Racial Gaps in Financial Outcomes

Even amidst strong macroeconomic conditions, families experience high levels of income volatility that have important implications for well-being. Previous JPMorgan Chase Institute research has shown that families cut consumption on everyday necessities when they experience job loss, and delay spending on healthcare and durable purchases until their tax refund arrives. A key reason for this is that they have an insufficient liquid cash buffer. Families with limited liquid assets are dramatically less likely to smooth consumption in the face of income fluctuations.

It stands to reason then that racial gaps in liquid assets and wealth could result in racial differences in consumption smoothing. Longstanding gaps in income and wealth between White families and Black and Hispanic families have been well documented and have only grown following the Great Recession. What are the downstream consequences of these racial gaps in financial circumstances, particularly when families’ incomes fluctuate on a day-to-day and month-to-month basis?

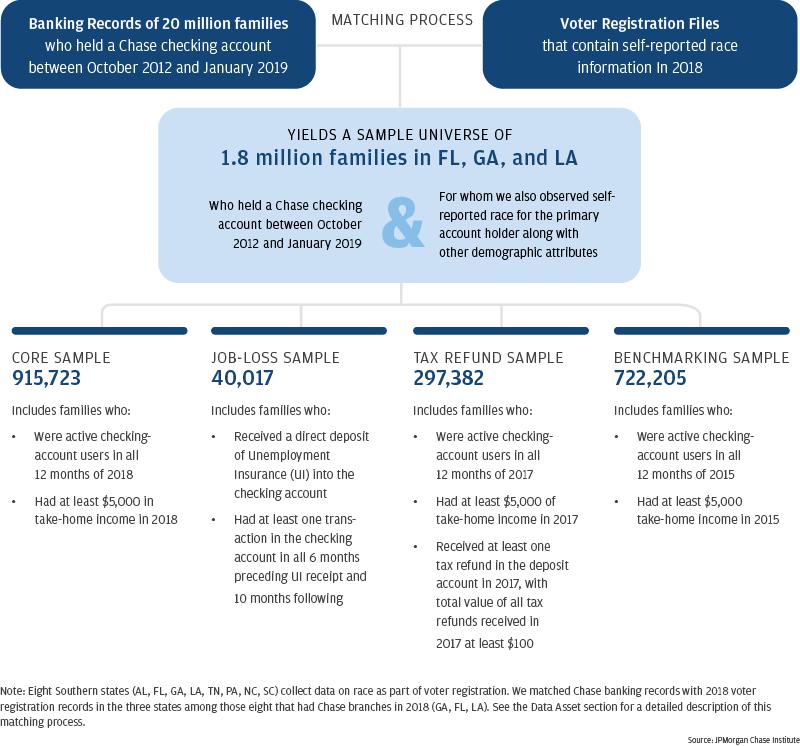

This report provides a first-ever high-frequency look at racial gaps in liquid assets, take-home income, and families’ consumption response to income volatility from the vantage point of a novel de-identified data source: administrative banking data paired with self-reported race information. We matched Chase banking records with 2018 voter registration records in the states that had Chase branches in 2018 and that, under the Voting Rights Act, collect race information during voter registration.

This match yielded a large sample of 1.8 million families for whom we observe the race of the primary account holder along with other demographic characteristics, and a high-frequency, integrated view of income, spending, and liquid assets. This sample is broadly representative of the respective income distributions of Black, Hispanic, and White registered voters nationally and provides a reliable window into racial gaps in financial outcomes compared to benchmarks.

With this new data asset, we answer three key questions in this report. First, how large are the racial gaps in take-home income and liquid assets among Black, Hispanic, and White families and to what extent do they persist after accounting for other demographic factors? Second, are there racial differences in how much families smooth their consumption? We examine changes in everyday spending in response to two different sources of income volatility: involuntary job loss identified through the receipt of unemployment insurance benefits, a negative cash-flow event; and the arrival of a tax refund, a positive cash-flow event. Third, to what extent do racial gaps in liquid and financial asset buffers account for racial differences in families’ consumption response to job loss and tax refunds?

Reprinted from JP Morgan,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.