© 2026 Followme

Liked

Liked

Liked

Liked

Liked

Forex and Cryptocurrency Forecast for January 19-23, 2026

The third trading week of 2026 opens with markets still pricing the balance between growth resilience, inflation trends, and the timing of the next policy steps from major central banks. Liquidity conditions may be thinner at the start of the week due to the US holiday on Monday, which can amplify i

Liked

Liked

Liked

Liked

Liked

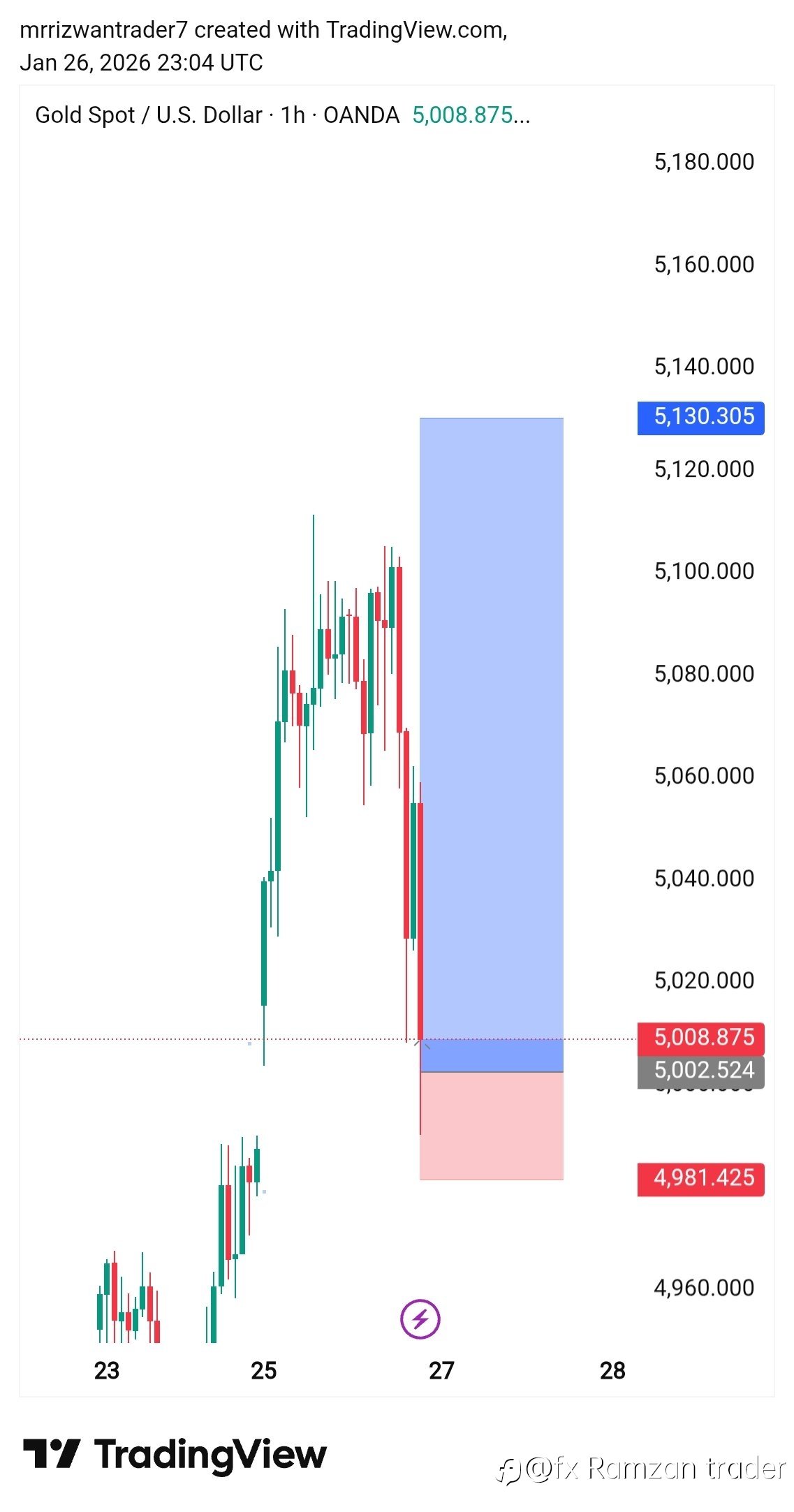

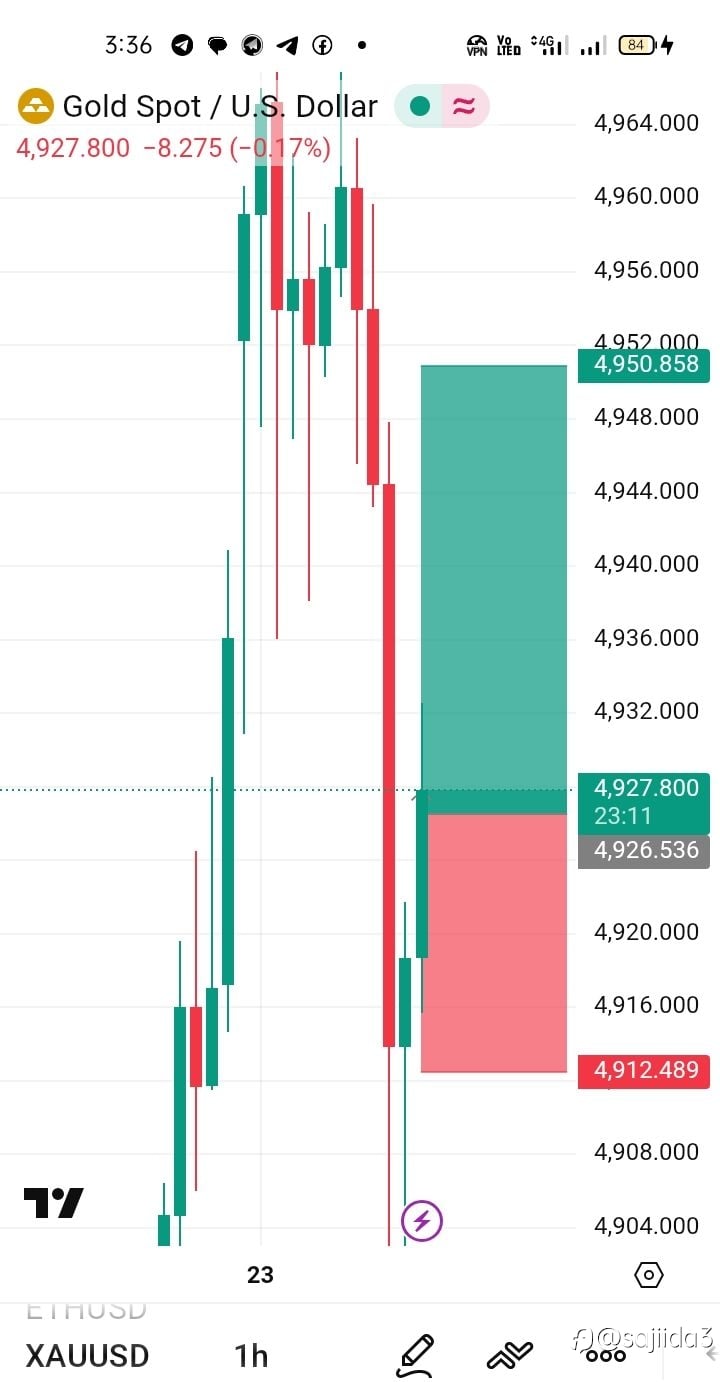

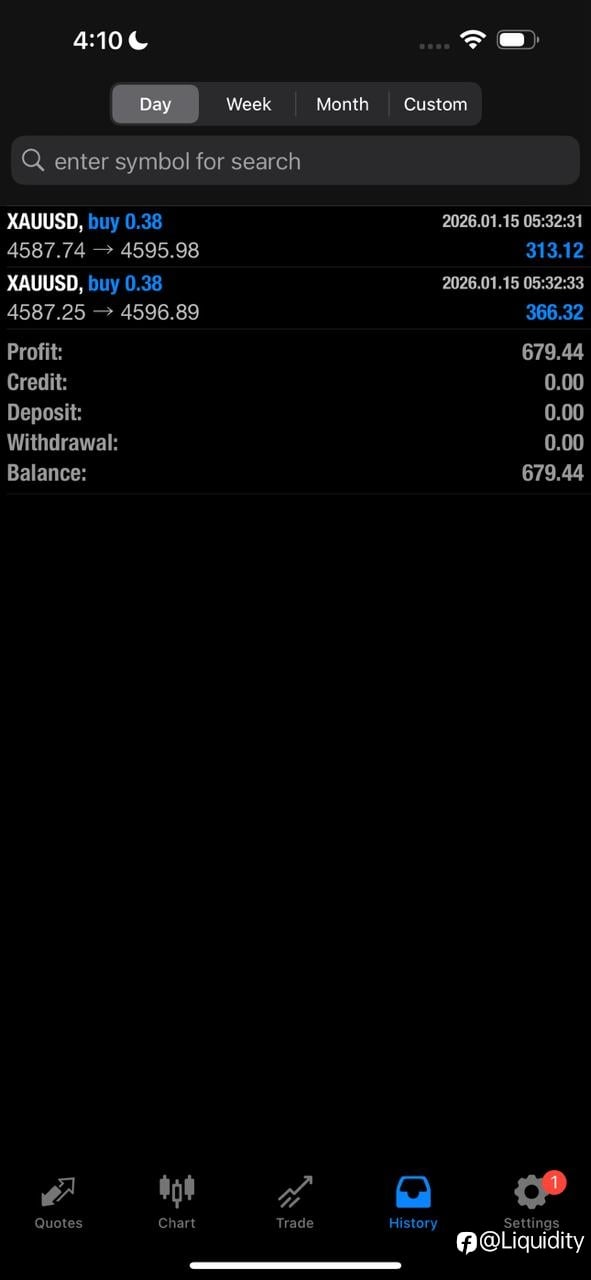

XAUUSD (GOLD) Intraday Buy Setup Analysis

Timeframe: 15-Minute Chart Instrument: Spot Gold (XAUUSD) Setup Type: BUY Trade Parameters: · Entry: 4326 · Stop Loss (SL): 4300 · Take Profit (TP): 4424 Market Context Gold has shown resilience recently, trading within a defined range on the lower timeframes. The current price action su

Liked

Benefits of Using a Boat Lift Controller

A smart boat lift controller offers a modern, efficient, and secure way to manage your boat lift. With smartphone-operated remote boat lift control, you can raise or lower your lift from anywhere. This eliminates waiting time at the dock and ensures your boat is positioned and ready as soon as you a