© 2026 Followme

Liked

Liked

Liked

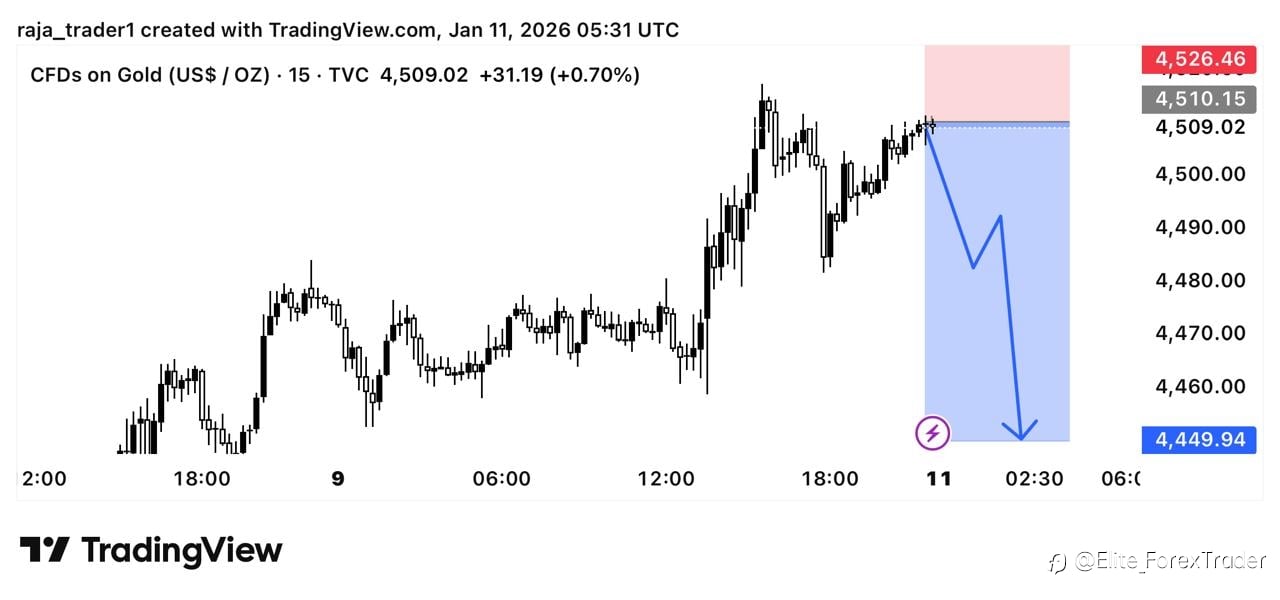

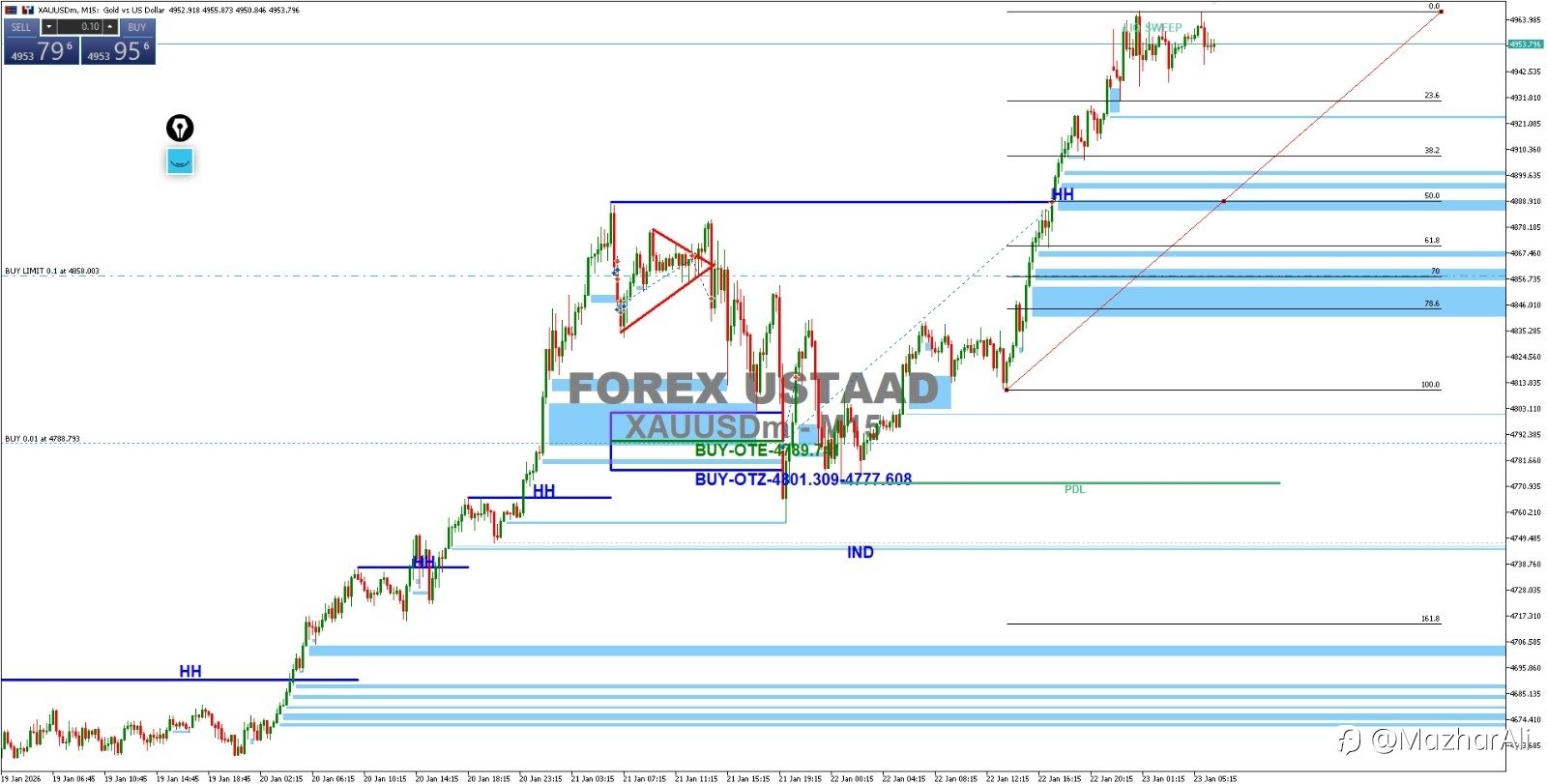

GOLD (XAUUSD) – TRADING SETUP

Direction: BUY Entry Zone: 4856.735 (near support/structure) Take Profit Targets: · TP1: 4888.910 · TP2: 4963.000 · TP3: 5100.000 Context: Price appears to be trading within a supportive structure, with the entry level aligned with a key reaction zone. The multi-tiered TP structure allows for

