Cycle trading: Keeping an eye on the dollar

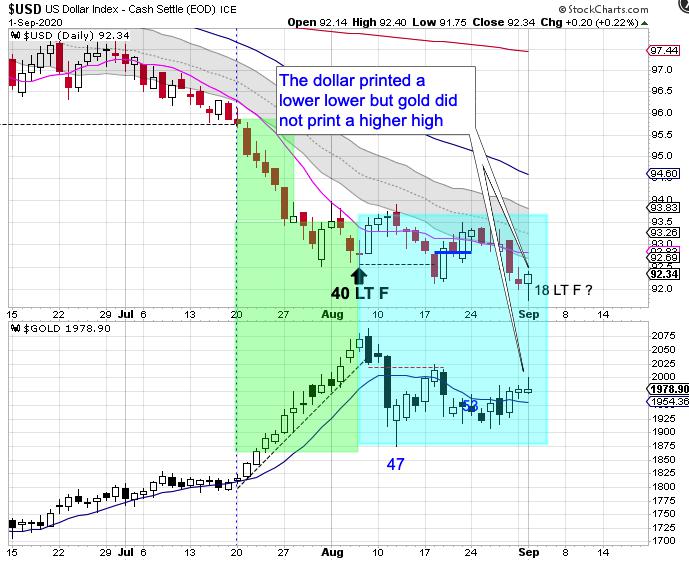

The dollar printed its lowest point Tuesday since May of 2018.

The dollar dropped pretty steeply in July through August 6th. There has been a change in character in the dollar since August 6th. Since then the dollar has leveled off which has allowed the 10 day MA to flatten. So in retrospect I believe that August 6th was the DCL. That would make Tuesday day 18 for the dollar's daily cycle to place it in the early part of its timing band for a DCL.

The dollar printed a bullish reversal on Tuesday. That eases the parameters for forming a swing low. A break above 92.40 would form a swing low, then a close above the 10 day MA would indicate a new daily cycle.

Since August 6th the dollar has gone on to print a lower low, but gold has not printed a higher high. With gold not breaking out to new highs as the dollar is forming new lows aligns with the dollar being in its timing band for an intermediate and yearly cycle low - which I plan to cover in the Weekend Report. Which makes sense since gold is in its timing band for an intermediate cycle decline. So if the pending DCL in the dollar is also an intermediate cycle low, then that could send gold into an intermediate cycle correction.

Reprinted from FXStreet,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-