Stocks are bouncing around on the 100th day of trading this year, with the Dow and S&P 500 headed for the worst annual start since 1970 and the Nasdaq its worst ever.

This choppy market can’t help itself, because “there are too many unknowns,” Stephanie Link, chief investment strategist and portfolio manager at Hightower told CNBC.

Take the debate over a possible U.S. recession. Ed Yardeni, president of Yardeni Research, thinks it can be avoided, but has just lifted his own recession expectations to 40% from 30%, because markets seem to be talking themselves into one. “Might the only recession we have to fear be one triggered by recession fear itself? “

On to our call of the day from Kevin Muir, the editor of the MacroTourist newsletter, who sees a possible short-term bottom amid thick-as-fog bearishness out there.

Muir says he’s headed to the sidelines with many of his “dark side bets,” some of which have hit his targets.

For example, the ratio of his top 8 technology stocks to the remaining 492 has dropped from 36 in December to his initial target of 28. Investors were at once point scrambling to buy those big names, such as Apple AAPL. They’ve lost 31% since that high, while the rest are down less than 15%, he said.

This chart shows the ratio between the two:

“I am by no means bullish on these Top 8 tech, or dream-tech, but I have been really short, and the trade is simply not as attractive anymore as it has moved a long way,” said Muir in a follow up comment.

Big, grim investors also play a part here. “When I combine that with some rather notable hedge fund gurus issuing apoplectic market warnings, I have come to the conclusion that many short-term worries could well be in the price,” he said.

Blowing the horn of Gondor on Tuesday, hedge-fund billionaire Bill Ackman tweetstormed about inflation out of control and a hapless Federal Reserve. “Bill might be a brilliant investor, but the last thing you should do is trade off his emotional tirades. They are better fades than signals,” said Muir.

Ackman is known for going big or going home positions, and at times, he’s done the latter. Some agree with Muir here:

Muir also highlighted George Soros’s Davos warning that “civilization may not survive” Russia’s war in Ukraine, with climate change taking a back seat.

“Although I am one of the most bearish traders out there when it comes to tech companies’ long-term fortunes, a trader’s-gotta-trade, and this is feeling like absolutely every bad piece of news was hurled at the market at once,” said Muir.

Simply, it’s just no longer “such an easy trade on the short side.”

If a bottom is looming (or even not), then it’s worth listening to Josh Brown, CEO of Ritholtz Wealth Management and author of the Reformed Broker blog, who recently opined on which stocks may lead the way out of a bear market.

“History says it’s never the stocks that led in the prior bull market..so it’s not that Apple, Google, whatever can’t go up coming out of this, I wouldn’t expect the bigger gains to be in those names. I would also skip growth tech, unprofitable, tech. Many of those stocks will have some semblance of a bounce, most of those won’t be hot stocks again,” he said on a podcast.

Instead, industrials and defense stocks are on his radar. “I think we’re going to spend the next 5 years rebuilding our capabilities in this country to make our own semiconductors and be energy independent, and quite frankly to fighting wars again,” said Brown. To play this he owns iShares U.S. Aerospace & Defense ITA.

Read: Here’s what KPMG’s U.S. chief is saying about the market downturn, the economy and M&A

The buzz

Investors will be looking for interest-rate clues from the Fed minutes of the May 3-4 meeting due at 2 p.m. Eastern. Ahead of that, data showed U.S. durable goods orders for April falling short of expectations. New Zealand’s central bank lifted its benchmark interest rate by 50 basis points a second straight time.

At Davos, Pfizer PFE announced plans to provide low-cost medicines, including its COVID-19 vaccine and treatment, at cheaper prices for poorest countries.

Wendy’s stock WEN is surging after Nelson Peltz’s activist hedge fund Trian Partners disclosed plans for a possible sale of the burger chain.

It could be a tense annual shareholder meeting for Twitter TWTR, as Snap’s SNAP painful warning took another bite out of shares, costing acquirer Elon Musk more than $1 billion.

Read: CEO who wants his company to be the Toyota of rocket launchers says losing two-thirds of its value won’t change strategy

Lyft LYFT has slowed hiring, cutting budgets and taking other actions as its stock hovers near an all-time low.

TV personality and entrepreneur Kim Kardashian will become Beyond Meat’s BYND first chief taste consultant.

Russia is moving closer to default as a U.S. government sanctions waiver is set to expire Wednesday.

The quote

“This only happens in this country and nowhere else.” —- That was Sen. Chris Murphy, the lawmaker who representing Newton, Connecticut during the Sandy Hook school massacre nearly ten years ago, begging his colleagues to act on gun violence as the death toll from Tuesday’s Ulvade, Texas school shooting reaches 21. Golden State Warriors coach Steve Kerr lambasted “50 senators who refuse to vote” on legislation, and President Joe Biden called for more legislation.

The markets

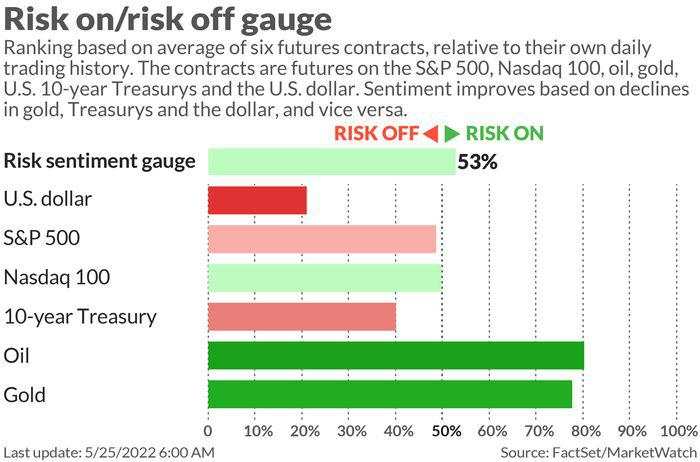

U.S. stocks DJIA SPX COMP are struggling for traction, as bond yields BX:TMUBMUSD10Y BX:TMUBMUSD02Y slip. Gold GC00 is down as the dollar DXY rises, and oil CL00 BRN00 is up. Bitcoin BTCUSD is just under $30,000.

The chart

The tickers

These were the top-traded tickers on MarketWatch as of 6 a.m. Eastern TIme.:

| Tickers | Security name |

| TSLA | Tesla |

| GME | GameStop |

| AMC | AMC Entertainment |

| AAPL | Apple |

| NIO | NIO |

| TWTR | |

| AMZN | Amazon |

| SNAP | Snap |

Random reads

AI is bringing missing-persons’ posters to life.

In Davos, Ukraine commandeers Russia’s former party hub

Also at Davos, the cryptocurrency party is full on

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

Leave Your Message Now