Bitcoin Vs. Gold: Which Is The Better Investment?

Summary

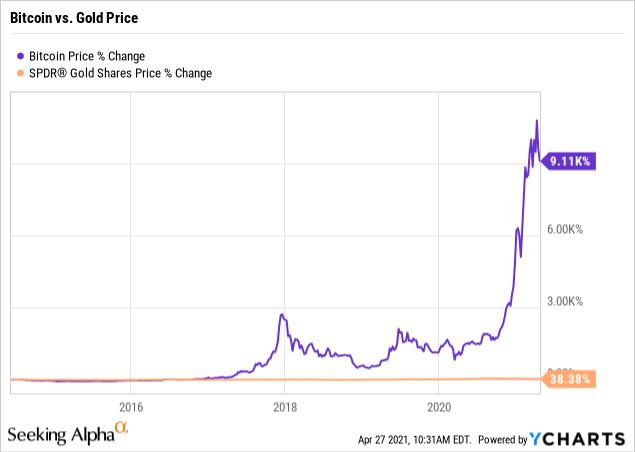

- Bitcoin is the best-performing asset class in the 2010s, while gold has been a store of value for thousands of years.

- Each asset has distinct advantages and disadvantages, and both are hedges against a decline in the value of the US dollar.

- Why I think Bitcoin and gold are complements, not substitutes, and serious investors should own both gold and bitcoin.

- Bitcoin has more catastrophic risk than gold does. I worry about what would happen to Bitcoin in the event of a 1-in-150 year electromagnetic storm.

- Bitcoin has factors growth and momentum, while gold has value.

In September of 1859 – out of nowhere, the largest electromagnetic storm in recorded history occurred, known as the Carrington Event. All over the world, observers noted strange happenings – auroras brighter than the full moon, telegraph wires spontaneously sparking and catching fire, and widespread failures in America's nascent electrical grid. Today, a similar event could make the economic disruption from the coronavirus look tame. Lloyds of London has estimated the storm as a 1-in-150 year event with a cost to the US economy of $600 billion to $2 trillion.

A similar storm happened in 2012, but that one missed the earth's orbit by about 9 days. A couple of readers have asked me what I thought would happen to Bitcoin (BTC-USD) if the entire electric grid went down, and I'll be honest, I don't really know what would happen. The absolute worst thing that could happen is that your record of owning Bitcoin would be somehow destroyed in a solar storm and everyone would be tied up in court for years, or would simply have to eat the losses. The best-case scenario would see Bitcoin holdings unavailable for a few days while crews work to restore power. I do have a reasonable amount of confidence in what would happen to the price of gold in the event of a major solar flare – it would skyrocket. The government would probably have to print a bunch of money to keep the economy going in the aftermath, which would further support gold.

Throughout history, gold (GLD), and to a lesser extent, silver (SLV), has served as a hedge against crisis and political and economic uncertainty. For this reason, I think that precious metals should be a part of every serious investor's portfolio. Bitcoin, on the other hand, is my largest holding, and one that has made me a very nice profit since buying in. I feel that investors should consider owning both gold and Bitcoin, with gold as defense and Bitcoin as offense.

Is Bitcoin a Better Investment Than Gold?

Over the last decade, Bitcoin investors have done historically well. After all, I regard Bitcoin as one of the greatest advances in technology of all time. Gold investors have done less well over the same period (but have still made money), in part due to the high starting price of gold. If you're an investor right now, you should be aware of the past but shouldn't fixate on it.

Finance theory indicates that Bitcoin and gold might be good investments to pair with one another. Bitcoin is a momentum investment, while gold is more of a value investment at this point. Research shows that value and momentum are a strong combo in your portfolio as they both have positive returns over time but are negatively correlated with one another. Owning both is better than owning either individually.

If, for example, another Carrington Event were to occur, it might be difficult to access Bitcoin for months, panic selling might occur, and the price would likely fall. Gold, even ETF gold, would allow owners to more quickly assert their ownership and would see panic buying in such an event. More run-of-the-mill events like currency devaluations, terrorist attacks, or regional wars might benefit gold and Bitcoin equally.

Another factor for investors to consider is volatility. Gold is historically about as volatile in price as stocks, but a good hedge in times of crisis (historical volatility of about 16 percent annually). Bitcoin, on the other hand, is more volatile. If you use the square root function to estimate the annual volatility from the daily volatility of a little over 2 percent, you get annual volatility of about 40 percent (~2.1 percent x square root of 365 days in a year). Therefore, Bitcoin is between 2x and 3x more volatile than gold. There are some of you who will read this and think that Bitcoin is too volatile for you, but your position size can and should be informed by the volatility of the underlying asset. Bonds aren't super volatile, but you could use leverage to make the volatility comparable to stocks. On the other hand, small allocations to assets like crude oil and Bitcoin futures might make a well-designed portfolio more robust and have little to no effect on overall volatility. What does this mean for conservative investors? You could own like 3 percent Bitcoin and 7 percent gold, and on a typical day, you would expect them to change in price about the same amount. The point of this is that you shouldn't shun Bitcoin just for being volatile if you're a conservative investor, but should size your positions accordingly.

Can Bitcoin Replace Gold?

There has been a fair amount of speculation over whether Bitcoin is likely to replace gold as the international store of value. I think this is unlikely. For much of history, gold and silver have coexisted with gold storing wealth and silver circulating more as currency. It isn't entirely clear where Bitcoin fits in this equation because Bitcoin is a new technology entirely.

The biggest weakness of Bitcoin in my mind is the vulnerability to electromagnetic storms. The modern electric grid is only about 100 years old, and the last major electromagnetic storm happened in 1859. Electromagnetic storms happen about every 150 years on average, but with considerable variability. I fear that when (not if) a similar event happens again that Bitcoin will suffer major losses, which may or may not be permanent. This said, Bitcoin can only go to zero, and I think it can go up substantially over the next 5 to 10 years, so this is a risk I'm willing to accept and try to manage.

Gold is not going away – it has use for jewelry and industry, and remains the main store of value for central banks. Gold is a form of money, albeit not the most convenient one, as in large quantities, it's so heavy, it's hard to steal. Gold is so valuable that governments have at one time or another banned it.

Bitcoin has also seen attempts to ban it. Bitcoin is far newer, so the regulatory risk is likely higher for Bitcoin. Bitcoin has fantastic upside. The technology continues to get better, and if new updates to the networks make it a better medium of exchange, then I feel the value could grow dramatically higher as adoption grows. Bitcoin is a much higher risk/reward proposition than gold, however, which is why I think they work well together.

Conclusion

Bitcoin and gold are both hedges against a decline in the US dollar. Bitcoin requires the electric grid to function, which in the event of a major catastrophe is not a given. Gold investors under worst-case scenarios would be able to access their money faster and more effectively than Bitcoin investors. Bitcoin has fantastic upside and limited downside, while gold has a more traditional risk-reward balance. Gold and silver seem undervalued to me based on fiscal and monetary policy. All three investments are likely to do well in the case of inflation. If you like one, consider owning them all!

Reprinted from Seeking Alpha,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.