Not much has changed since the previous global macro update except that BTC is now lower at 30k, and the S&P500 breached below 4400.

So naturally, we begin to receive the popular “can I buy the dip yet?” question…And the answer is in the first sentence of this email note Friend's.

“Not much has changed since the previous global macro update.”

Meaning… the macro conditions are still the same, bearish crypto (and stocks) due to the ongoing aggressive hawkish monetary policy regime.

The FED’s forward guidance shows continued aggressive tightening ahead. In other words, the FED is still ready to bulldoze through a recession to lower inflation.

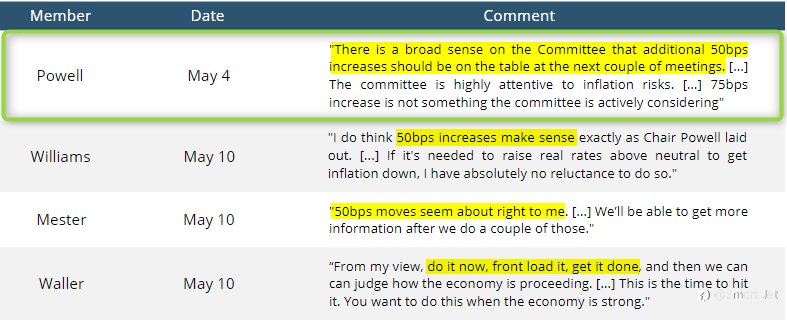

Here’s their forward guidance since the FOMC: Picture attached

Sure, a 75bps hike is off the table entirely for the time being.

But “a couple of 50bps rate hikes” is still aggressive tightening Friend's, especially paired with the starting QT program, which will officially begin to ramp up at the beginning of June.

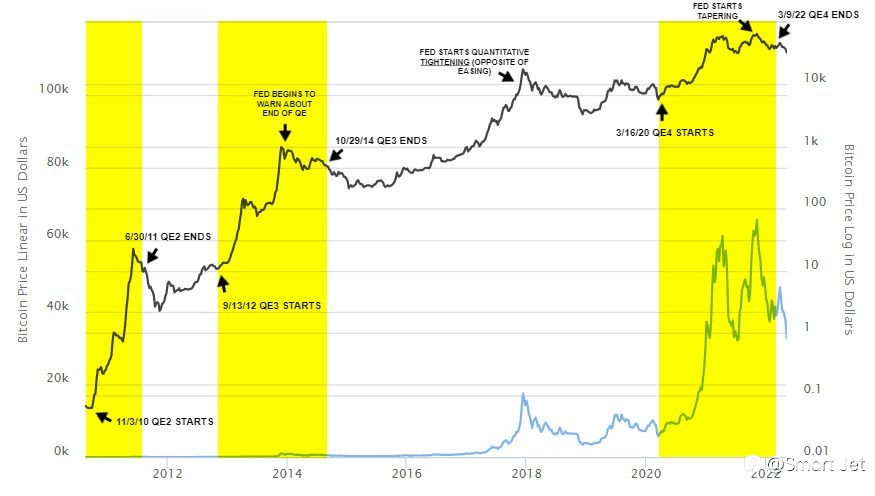

And (like we said many many times) crypto doesn’t cope well with Quantitative Tightening.

We are still in an “aggressive tightening” regime and far from a “dovish pivot” from the FED for the time being Friend's.

And we also just got another surprise higher in CPI which somewhat brings back the possibility of a 75bps hike, still early to say, but the markets may begin to push for that again.

As such, we can’t but continue to be bearish risk assets such as stocks and crypto.

Long story short... no, we don’t think it’s time to buy the dip yet. Yes, there will be some impulsive pullbacks higher, but bears will continue to dominate with aggressive dumps keeping the bearish trend intact in both stocks and crypto.

And that’s everything Friend's, quick global macro, the macro conditions are still the same, bearish stocks and bearish crypto, but remember, we don’t short lows, we short pullbacks.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.