Australia’s economic growth disappointed market expectations in the third quarter of 2025, with GDP expanding 2.1% year-over-year compared to forecasts of 2.2%.

On a quarterly basis, the economy grew 0.4%, missing the 0.7% Reuters poll estimate, according to data released by the Australian Bureau of Statistics.

Key Takeaways

- Annual GDP growth: 2.1% (expected 2.2%, prior 2.1%)

- Quarterly GDP growth: 0.4% (expected 0.7%, prior 0.7%)

- Private investment: Surged 2.9%, the strongest quarterly increase since March 2021

- Household consumption: Rose 0.5%, driven by essential spending

- Net trade: Detracted 0.1 percentage points from growth as imports outpaced exports

- Terms of trade: Increased 0.3%, with iron ore prices offsetting LNG weakness

- Household saving ratio: Rose to 6.4% from 6.0%

Link to official ABS Australian GDP (Q3 2025)

Business investment emerged as the standout performer, with machinery and equipment expenditure soaring 7.6%, marking its strongest pace in over four years. The surge was driven primarily by major data center investments across New South Wales and Victoria, reflecting Australia’s growing role in the global digital infrastructure buildout.Dwelling investment also contributed meaningfully, rising 1.8% as residential construction gained momentum in the eastern states. New and used dwelling construction climbed 2.6%, while ownership transfer costs jumped 5.0%, reflecting heightened property market activity.

Household consumption grew at a modest 0.5% pace, with essential spending leading the way at 1.0% growth. Discretionary spending proved weaker, with falls in cigarettes and tobacco (-10.7%), transport services (-0.9%), and alcoholic beverages (-0.3%) partially offsetting essential spending strength.

The external sector proved to be a drag on growth, subtracting 0.1 percentage points as import growth of 1.5% outpaced export gains of 1.0%. Also, inventory drawdowns detracted a significant 0.5 percentage points, as mining companies ran down stockpiles to service increased export demand while production remained subdued.

Market Reactions

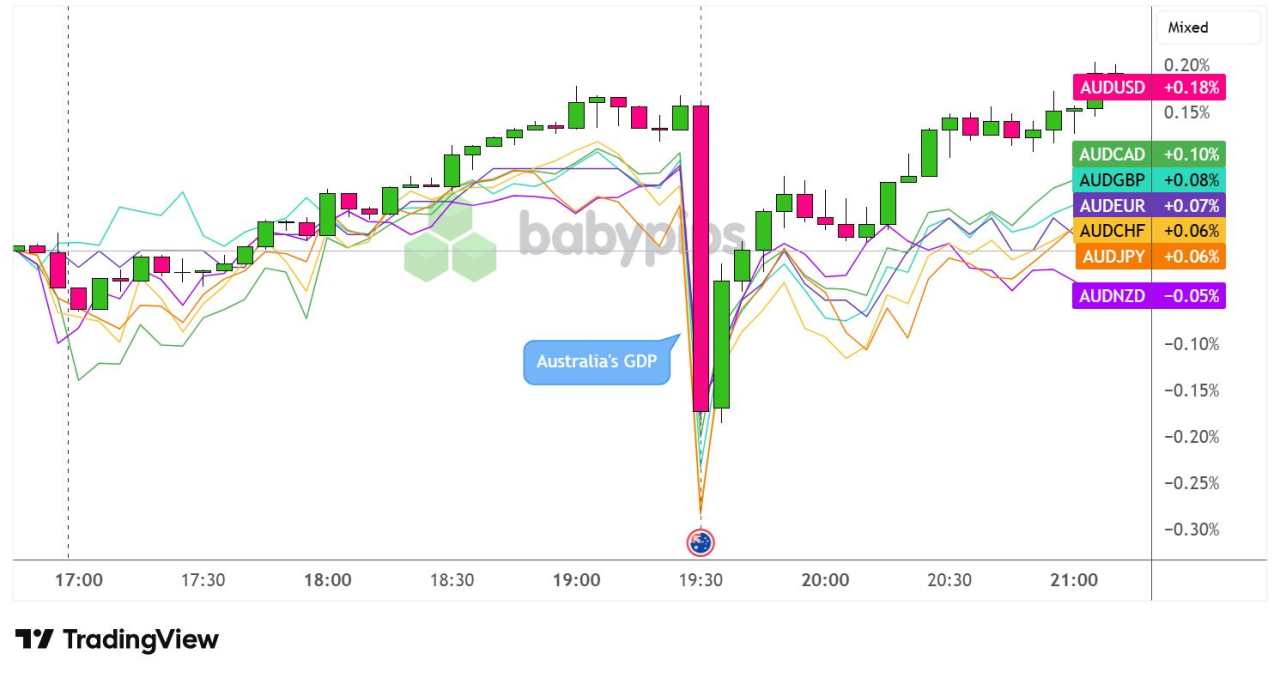

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

The initial spike lower in the AUD reflected disappointment with both the headline and quarterly growth figures, which likely tempered some market expectations around the Reserve Bank of Australia’s policy path, though the underlying strength in domestic demand and persistent price pressures suggest the central bank may maintain its cautious approach to further easing.

With that, the currency managed to get back on its feet pretty quickly, recovering back to pre-GDP levels against most of its counterparts within a few hours after the release. AUD is up 0.18% against USD and 0.10% against CAD but remained 0.08% in the red against comdoll rival NZD.

Leave Your Message Now