USDINR 78.52 ▲ 0.23%.

EUR/USD 1.0584 ▲ 0.01%.

GBP/USD 1.2277 ▲ 0.11%.

India 10-Year Bond Yield 7.442 ▲ 0.47%.

US 10-Year Bond Yield 3.179 ▼ 0.47%.

ADXY 102.76 ▲0.01%.

Brent Oil 116.30 ▲ 1.08%.

Gold 1,827.60 ▲ 0.15%.

NIFTY 50 15,741.20 ▼ 0.57%.

Global developments

US May Durable goods data beat expectations coming in at 0.7% MoM against expectations of a 0.1% increase.

The G7 has agreed to extend support to Ukraine till the very end. It also called a missile attack on a shopping mall in Ukraine a war crime.

Price action across assets

US yields have risen about 6bps across the curve. The Dollar is broadly stable. Price action in major currency pairs has been range-bound. The rally in US equities took a breather yesterday with S&P500 ending 0.3% lower. Crude prices have risen on fears of Western countries imposing further restrictions on Russian energy exports to choke off Russia's funding for the war. Brent has risen to USD 116 per barrel. Gold is hovering around the USD 1825 per ounce mark.

China's May industrial profits slump again despite easing COVID curbs.

Domestic developments

Two day GST council meeting starts today. States compensation, and rate rationalization to be in focus.

In an encouraging sign that consumption is picking up, credit card spending hit a fresh high in May at Rs1.14 lakh crs, up 8% MoM.

USD/INR

The rupee had opened stronger yesterday at around 78.24 but weakened through the session to end at 78.35. Today is the June exchange-traded currency derivative expiry. We are likely to see Dollar demand at RBI fix today. The open interest in the June contract is around USD 5bn.

3m ATMF vols ended lower at 5.10% while 1y forward yield dropped 10bps to end at 3.06%.

Bonds and rates

The yield on the benchmark 10y bond ended 2bps lower at 7.41%. OIS was down 2-4bps across the curve. 5y OIS ended at 6.95%. We may see a bit of selling pressure on bonds today on higher US treasury yields and higher crude prices.

Equities

Domestic equities started off the week well with the Nifty gaining 0.85% to end at 15832. Energy and IT stocks which had underperformed over the last few sessions led the gains in Nifty.

Strategy

Exporters are advised to hold for cover with a stop loss of 77.90. Importers are suggested to cover through a combination of options and forwards. The 3M range for USDINR is 77.20-79.20 and the 6M range is 76.75–80.00.

UK's Northern Ireland trade law clears first parliamentary hurdle.

FX outlook of the day

USD/INR (Spot: 78.52)

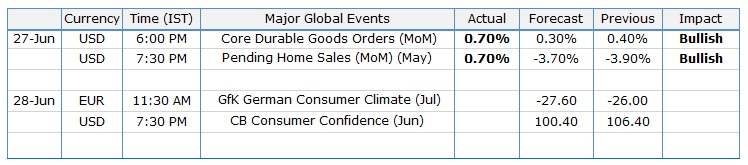

The USDINR pair started the day with a gap-up opening of 78.52 levels. The Indian Rupee has been on a decline due to continuous foreign fund outflows and a risk-averse environment. The Dollar is broadly trading stable in the global market while the Price action in major currency pairs has been range-bound. The surge in the Brent price is expected to keep the domestic currency under pressure. The domestic bond market too is expected to see a correction from its earlier gains due to elevated crude prices. Today is the June exchange-traded currency derivative expiry due to which the pair is expected to remain volatile with upward bias movement. The focus will be on the US CB Consumer Confidence data due later today.

EUR/USD (Spot: 1.0581)

The pair managed to extend Friday’s recovery moves amid cautious optimism in the markets, considering mixed US data and optimism ahead of this week’s key European Central Bank (ECB) Forum. However, challenges to risk appetite emanated from the headlines surrounding Russia and China, which later on joined upbeat US economic data, exerted fresh downside pressure on the EURUSD. Russia's failure to make its coupon payment resulted in a default. US Durable Goods Orders rose to 0.7% in May, versus 0.1% expected. Further, the US Pending Home Sales also surprised the markets with 0.7% MoM figures for May versus -3.7% expected. For the day, ECB President Lagarde's speech and US consumer confidence data will be watched out. The pair is expected to trade in the range of 1.0530 to 1.0630.

GBP/USD (Spot: 1.2276)

GBP managed to gain above 1.23 at the start of the European session but couldn't hold onto the gains and retreated back to 1.2270 levels. UK parliament members will vote on legislation that would allow ministers to rewrite parts of the post-Brexit deal and remove checks on goods entering Northern Ireland from the rest of the UK. When legislation was proposed, the European Union voiced its opposition and said that it would violate international law. Brexit-related headlines and mixed market sentiment could weigh on cable. The pair is expected to trade in the range of 1.2220 to 1.2330.

USD/JPY (Spot: 135.32)

The pair is oscillating around 135 level amid the unavailability of any potential trigger that could fetch a significant move on either side. Upbeat US economic data and rising bond yields have supported the greenback. Investors will keep an eye over the release of the US Consumer Confidence data, which will dictate the confidence of the consumers in the economic activities. A higher print determines strong demand from the households, which will further support the greenback. On the Tokyo front, Wednesday’s Retail Trade data will keep being important. A preliminary estimate for the yearly Retail Trade is 3.3%, higher than the former print of 2.9%. While the monthly Retail Trade may drop to -0.1% vs. 0.8% recorded earlier. The pair is expected to trade in the range of 134.80 to 135.60.

Russia in historic default as Ukraine sanctions cut off payments.

Economic calendar

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now