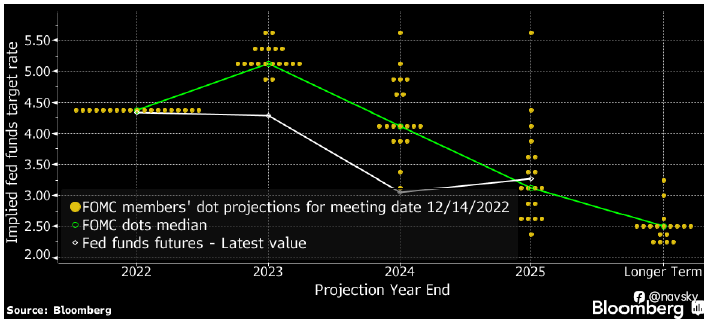

FOMC The US Federal Reserve unanimously raised the FFR by 0.50% to 4.25-4.5%, as expected. The last four rate hikes have been in increments of 0.75%.

The median FOMC dot plot for FFR at the end of 2023 is now 5.1%, well above both the previous (September) forecast of 4.6% and derivatives market expectations. Against this background, the dollar rose against the G10 currencies, and the US stock market fell by about 1.5%.

The FOMC's accompanying statement retained the word "ongoing" in reference to the rate hikes needed to reach a sufficiently restrictive level to bring inflation back to 2% over time.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-