Liked

Liked

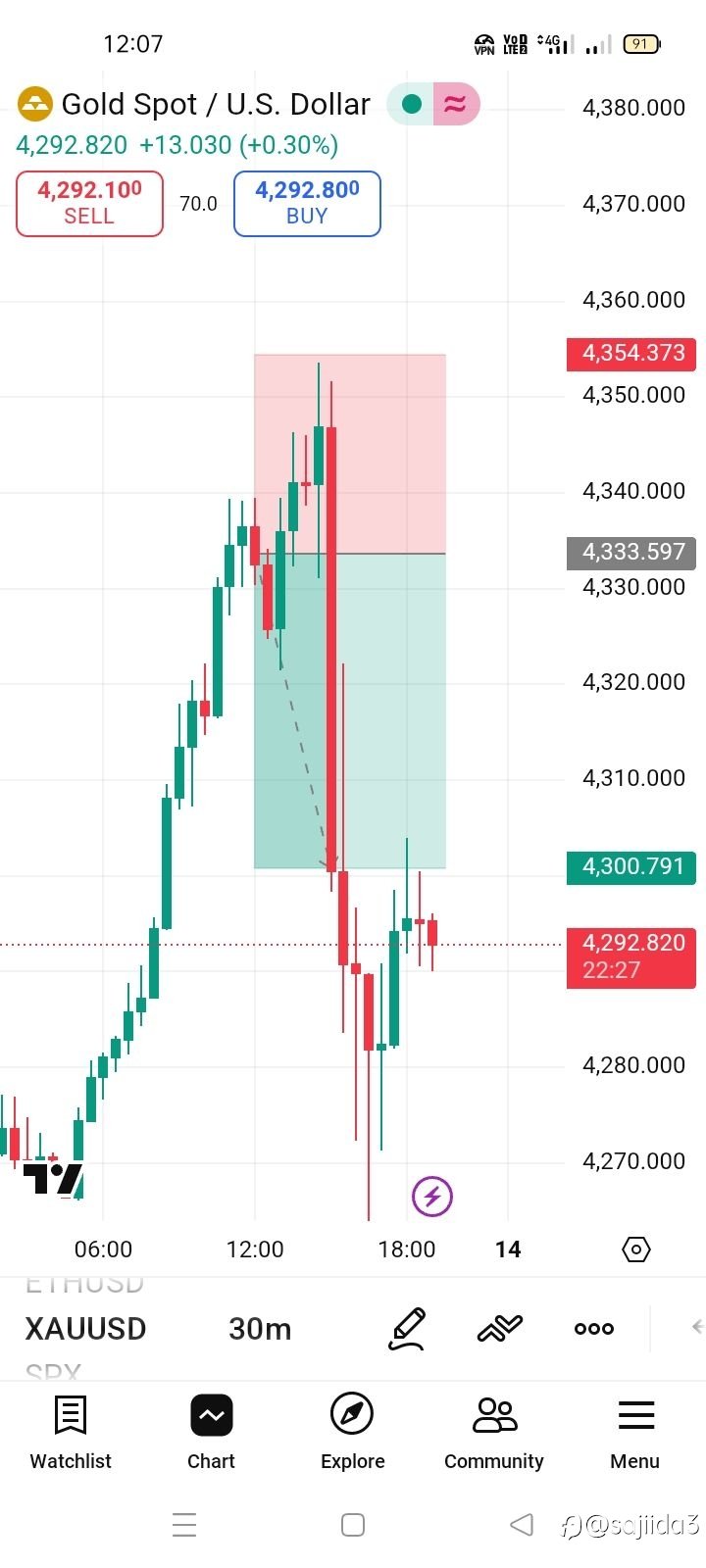

🟡 Gold Update

Market stuck in a tight range — levels are everything. 🔻 Resistance: 4618–4630 (selling pressure) 🔺 Support: 4597–4581 (demand zone) Above 4630 → upside momentum Below 4581 → intraday weakness Bias: Range-bound | Best trade: wait for confirmation #Gold #XAUUSD #TradingView #MarketLevels

Liked

