全球外汇市场日均交易量飙升至6.6万亿美元

译者 王为

Ginormous numbers, FX swaps and spot trades, USD, EUR, JPY, GBP, Australian & Canadian dollars… but where the heck is China’s CNY?

大得惊人的成交量数字,外汇互换和即期外汇交易,美元、欧元、日元、英镑、澳大利亚元和加拿大元,但中国的人民币排在哪?

It happens every three years: The Bank for International Settlements released its Triennial Central Bank Survey about the global foreign exchange (FX) and over-the-counter (OTC) derivatives markets, as it occurred in April. The numbers are ginormous, and get more ginormous with every survey, with trading volume measured in trillions of dollars per day. This is a huge data trove, and I will focus here on global FX trading.

今年四月份,国际清算银行发布了每三年一度的《全球央行调查报告》,统计全球外汇和场外衍生品市场的交易量。可以看到,全球外汇和衍生品市场的成交量数字非常惊人,每更新一次报告成交量数字会变得更大,日成交量数以万亿美元计。该调查数据具有极高的价值,我今天将主要写写全球外汇市场的情况。

国际清算银行的《全球央行调查报告》下载地址:https://www.bis.org/statistics...

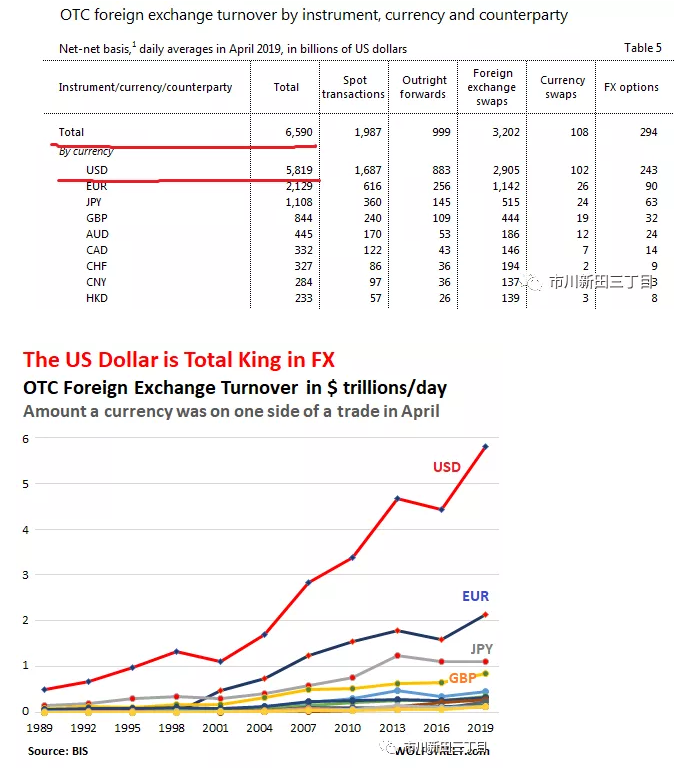

To start with, there are the amounts. Currencies are traded in pairs, such as the US dollar against the euro. In April 2019, trading in FX markets reached $6.59 trillion per day, up 30% from the prior survey period, April 2016. Trades with the USD on one side of the trade averaged $5.82 trillion per day in April 2019. This was up 31% from the daily average in April 2016 and was over five times the daily average in April 2001:

先看几个数字,外汇交易是以货币对的形式出现的,比如美元/欧元。2019年4月份,全球外汇市场每天的成交量达到6.59万亿美元,比2016年4月所作的前一次调查增加了30%;货币对中有一方是美元的外汇交易量在2019年4月份达到每天5.82万亿美元,比2016年4月所作的前一次调查升了31%,相当于2001年4月调查结果的5倍还多。

The sudden appearance of the euro in 2001 as the second largest currency out of nowhere indicates that at that time, it had just replaced five currencies, including the biggie, the Deutsche Mark.

2001年欧元横空出世成为全球第二大货币,当时欧元刚刚由5个国家的货币组成,包括德国马克这个欧洲货币中的老大。

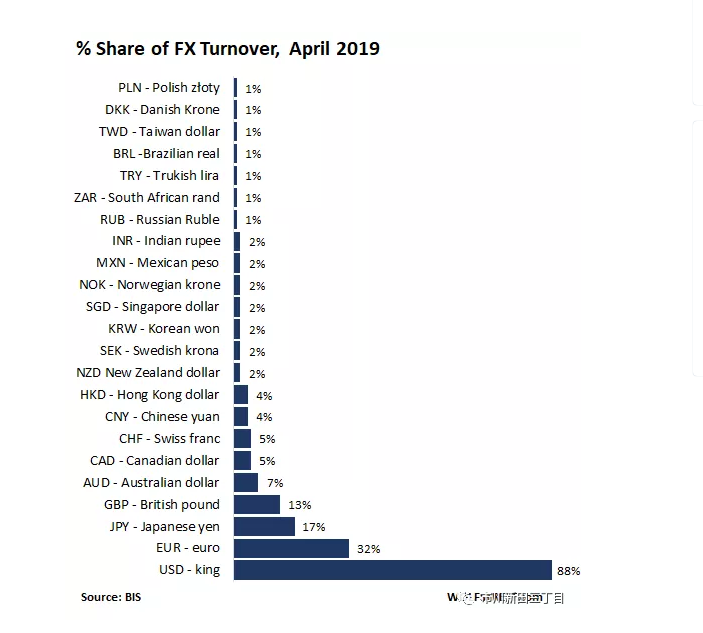

The chart above shows the top 16 most traded currencies. Four have a significant share – USD, EUR, Japanese yen (JPY), and British Pound (GBP). The remaining 12 of the top 16 currencies are the limp spaghetti at the bottom of the chart, including the Chinese renminbi (CNY).

