Market sentiments are generally calm in Asia, which follow US equities higher. Investors were assured by Fed officials that interest rate is going to stay low at current level for a while. Commodity currencies are recovering today, with Aussie leading the way, even though upside remains rather limited. Yen and Swiss Franc are trading softer, followed by the greenback. Sterling is mixed, awaiting some important economic data today.

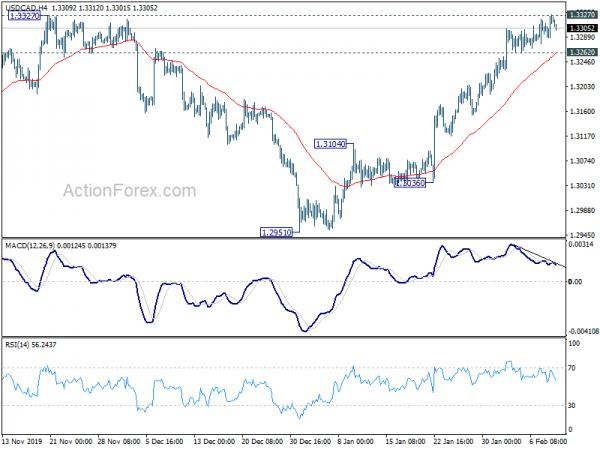

Technically, EUR/USD’s decline is in acceleration, on track to retest 1.0879 low. EUR/CHF breached 1.0665 low but is repelled by 1.0629 key support again. USD/CHF is losing some intraday upside momentum, but there is no sign of topping. The interplay between these three pairs is something to watch today. AUD/USD and USD/CAD are worth a note too. AUD/USD is trying to draw support from 0.6670 low after breaching it. USD/CAD also struggle to sustain above 1.3327 resistance. Dollar could retreat against these two currencies.

In Asia, currently, Japan is on holiday. Hong Kong HSI is up 1.25%. China Shanghai SSE is up 0.33%. Singapore Strait Times is up 0.74%. Overnight, DOW rose 0.60%. S&P 500 rose 0.73%. NASDAQ rose 1.13%. 10-year year yield dropped -0.031 to 1.547.

Fed Daly: Inflation won’t hit 2% until 2021

San Francisco Fed President Mary Daly said “policy is in a good place. The economy is in a good place. And barring a material change in the outlook, then I’m comfortable with policy where it’s at, for the foreseeable future.” Her own forecast for inflation is that “it is gradually moving up to target, but my expectation is it wouldn’t achieve something like 2% until somewhere in 2021 as opposed to 2020.”

She added that “we haven’t seen much yet” regarding the impact of China’s coronavirus outbreak. And, “the most important impact would be through confidence, and we haven’t seen that yet either.”

Harker: Fed is on track to meet 2% inflation target

Philadelphia Fed President Patrick Harker said “my own view right now is that we should hold steady for a while and watch how developments and the data unfold before taking any more action.” He added, “we haven’t quite met our 2% inflation target, but we’re on track to get there.”

Harker also said it’s “too early to say what impact the spread of the coronavirus will have on the global economy, but the negative effects on the Chinese economy and international travel are something to watch”. He added, “If the situation gets significantly worse and we start to see significant impact on the U.S. economy, then we have to think about accommodating. But I don’t think we’re at that point right now.”

Australia NAB business confidence rose to -1, but decline in employment a concern

Australia NAB business confidence rose from -2 to -1 in January. Business conditions were unchanged at 3. Looking at some details, Trading conditions dropped from 6 to 5. Profitability conditions rose from 1 to 2. But employment conditions dropped sharply from 4 to 1.

Alan Oster, NAB Group Chief Economist warned: “The concern this month is the decline in employment. It is now below average and a worry given the labour market has been a bright spot in the economic data. That said, there is a risk that ongoing weakness in business activity sees a pull-back in hiring intentions”.

China’s coronavirus death toll hits 1016, could lose up to 1% GDP

According to China’s National Health Commission, on February 10, confirmed coronavirus cases rose 2478 to 42638. That’s notably smaller than 3062 new cases reported back on February 9. However, death tolls rose 108 to 1016. Serious cases, surged 849 to 7333, much faster than prior day’s 296 new serious cases.

Zeng Gang, vice chair of the National Institute for Finance and Development, said in “according to different scenario assumptions, researchers expect the negative impact of the epidemic on full-year GDP growth to be in the range of 0.2% to 1%.”

He added, ” in the short term, the epidemic’s impact on economic activity cannot be ignored, especially with tertiary industries and small enterprises with tight cash flows facing greater pressures.”

Looking ahead

UK data will be the major focuses today. GDP, productions, and trade balance will be featured.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3296; (P) 1.3312; (R1) 1.3336;

Intraday bias in USD/CAD stays on the upside with focus on 1.3327 resistance. As noted before, corrective pattern from 1.3664 should have completed as a triangle at 1.2951. Sustained break of 1.3327 resistance should confirm this bullish case and pave the way for retest of 1.3664 high. On the downside, below 1.3262 minor support will turn intraday bias neutral for consolidation first, before staging another rally.

In the bigger picture, price actions from 1.3664 (2018 high) is seen as a corrective move that has probably completed. Rise from 1.2061 (2017 low) might be ready to resume. Decisive break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685 will pave the way to retest 1.4689 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Jan | 0.00% | 0.60% | 1.70% | |

| 0:30 | AUD | NAB Business Confidence Jan | -1 | -2 | ||

| 0:30 | AUD | NAB Business Conditions Jan | 3 | 3 | ||

| 9:30 | GBP | GDP M/M Dec | 0.20% | -0.30% | ||

| 9:30 | GBP | GDP Q/Q Q4 P | 0.00% | 0.40% | ||

| 9:30 | GBP | Industrial Production M/M Dec | 0.30% | -1.20% | ||

| 9:30 | GBP | Industrial Production Y/Y Dec | -0.80% | -1.60% | ||

| 9:30 | GBP | Manufacturing Production M/M Dec | 0.50% | -1.70% | ||

| 9:30 | GBP | Manufacturing Production Y/Y Dec | -3.70% | -2.00% | ||

| 9:30 | GBP | Index of Services 3M/3M Dec | 0.00% | 0.10% | ||

| 9:30 | GBP | Goods Trade Balance (GBP) Dec | -10.0B | -5.3B | ||

| 13:00 | GBP | NIESR GDP Estimate (3M) Jan | 0.20% | 0.00% |

Hot

-THE END-