Liked

Liked

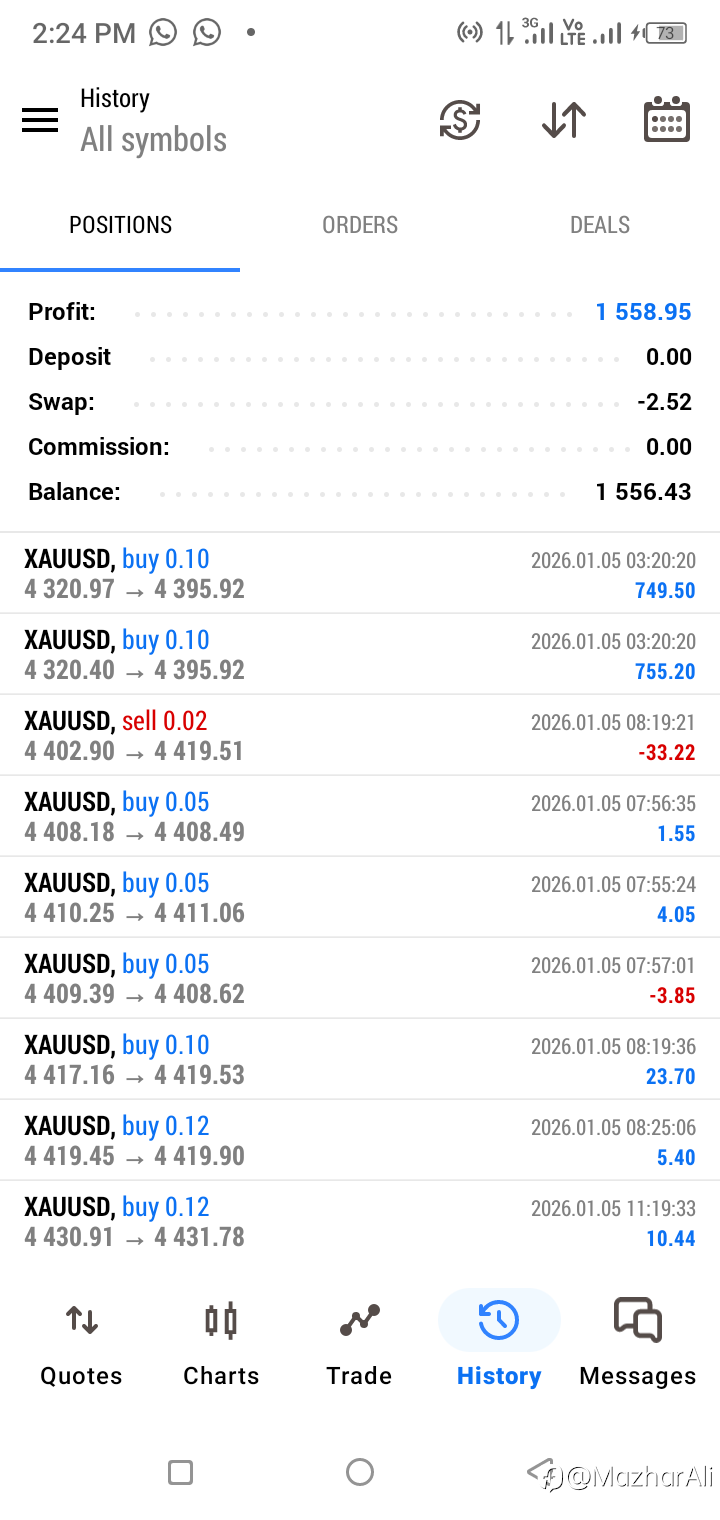

Update

🌍 Global Market Update | Trading Markets remain mixed today as traders stay cautious amid global economic signals. Volatility is creating opportunities, but patience and risk management are key. Focus on structure, not emotions — smart trades win long-term. 📊 Trade with discipline. Protect capital

Liked