#joebidennewpresident#

994 View

387 Discuss

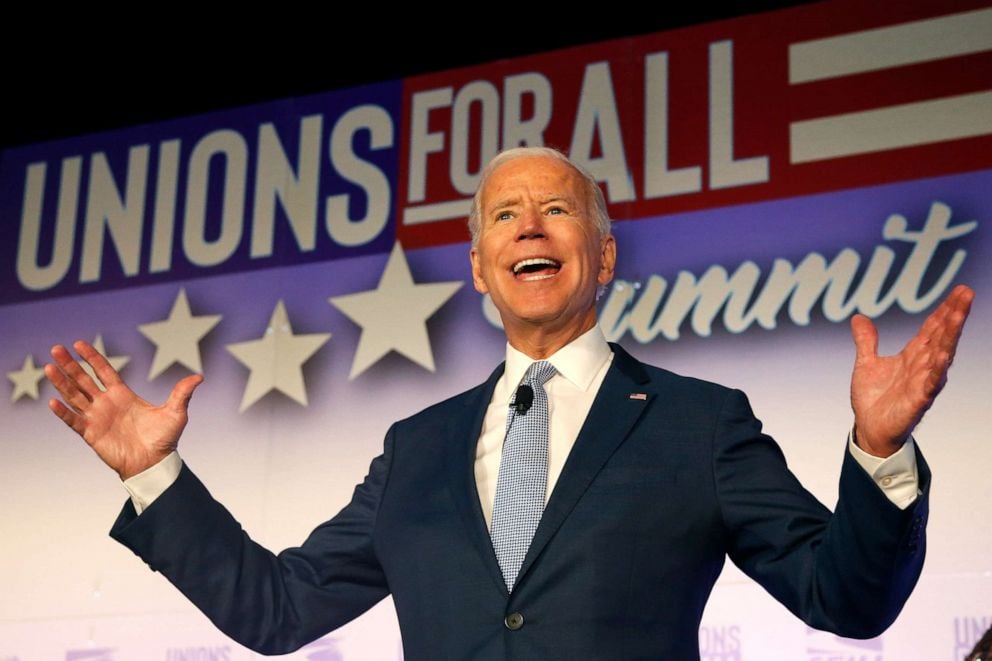

Joe Biden has officially won the 46th Presidential Election, meeting expectation as many predicted.

Tác động của việc Mỹ chia tách các công ty công nghệ của Trung Quốc và Ấn Độ

Theo báo cáo trước đó của Reuters, Trump dự kiến sẽ tiếp tục có thái độ đối đầu với ngành công nghệ Trung Quốc, với việc đưa nhà sản xuất chip hàng đầu SMIC vào danh sách các công ty liên kết với quân đội Trung Quốc. Theo báo cáo của “Washington Post”, trong tương lai, các chuyên gia dự đoán rằng ôn

(JPMORGAN CHASE & CO.) Research: Small Business Expenses during COVID-19

November 2020 As the COVID-19 pandemic continues to affect the physical and economic health of the U.S., policymakers continue to have an incomplete view of the financial response of the small business sector. In the early months of the pandemic, the typical small business saw substantial revenue an

InteractiveCrypto Fast Becoming Traders Favourite Crypto News Platform

The site offers the latest crypto news, educational articles and guides, in-depth studies, expert opinions, information on trading and the best brokers for cryptocurrency trading, along with digital wallets. All the cryptocurrency information and news offered on the InteractiveCrypto platform is bas

BREAKING: U.S. Electoral College Formally Confirms Joe Biden's Victory Over Trump

Photo: Reuters LANSING, Mich. (Reuters) - Democrat Joe Biden on Monday won the state-by-state Electoral College vote that formally determines the U.S. presidency, all but ending President Donald Trump's floundering campaign to overturn his loss in the Nov 3 election. California, the most populous st

BREAKING: China Stocks Retreat from Five-Year High

SHANGHAI, Nov 24 (Reuters) - China stocks ended lower on Tuesday, as investors locked in profit following a recent rally, while the market showed scant reaction to news that U.S. President-elect Joe Biden was given the go-ahead to begin his White House transition. Analysts said a Biden presidency, w

MEXGroup:港美股前瞻|美股新年遭遇“开门黑”,但新能源汽车股大幅飙升

周一,美国股市创下2016年以来最差新年开局表现,主要是全球新冠病例激增令经济复苏前景蒙阴。就目前来看,新年假期过后,美国单日确诊新冠病例飙升至近30万例的纪录水平,更易传播的变异毒株可能加剧疫情恶化。此外,佐治亚州的关键选举、街头抗议的可能性和总统特朗普对11月大选结果的负隅顽抗都有可能导致共和党分崩离析。因此,预计短期内美股或难有太强的表现,维持其为高位震荡格局。港股方面,中期而言,看多的大逻辑不变,依然是全球宽松货币环境+经济持续复苏+港股低估的背景下,将呈现螺旋式上涨结构。 回顾与热点聚焦 一、前情回顾: 美国市场:周一,美股新年遭遇“开门黑”,三大指数高开低走,跌幅均逾1%。收盘,道

