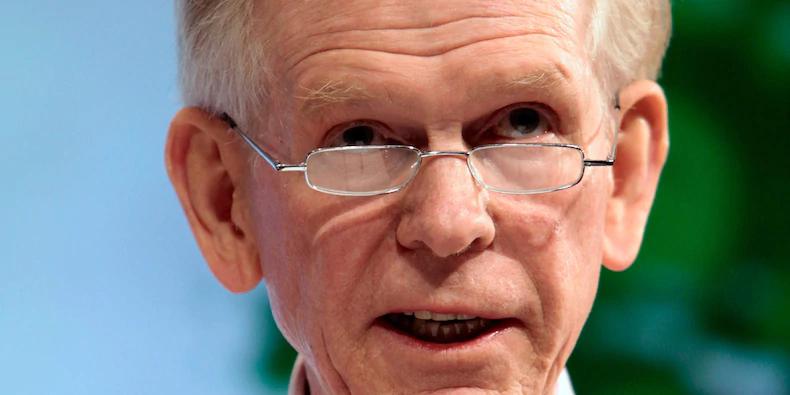

Legendary investor Jeremy Grantham's fund sold GameStop stock before it soared, missing out on a potential $18 million windfall

REUTERS/Nicholas Roberts

- Jeremy Grantham's fund potentially lost out on $18 million by dumping its GameStop stake.

- GMO held around 38,000 GameStop shares, but sold them a few years ago.

- Even if it held on during the short squeeze, its stake would be worth $5 million today.

- See more stories on Insider's business page.

Legendary investor Jeremy Grantham's fund missed out on a possible $18 million windfall by selling GameStop before the stock skyrocketed this year.

Grantham, Mayo & Von Otterloo owned 37,700 shares in the video-games retailer in the fourth quarter of 2016, regulatory filings show. GameStop's stock was trading around $25 at the time, valuing GMO's stake at close to $1 million.

Grantham and his team cashed out the following quarter. If they hadn't, their GameStop shares would have fetched over $18 million at the height of the short squeeze in January. If they didn't sell at all, their stake would be worth about $5 million today.

GMO's bosses won't be too concerned about missing out, however. They had about $16 billion worth of US stocks in their portfolio at the end of December, including a $683 million stake in Microsoft and $578 million of Apple stock, filings show.

Others have left much more money on the table. Veteran investor Bill Miller's fund, Miller Value Partners, held nearly 1.7 million GameStop shares at the end of 2015. Those shares would have fetched over $800 million at the peak in January, and more than $200 million at the current stock price.

However, Miller and his team slashed their position by more than 95%, ending 2020 with around 116,000 shares - worth about $18 million today.

Similarly, Michael Burry of "The Big Short" bought a stake in GameStop in 2019, and wrote several letters to the company's board that championed its potential. However, the investor's Scion Asset Management fund sold its 1.7 million GameStop shares in the fourth quarter of 2020. Those shares would have been worth more than $820 million in January.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.