The numbers are heading in the right direction, but we are not where we want to be. These words of Bundesbank President Joachim Nagel are true for both the European Central Bank and the Federal Reserve. Despite the fact that the core inflation in the U.S. increased by the same 3.9% in January as in December, the trend remains downward. The same applies to the Eurozone, where consumer prices fell from 10.6% in the fall of 2022 to 2.8%. However, both indicators are still far from the 2% target. The central banks' work is not done, and the most interesting part for EUR/USD is just beginning.

The retreat of the main currency pair is related to how officials interpreted the current situation. While Chicago Fed President Austan Goolsbee claimed that delaying monetary policy easing could lead to a sharp rise in unemployment, Germany has a different stance. According to Nagel, haste makes waste. History has examples of premature declarations of victory over inflation resulting in a double recession, as seen in the development of the U.S. economy in the 1970s.

Goolsbee is a "dove," Nagel is a "hawk." If other officials at the Fed and ECB adopted their positions, it would be safe to buy EUR/USD. Frankfurt would continue to stay on the sidelines, at least until June, while Washington would cut rates as early as May or even March. However, the central bank is not a one-actor show. Its representatives have different views on the future. Therefore, the question of who starts first remains open.

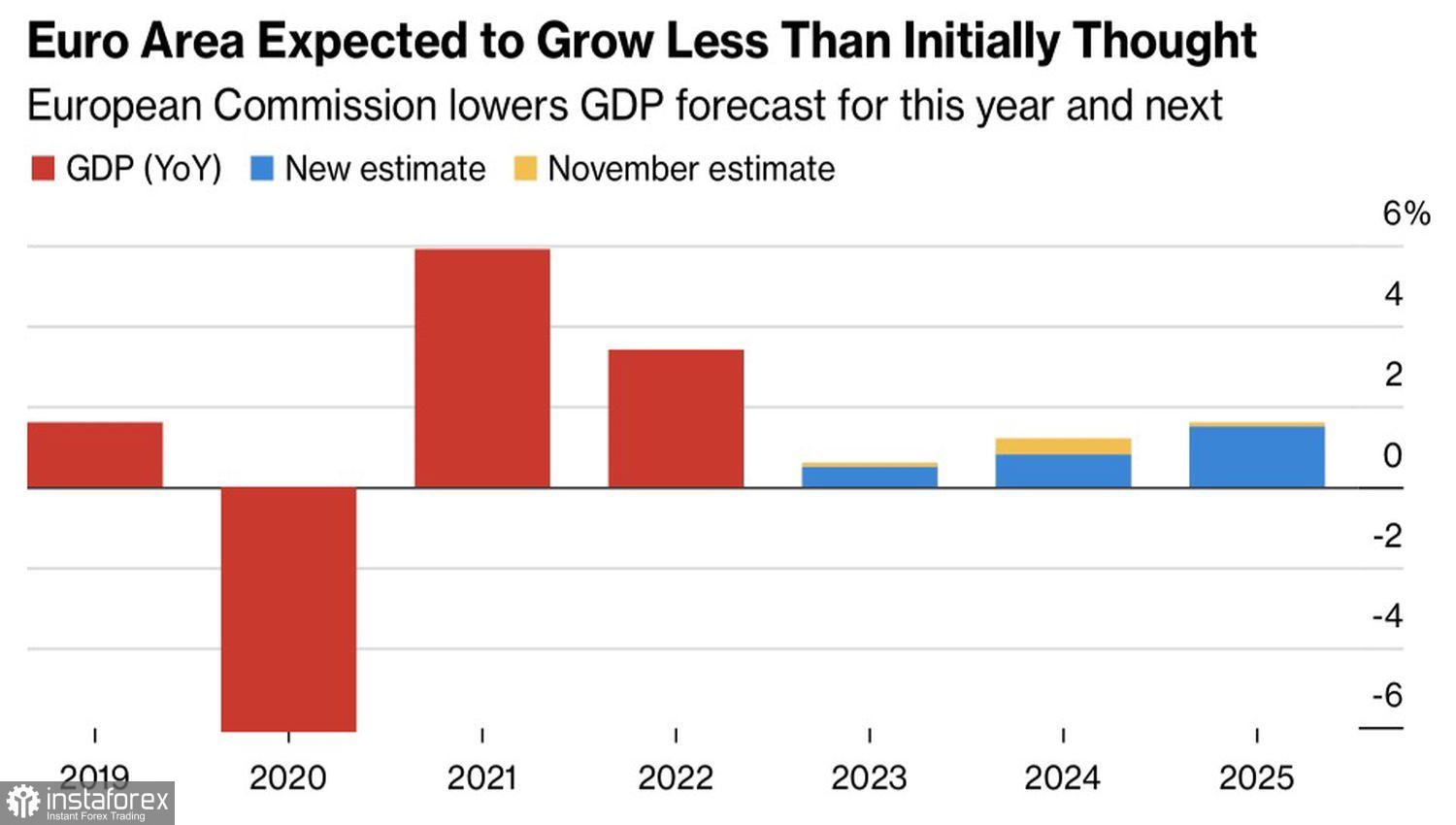

From an economic standpoint, the ECB should be the one to start. The European Commission lowered the GDP forecasts for the currency bloc in 2024 from 1.2% to 0.8% and in 2025 from 1.6% to 1.5%. The expected rebound from 0.5% in 2023 over these two years will be weaker than anticipated. Nevertheless, the remarkable strength of the labor market, growth in real incomes, and a slowdown in inflation will enable it to materialize.

