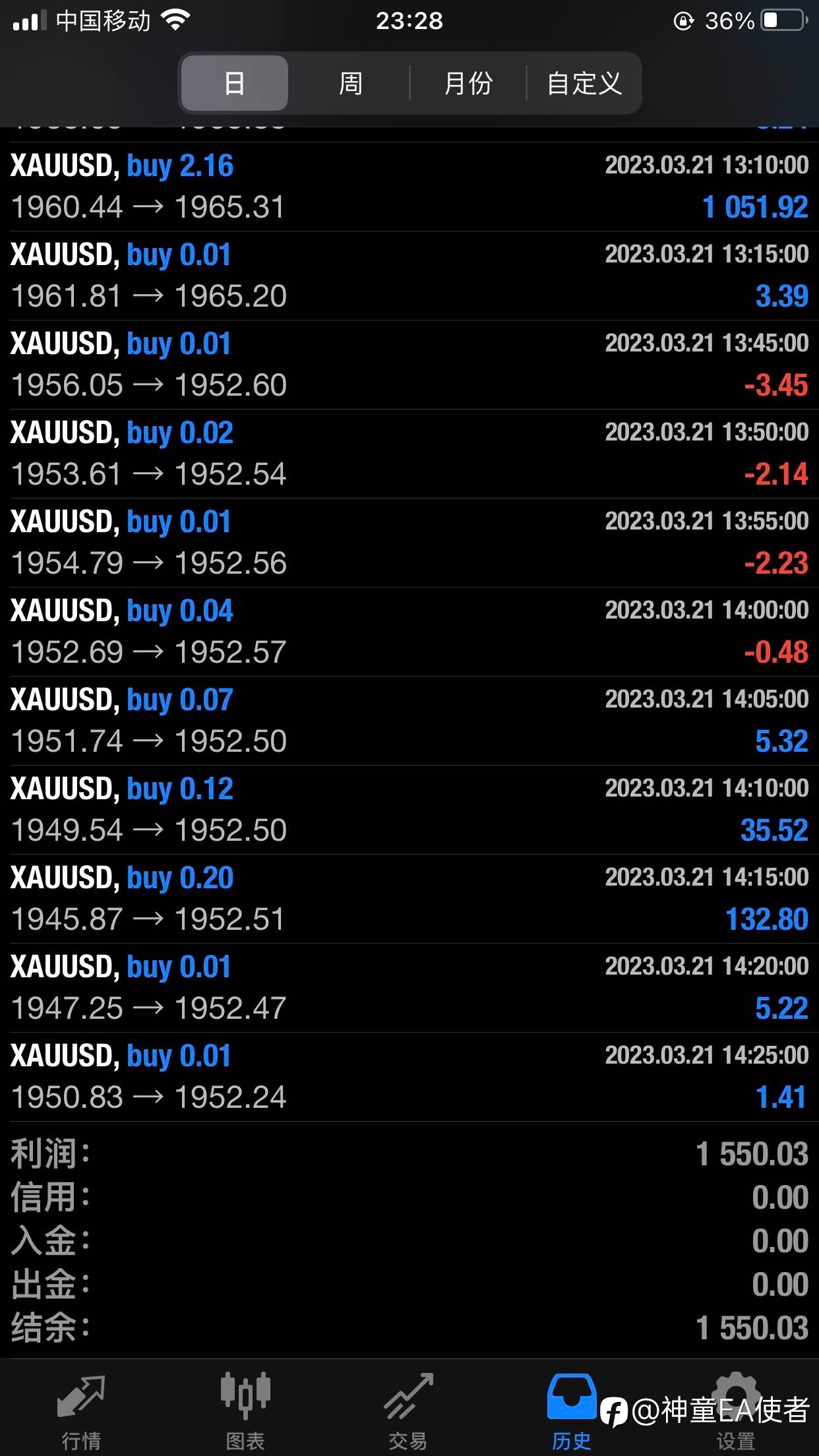

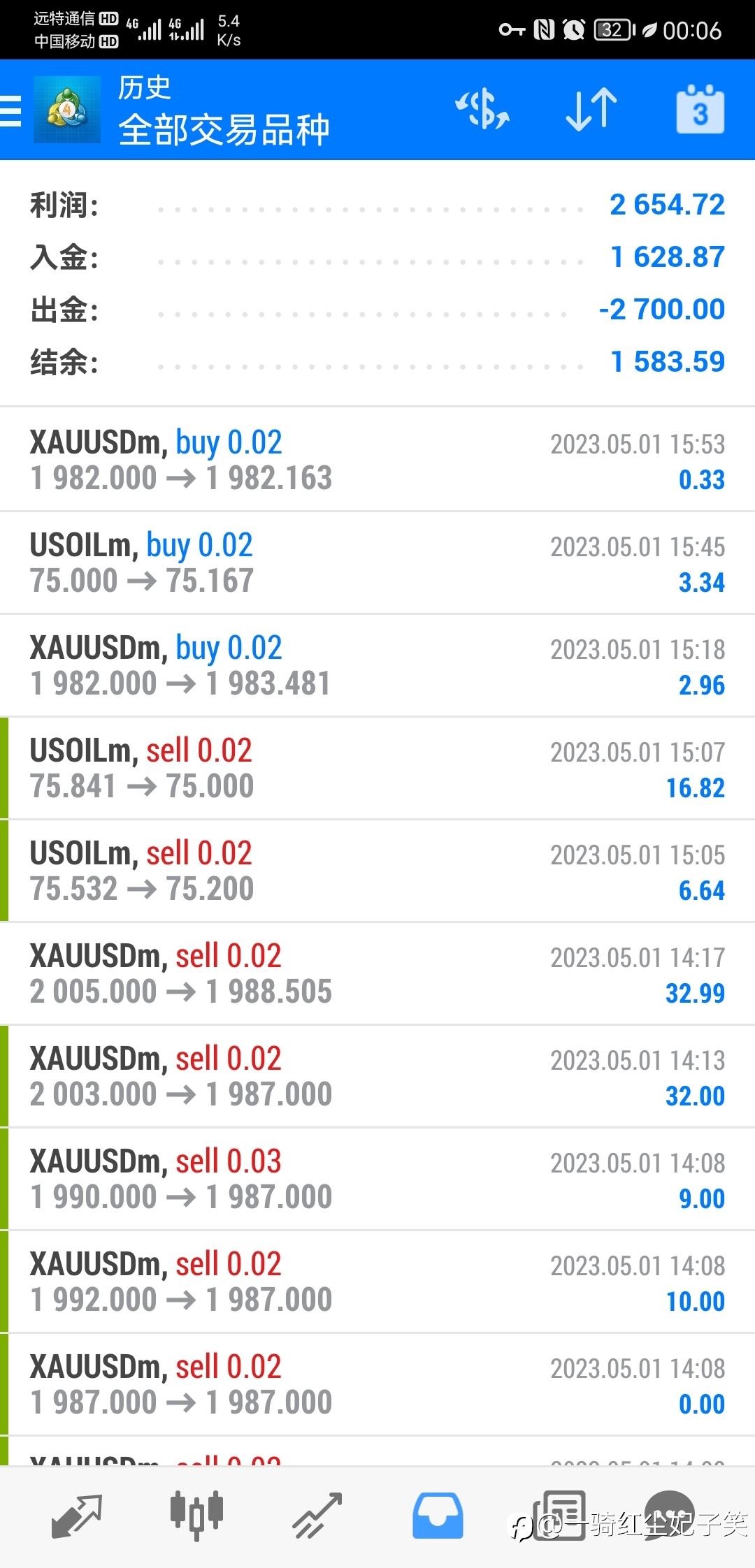

