© 2026 Followme

Tại Sao Sự Tăng Trưởng Trong Mất Mát Do Lừa Đảo Đầu Tư Cho Thấy Rằng Niềm Tin và Tốc Độ Mới Là Mối Nguy Hiểm Thực Sự Trong Giao Dịch

Là một người đã theo dõi tin tức forex và giao dịch trong nhiều năm, báo cáo từ FSMA của Bỉ về khoản mất mát 23 triệu euro trong lừa đảo đầu tư trong nửa cuối năm 2025 không phải là điều ngạc nhiên, nhưng chắc chắn là

Cách Một Lừa Đảo 3 Triệu USD Nhắc Nhở Tôi Luôn Phải Thận Trọng Trong Việc Xác Minh Trước Khi Tin Cậy Vào Giao Dịch

Là người đã tham gia thị trường lâu năm, đọc câu chuyện về nhà đầu tư 85 tuổi trở thành nạn nhân của một mô hình lừa đảo qua nhóm WhatsApp khiến tôi cảm thấy rất gần gũi. Sự gia tăng của các ứng dụng giao dịch giả

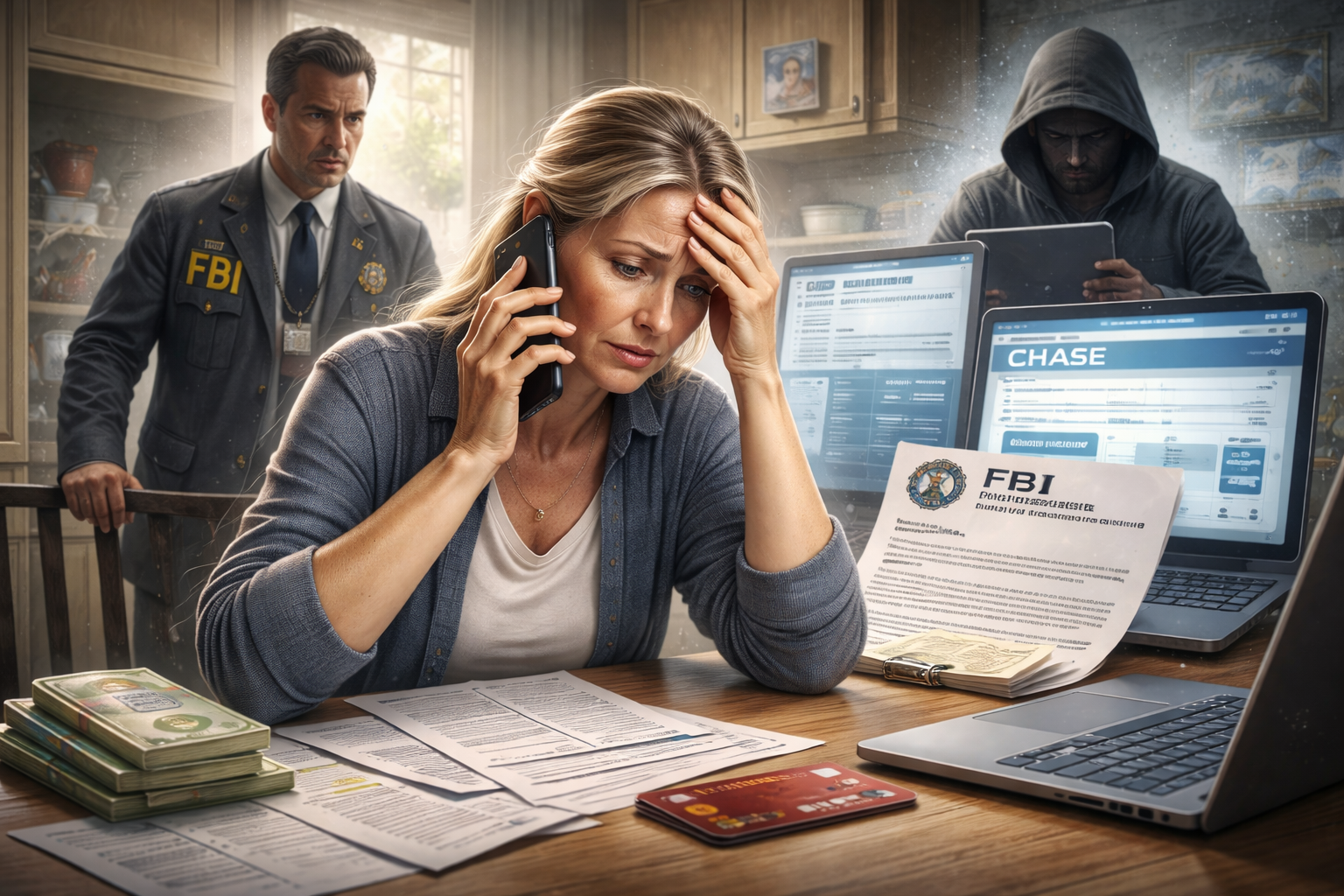

Retired Professional Trader Persona As a retired professional trader, this Houston case highlights one of the darker aspects of financial manipulation that goes beyond just market moves — it exploits human trust. Scammers impersonating trusted institutions like banks and the FBI is an old trick but with new, sophisticated technology, making it harder for even the most cautious to detect. The scam

Là một trader chuyên nghiệp đã nghỉ hưu, vụ việc tại Houston này làm sáng tỏ một trong những mặt tối của thao túng tài chính, vượt ra ngoài những biến động thị trường — nó khai thác lòng tin của co

Lời hứa lợi nhuận dễ dàng trên WhatsApp? Đó không phải giao dịch, đó là cái bẫy

Là một trader chuyên nghiệp đã nghỉ hưu, các vụ lừa đảo liên quan đến các nền tảng giả mạo đã đăng ký với SEBI ở Ấn Độ là lời nhắc nhở về mặt tối của thị trường đầu tư. Những kẻ lừa đảo lợi dụng những yếu tố yếu mềm của con người m&

Nếu “broker” sống trên Telegram và một website clone, đó không phải đầu tư, đó là cái phễu hút tiền

Là một trader chuyên nghiệp đã nghỉ hưu, tôi thấy vụ Bangladesh này là một kịch bản “bẫy nhà đầu tư nhỏ lẻ” kinh điển nhưng được khoác lên lớp công cụ hiện đại: dùng website clone để mượn uy tín, d&ugr

Khi “cược dựa trên sự kiện” biến thành “thao túng thông tin”, đó không phải may mắn, mà là một dấu hiệu đỏ

Là một trader chuyên nghiệp đã nghỉ hưu, việc một tài khoản ẩn danh kiếm được khoảng 410.000 USD từ một cược dựa trên dự đoán chính trị Venezuela khiến tôi cảm thấy đó không phải là một sự tình cờ hiếm hoi m&agrav

Ước gì tôi học được sớm hơn rằng “lợi nhuận đảm bảo” luôn che giấu cùng một cái kết

Là người đã nhiều năm tham gia thị trường, đọc về vụ Sun Pariwar ở Ấn Độ khiến tôi cảm thấy vừa quen thuộc vừa rợn người, và tôi thực sự ước bài học này đã rõ ràng với tôi từ sớm hơn. Lời hứa lợi nhuận 100% mỗi năm kh&o