US GDP growth slows markedly, and inflation remains the focus

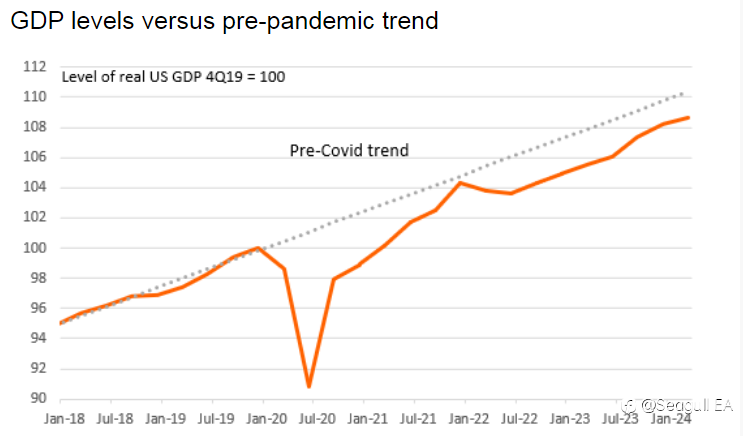

US GDP growth slowed to 1.6% annualised in the first quarter of this year, less than half the 3.4% rate recorded in 4Q23, but core inflation was stronger, picking up from a 2% annualised rate to 3.7%. This implies upside risks to tomorrow's key monthly core PCE deflator and makes a near-term rate cut even less likely.

Higher inflation catches the markets' eye, rather than weaker growth

US first quarter GDP growth is an annualised 1.6%, well below the 2.5% consensus expectation, but inflation is hotter with the core PCE deflator up 3.7% annualised versus 3.4% expected. This suggests, assuming no revisions to monthly data, that the core PCE deflator will come in above 0.4% tomorrow rather than the current 0.3%MoM consensus forecast. Unsurprisingly, Treasury yields have pushed higher as if that is the case, it makes a near-term Federal Reserve interest rate cut look even more unlikely.

As for the growth outlook, we expect to see more subdued activity in upcoming quarters. The divergence between business surveys and official data is very wide. We strongly suspect that business caution will translate into weaker hiring and wage growth and subdued business capex, and that will eventually show up in the official GDP data. The move higher in market borrowing costs this year will also weigh on activity and eventually dampen price pressures in the economy. Nonetheless, there is next to no chance of a rate cut before September.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.