Dynamics and Forecasts for Eurozone GDP

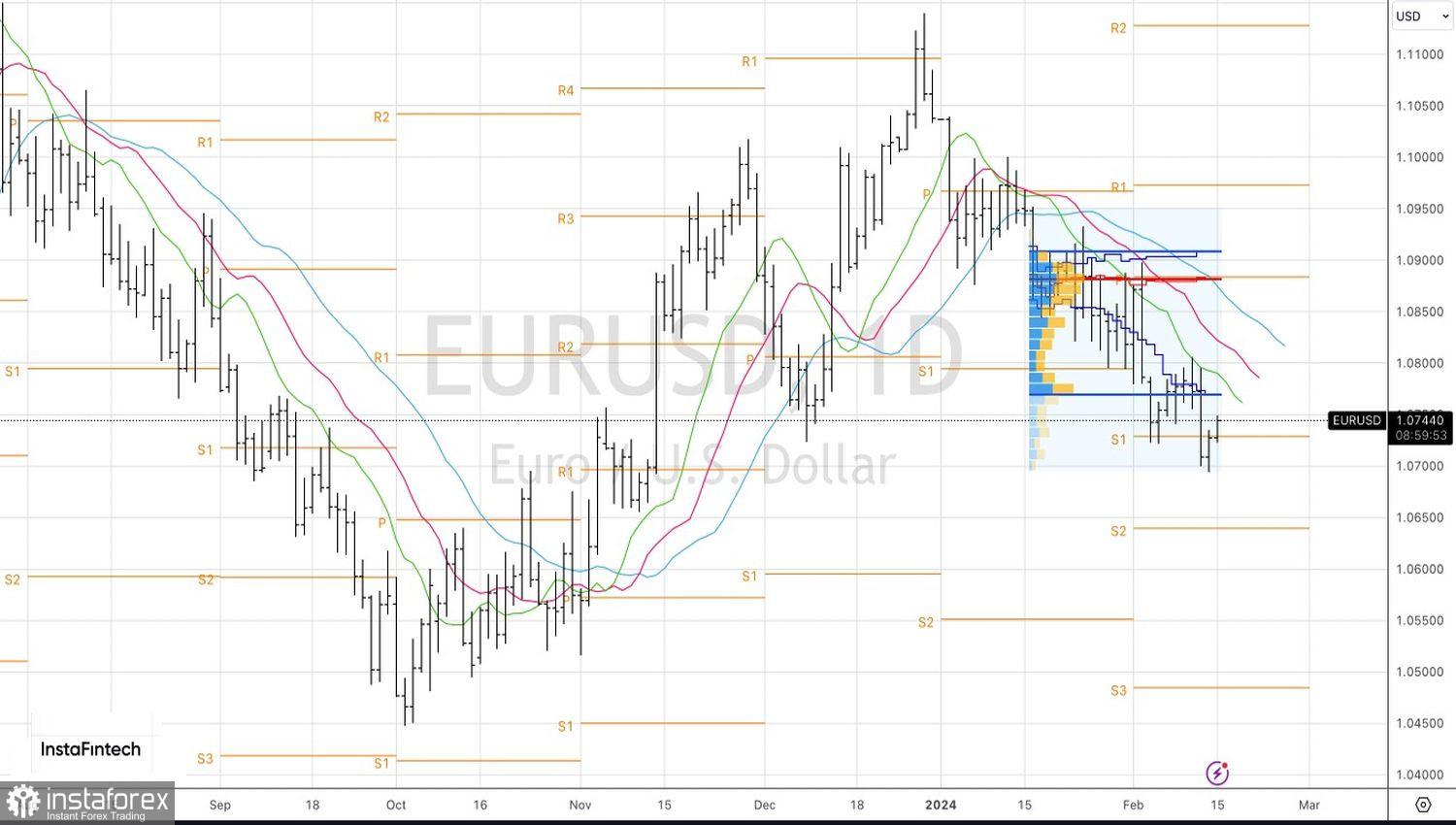

Therefore, assuming that both the Fed and the ECB will start monetary expansion cycles in June, the significant weakness of the Eurozone's economy compared to the American one provides a basis for selling EUR/USD. This contradicts the views of the heads of the Bundesbank and the Chicago Fed. It will be interesting to see the direction the main currency pair takes.

In my opinion, two out of three U.S. dollar trump cards have been played or are ready to be played. This pertains to the convergence of market views on the fate of the federal funds rate and FOMC forecasts, as well as the gradual slowdown of the economy and the loss of the USD index's driver, such as American exceptionalism. The dollar could use its safe-haven status, but the rapid recovery of stock indices indicates an increased appetite for risk. In such conditions, reliable assets suffer.

Technically, on the daily chart, EUR/USD may form a reversal pattern called Anti-Turtles. In this case, an increase in quotes above $1.076 would be a reason to buy the euro, especially if the main currency pair then manages to return to the fair value range of 1.077–1.091.

Hot

No comment on record. Start new comment.