OKEx, which claimed over $1.2 billion of crypto trading volumes in the last 24 hours, has rolled out three more expiration dates to its options trading. The product addition will help traders take advantage of volatility, hedge risk and discover prices through daily, two-day and monthly derivatives contracts.

OKEx CEO Jay Hao says the multi-expiry represents part of an upgrade to its platform architecture and its crypto options offering. The move follows the launch of bi-weekly, quarterly and bi-quarterly options which provided the exchange’s users with more tools to fulfill their needs of executing different trading strategies.

“Based on this concept, we have launched more options to fulfill the demands of users with different amounts of funds and trading strategies, providing our global users with even better trading experience,” added the head of Malta-based exchange.

To access OKEx options, which takes feeds from multiple exchanges, traders have to go through a KYC verification, as well as pass a suitability test.

OKEx, which describes itself as the world’s largest futures cryptocurrency exchange, says this ensures that traders understand risk associated with options trading while its pricing model accurately reflects the entire market.

For investors interested in this new trading vehicle, OKEx contract follows the European-style options, which may be exercised only at the expiration date of the option, i.e., at a single pre-defined point in time.

Crypto derivatives continue to gain momentum. The world’s most influential crypto exchange, Binance, has recently expanded its offering with the launch of new options on ETH/USDT and XRP/USDT. Derivatives exchange giant CME Group has also its own options product tied to its bitcoin futures, alongside other platforms such as Bakkt, Deribit and LedgerX.

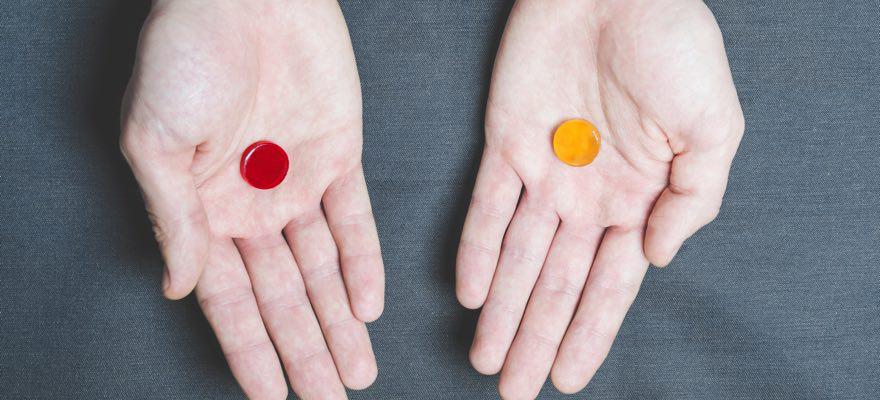

Both futures and options are a way for investors to bet on the trends of bitcoin price without having to actually hold the digital currency, which skirts regulatory and custodian issues. However, futures are in general riskier than options as the only financial liability for the latter is the premium paid at the purchase time. Futures contracts, on the other hand, involve maximum liability.

Hot

No comment on record. Start new comment.