Doo Prime 新年上新!新增期货产品即将上线

自2021年01月17日起,Doo Prime 将新增13个期货差价合约品种,品种开放后可于平台时间01月18日01:00起进行交易。 大宗商品期货是此次新增的最大亮点之一。2020年诸多商品期货品种均走出了流畅的趋势行情,比如玉米、铜、铁矿石等。其中黑色系期货的表现可谓一骑绝尘,全线飙涨,深受广大投资者青睐。 进入2021年,疫情及宽松的货币政策或持续,高盛认为大宗商品将在2021年迎来新一轮的牛市,而铜将是2021年的最佳金属品种。 为了及时抓住牛市起涨阶段的投资机会,并配合市场所需,Doo Prime 在此次的产品扩容中,新增了铜、玉米、黄豆、小麦等热门期货产品,将为

D Prime

MEXGroup:交易课堂 | 炒外汇的人越来越多,到底什么样的人适合炒外汇?

外汇市场具备强大的吸引力,使得全球炒外汇的队伍愈发壮大,很多投资者都想在外汇市场稳步立足。但并非所有人都能够留在外汇市场,那么什么样的人最适合炒外汇呢? 俗话说,术业有专攻,越来越多的人投入到外汇市场无非是想赚钱,但若想在外汇市场稳步盈利,就真的需要某些特质才行了。 比如很多人的条件压根就不适合练钢琴,但却有一把好嗓子,兴许练声乐就能练出来,最不济的话也能“超女”一把,或者在卡拉OK里一亮声就能艳压群芳,这种例子简直太多了! 同理,炒外汇也不是每一个人都适合做,因为在外汇市场中“成功”,指的是能长年累月地赢多输少,才算。何况,外汇市场本身就不同于其他金融、证券市场,它就有它自身的特质。只有具有

MEXGROUP丨从5万做到500万的高手告诉你,外汇交易赚钱平仓后,这4件事要记得做!

有人说交易难。 不错,但世界上赚钱的事哪个不难?如果轻而易举的就能做得很成功,那世界上其他的事还有谁会去做? 交易赚钱难是肯定的,不管你是做的股票、期货还是外汇,大部分人都会遇上难以逾越的门坎,都有感觉撑不下去的时候,这不稀奇。 所不同的是有的人挺过来了,并逐渐形成自己的交易方式和盈利习惯,而有的人则是在有此意识之前就已经被市场消灭了。 新手总是想抓住一切赚钱的机会,而老手多数想着还有哪些行情我更应该放弃,习惯性地回避未知风险,因为他知道市场里的钱是赚不完的。 MEXGROUP丨外汇交易赚钱平仓后,这4件事要记得做 今天大通金融MEXGROUP就分享一位从5万做到500万的外汇交易高手的赚钱经

MEXGroup:每日快讯 |全球股市回升提振风险偏好,短线可关注商品货币

今晚21:45,美国将公布“小非农”就业数据,目前市场预期增加5万人,前值为减少12.3万人。考虑到1月份美国疫情并未好好转,这对劳动力市场造成了比较大的压力,这组数据可能不会太好看。因此,短线在维持美元指数仍有上升动能的同时预计其上升空间仍然有限。 汇市焦点 美元方面,周二,美元指数基本持稳,盘中一度触及两个月最高91.28,主要是因美债大涨提振,以及市场认为美国复苏前景强于欧洲,从而提振了美元。今晚21:45,美国将公布“小非农”就业数据,目前市场预期增加4.5万人,前值为减少12.3万人。考虑到1月份美国疫情并未好好转,这对劳动力市场造成了比较大的压力,这组数据可能不会太好看。因此,短线

尊享 Doo Prime 新春多重福利,领高达 888 美金红包

金牛贺岁,欢乐祥瑞!Doo Prime 感谢广大客户相伴,与我们一起走过不平凡的 2020 年,让我们在多项经纪商评比中勇夺殊荣、创下最高月度交易总额的历史纪录。 为回馈客户的长期支持,Doo Prime 将于 2 月 8 日起举办“金牛开运夺头彩”新春活动,向新老客户放送无限个满载好运的开年红包,更有机会领高达888美金红包,助各位争夺牛年最强头彩,新一年交易无阻、财福双收! 活动将献上多重福利,100%中奖,金额更可随时提现,其中包括: 尊享交易红利 只要入金满1,000美金及交易1手,即可领取红包1个。入金交易越多,奖金越多,红包数量不设上限! 开户入金福利 新客户在活动期间

D Prime