USDINR 78.01 ▲ 0.04%.

EUR/USD 1.0530 ▲ 0.20%.

GBP/USD 1.2278 ▲ 0.23%.

India 10-Year Bond Yield 7.477 ▲ 0.66%.

US 10-Year Bond Yield 3.282 ▲1.34%.

ADXY 102.87 ▲ 0.10%.

Brent Oil 115.22 ▲ 0.96%.

Gold 1,842.15 ▲ 0.08%.

NIFTY 50 15,435.50 ▲ 0.56%.

Global developments

German producer prices rose 33.6% in May, the most ever.

ECB president Lagarde said the risk of an abrupt correction in European financial and housing markets is high. She added that risks to financial stability would not undermine ECB's fight against inflation and restated her intention to raise rates in July and September.

US markets were shut yesterday for Juneteenth holiday.

Priceaction across assets

Price across assets is muted. Overall risk sentiment is positive in Asia session today. US markets were shut yesterday. Asian equities are trading with gains of 0.5-1%. US Dollar has weakened in early Asia session. Euro and Sterling have bounced back about 40 pips overnight. US yields have inched higher by 4-5 bps across the curve with 10y now at 3.29%. Crude prices have risen with Brent now at USD 115 per barrel. Gold is trading around USD 1840 per ounce mark.

Fifteen EU nations say bloc must urgently accelerate trade deals.

Domestic developments

USD/INR

The Rupee had appreciated in the early part of session yesterday on lower crude prices but could not hold on to gains due to persistent bids from oil companies.

1y forward yield dropped 3bps to 3.35% while 3m ATMF vols cooled 15bps to 5.20%.

Asian currencies with the exception of Thai Baht and Philippines Peso are trading stronger against the Dollar.

Bonds and rates

Bonds and rates market rallied yesterday with the yield on benchmark 10y ending 12bps lower at 7.43% and 5y OIS ending 18bps lower at 7.03%. The benchmark 10y bond had rallied 5bps on Friday as well after a successful Gsec auction. Lower crude prices have caused markets to reprice the extent of tightening by the RBI.

Equities

Domestic equities began the week on a positive note with Nifty gaining 0.4% to end at 15350. Mid and small caps underperformed. Metals and Oil & Gas stocks got hammered on weaker commodities amid global growth concerns. IT stocks made a comeback.

Strategy

Exporters are advised to cover on upticks towards 78.50. Importers are suggested to cover through options. The 3M range for USDINR is 77.20-79.20 and the 6M range is 76.75–80.00.

German producer prices rise at record speed in May.

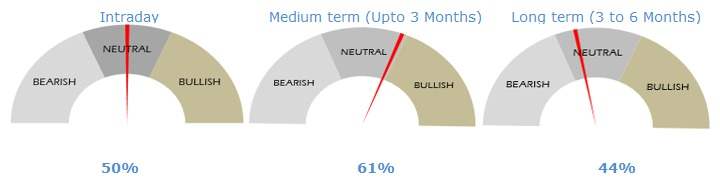

FX outlook of the day

USD/INR (Spot: 78.01)

The Indian rupee had appreciated in the early part of session yesterday on lower crude prices but could not hold on to gains due to persistent bids from oil companies. Domestic bonds and rates market rallied yesterday with the yield on benchmark 10y ending 12bps lower at 7.43% and 5y OIS ending 18bps lower at 7.03%. The benchmark 10y bond had rallied 5bps on Friday as well after a successful G-Sec auction. Lower crude prices have caused markets to reprice the extent of tightening by the Reserve Bank of India. Price across assets is muted. Overall risk sentiment is positive in Asia session today. US markets were shut yesterday. US Dollar has weakened in early Asia session. The pair is expected to trade with a sideways bias within the range of 77.80-78.10. The focus will be on the FOMC Member's speech due later today.

EUR/USD (Spot: 1.0529)

The shared currency remained in a confined range of 1.0472-1.0545, on a thin liquidity trading session due to US bank holiday. ECB President Christine Lagarde expects to raise interest rates by 25 bps in July and again in September, while the calibration of the September hike will depend on the updated medium-term inflation outlook. The ECB’s Chief Economist Philip Lane said that the larger increment for a rate increase in September does not represent a red alert assessment of inflation. There is no major economic data from eurozone while market participants will be looking forward for US home sales data. The pair is expected to trade in the range of 1.0490 to 1.0580.

GBP/USD (Spot: 1.2276)

Cable gained 0.23% yesterday amid positive risk sentiment, lack of major price action and positive comments from BOE policymaker. BoE’s Catherine Mann said that 50 bps moves reduce the risks of domestic inflation, boosted by a weaker pound. Mann said that the BoE should raise rates faster because the weakness in the pound’s value is adding to inflationary pressures. Mann added that inflation is becoming more embedded and persistent. On the US side, Fed Governor Christopher Waller support a 75 bps hike in July if data come in as he expects, reiterating that the central bank is all in on re-establishing price stability. Tomorrow, UK will be publishing May month inflation data. The pair is expected to trade in the range of 1.2220 to 1.2330.

USD/JPY (Spot: 135.01)

USDJPY traded sideways lacking any firm direction on Monday. A break above 135.50-60 area and below the 134.00 mark might prompt aggressive move in the pair. Rising US bond yields and divergence of Fed-BoJ monetary policy is going to support the pair in medium term. During the week, Japan's CPI data will be watched out. The pair is expected to trade in the range of 134.50 to 135.60.

BOJ and govt closely coordinating on FX, Kuroda says after meeting PM.

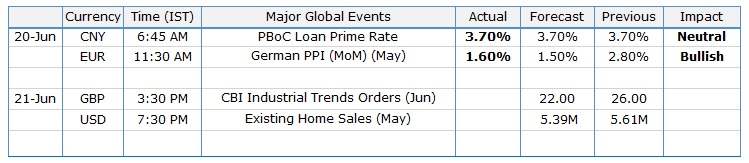

Economic calendar

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now