Oil continues to fall on demand concerns

Oil prices fell in Thursday trading as the US dollar strengthened on expectations of an interest rate hike. The latest economic data from the US and China did not have enough impact on expectations of improvement in fuel demand.

According to a Federal Reserve report released on Wednesday, economic activity in the US has not changed much in recent weeks: employment growth has slowed somewhat, and price growth appears to have slowed down.

U.S. crude inventories fell by 4.6 million barrels last week due to increased refinery capacity and exports, while gasoline inventories jumped unexpectedly on disappointing demand, according to the US Energy Information Administration (EIA).

The drawdown in crude inventories was much stronger than analysts had forecast at 1.1 million barrels, with the American Petroleum Institute's estimate released late Tuesday at 2.7 million barrels.

On the supply side, oil loading from Russia's western ports is likely to rise to its highest level since 2019 in April, topping 2.4 million barrels a day, despite Moscow's pledge to cut output, trade and shipping sources said.

At the same time, gasoline markets in Asia are showing signs of weakness due to falling revenues from fuel production. Diesel is also lagging behind, with some refiners considering cuts in refining as margins decline. This is putting pressure on oil prices such as Murban, which has been trading in a bearish contango structure for some time.

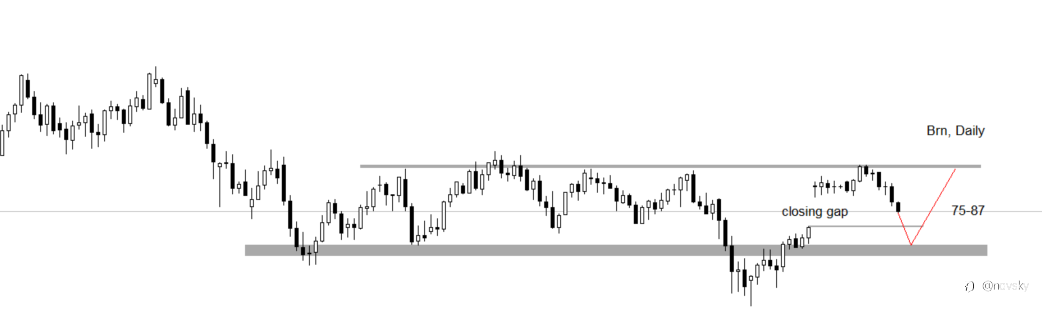

Despite this week's pullback, oil prices are still rising from a 15-month low hit in mid-March after banking turmoil. The unexpected announcement by OPEC+ to cut production and limit oil supplies from Iraq underpinned some of the gains, as did expectations of a recovery in demand in China.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.