- 吴丹丹 :你还真应证了一句话 钱都是大风刮来的😂

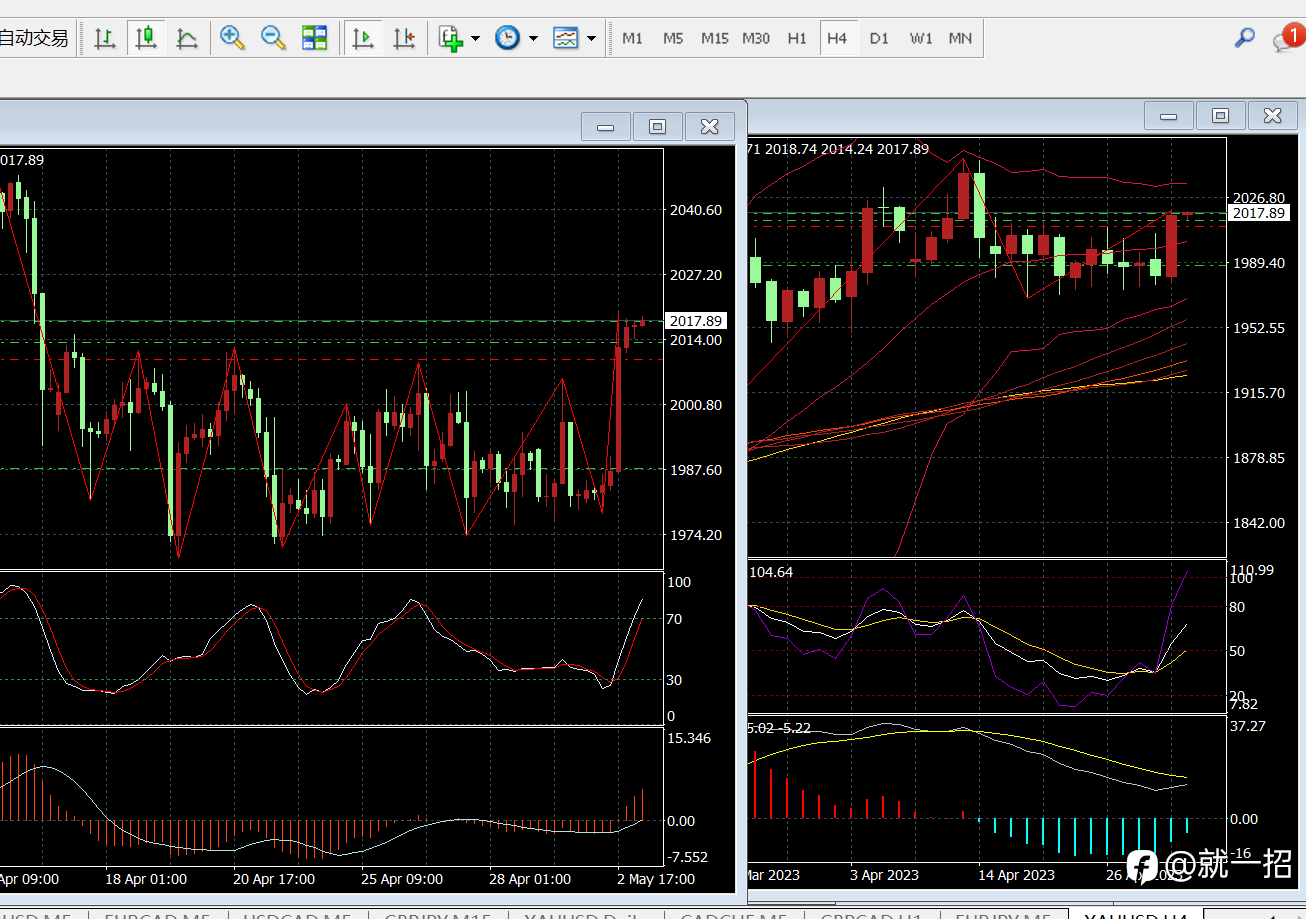

- 世界之王 :刚刚看了一下 你有100多个挂上来了 为什么要开那么多账户 开这么多作用是?

Liked

Liked

Liked

Liked