New Zealand Dollar rallies after US CPI result lifts risk appetite

- The New Zealand Dollar recovers on Tuesday after drifting lower for over 10 days straight.

- The Kiwi rebounds after US CPI data shows an unexpected slowdown in October, weighing on USD and lifting sentiment.

- NZD/USD reverses its bearish short-term trajectory and aims for the November highs.

The New Zealand Dollar (NZD) trades higher against most counterparts after the release of softer-than-expected US inflation data cheers Wall Street with the prospect of cheaper borrowing costs, lifting risk appetite and supporting commodity currencies like the Kiwi.

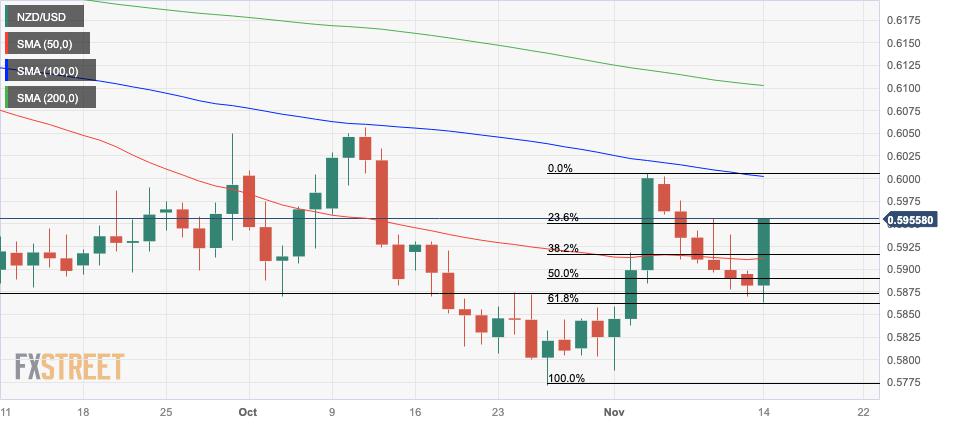

For NZD/USD, the short-term technical situation dramatically reverses after temporarily flirting with deeper losses. An earlier break below key support at 0.5874 had suggested a possible continuation lower but the pair reversed at a key Fibonacci level and now trades back above 0.5900 as the US session gets underway.

Daily digest market movers: New Zealand Dollar: US CPI brings uplift to Kiwi

- The New Zealand Dollar trades higher after the release of US Consumer Price Index (CPI) data shows a slowdown in inflation in October and triggers an improvement in risk appetite.

- As a commodity currency, the NZD tends to do well when market sentiment is risk-on.

- US Consumer Price Index (CPI) data showed no-change in broad headline inflation in October (0.0%) when economists had forecast a rise of 0.1% MoM. Year-on-year, a 3.2% increase was registered when 3.3% had been expected.

- For Core CPI, the data showed a 0.2% increase MoM versus 0.3% expected and 4.0% YoY against 4.1% forecast.

- The data suggests even less likelihood of the Federal Reserve (Fed) raising interest rates at their December meeting or at the start of 2024. Probabilities were already low at about 15%, but these have dropped even further following the release.

- The US Dollar has fallen after the data as the prospect of no further increases to interest rates makes the US a less attractive place for global investors to park their capital, reducing demand for the USD.

- Chinese Industrial Production and Retail Sales data out on Wednesday morning at 02:00 GMT could also impact the Kiwi since China is its largest trading neighbor.

- Recent downbeat Chinese inflation data has dampened the outlook for global growth, weighing on NZD last week.

- An inflation report from the RBNZ showed both one-year-out and two-years-out inflation expectations for New Zealand falling in Q3 compared to the previous quarter.

- The lower inflation expectations imply the RBNZ is less likely to raise interest rates.

- Tuesday’s lower-than-estimated CPI data will have overshadowed both the higher University of Michigan inflation expectations data out on November 10, and the recent hawkish tone of many Fed officials.

New Zealand Dollar technical analysis: NZD/USD surges higher at 61.8% Fib level

NZD/USD – the number of US Dollars one New Zealand Dollar can buy – finds a floor at around 0.5862, the key 61.8% Fibonacci retracement of the rally from the year-to-date lows, and lifts off! It surges higher at the start of the US Session on Tuesday after the release of US CPI data weakens the US Dollar.

New Zealand Dollar vs US Dollar: Daily Chart

The pair is in a large part reversing the steady decline since November 3, however, it needs to make a higher high above 0.6001 to re-affirm belief in the short-term uptrend.

A break above 0.6001 would confirm the short-term bullish bias again. The likely target thereafter would be the 0.6055 October high.

In the event it is unable to break above 0.6001, there remains a risk of a capitulation. A break below the 0.5862 day’s lows would be required to signal a resumption of the short-term bear trend. The main targets to the downside would then be 0.5790, followed by 0.5773.

The medium and long-term trends are both still bearish, suggesting the potential for more downside remains strong.

Bulls would have to push above the 0.6055 October high to change the outlook in the medium term and indicate the possibility of the birth of a new uptrend. Such a move would then target the 200-day Simple Moving Average (SMA) at around 0.6100.

New Zealand Dollar FAQs

What key factors drive the New Zealand Dollar?

The New Zealand Dollar (NZD), also known as the Kiwi, is a well-known traded currency among investors. Its value is broadly determined by the health of the New Zealand economy and the country’s central bank policy. Still, there are some unique particularities that also can make NZD move. The performance of the Chinese economy tends to move the Kiwi because China is New Zealand’s biggest trading partner. Bad news for the Chinese economy likely means less New Zealand exports to the country, hitting the economy and thus its currency. Another factor moving NZD is dairy prices as the dairy industry is New Zealand’s main export. High dairy prices boost export income, contributing positively to the economy and thus to the NZD.

How do decisions of the RBNZ impact the New Zealand Dollar?

The Reserve Bank of New Zealand (RBNZ) aims to achieve and maintain an inflation rate between 1% and 3% over the medium term, with a focus to keep it near the 2% mid-point. To this end, the bank sets an appropriate level of interest rates. When inflation is too high, the RBNZ will increase interest rates to cool the economy, but the move will also make bond yields higher, increasing investors’ appeal to invest in the country and thus boosting NZD. On the contrary, lower interest rates tend to weaken NZD. The so-called rate differential, or how rates in New Zealand are or are expected to be compared to the ones set by the US Federal Reserve, can also play a key role in moving the NZD/USD pair.

How does economic data influence the value of the New Zealand Dollar?

Macroeconomic data releases in New Zealand are key to assess the state of the economy and can impact the New Zealand Dollar’s (NZD) valuation. A strong economy, based on high economic growth, low unemployment and high confidence is good for NZD. High economic growth attracts foreign investment and may encourage the Reserve Bank of New Zealand to increase interest rates, if this economic strength comes together with elevated inflation. Conversely, if economic data is weak, NZD is likely to depreciate.

How does broader risk sentiment impact the New Zealand Dollar?

The New Zealand Dollar (NZD) tends to strengthen during risk-on periods, or when investors perceive that broader market risks are low and are optimistic about growth. This tends to lead to a more favorable outlook for commodities and so-called ‘commodity currencies’ such as the Kiwi. Conversely, NZD tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Reprinted from FXStreet_id,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.