上图显示的是交易量排名前16位的货币,其中四个货币的占比非常突出,美元、欧元、日元和英镑,其他12个货币就像意大利面条一样匍匐在图表的最底部,包括人民币。

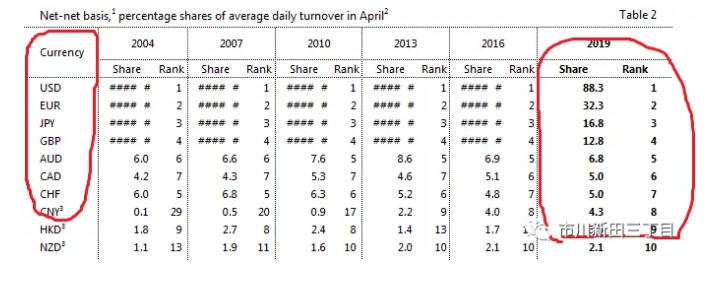

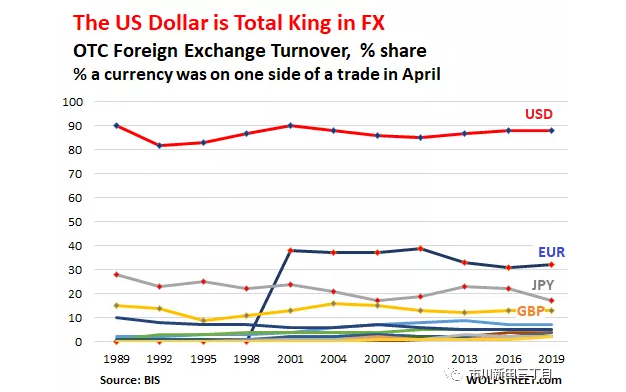

In terms of the share that a currency is on one side of a trade, the US dollar remains total King, at 88.3%. Its share has remained relatively stable over the years, despite three factors:

如果对外币对中的一方货币的成交量进行统计,美元在总交易量中的占比为88.3%,占比已连续多年保持稳定,尽管有以下三个制约因素:

One, the arrival of the euro, whose share, after a brief surge to 38% between 2001 and 2010, got whacked by the euro debt crisis in 2010-2012, and fell to a series low of 31.4% in 2016. But in 2019, its share ticked up to 32.3%. This slight increase in share was due to higher than market-average growth in trading of the EUR/JPY and the EUR/CHF currency pairs.

第一,是欧元的诞生。在2001- 2010年期间,欧元的占比一度升至38%,但因受到2010-2012年期间欧洲危机的影响,欧元的占比跌至2016年的31.4%,但2019年占比升至32.3%,升幅虽然不大,但主要是受到欧元/日元以及欧元/瑞士法郎交易量的增速超过市场平均增速的影响;

Two, the surge of emerging market currencies, including the CNY, from near zero in 2001 to 21% in 2016, and to 24.5% in 2019.

第二,是新兴市场货币地位的蹿升。包括人民币在内的新兴市场货币的外汇成交量从2001的近乎0升至2016年的21% ,到了2019年又升至24.5%;

Three, the arrival of the CNY, whose share rose from 0% in 2007 to 4.0% in 2016, but has essentially remained stuck there, at 4.3% in 2019, which puts the currency of the second largest economy in the world just below the currency of a tiny economy, Switzerland.

第三,是人民币出现在国际市场上,人民币的外汇成交量从2007的0%升至2016年的4.0% ,但在那之后变化不大, 2019年的占比为4.3%,结果是全球第二大经济体的货币-人民币在外汇市场的成交量占比还没有经济总量远不及中国的瑞士的货币-瑞士法郎的占比高。

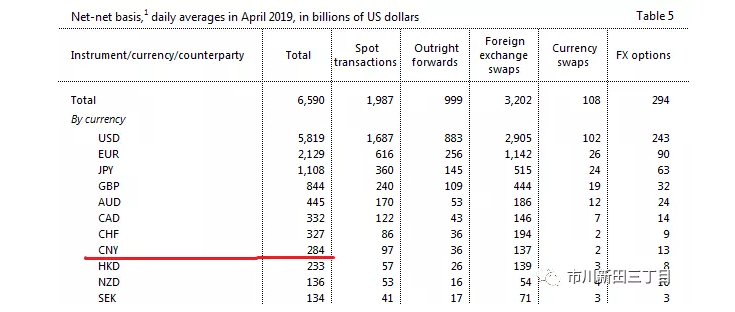

CNY trading, with a turnover of $284 billion a day, was in eighth place, with the USD being on the other side in 95% of the trades.

人民币在全球外汇市场上每天成交量2840亿美元,在各主要货币中排名第八,其中人民币/美元的交易量就占了95%。

The Japanese yen, however, lost 5 percentage points in share since 2016, dropping to a new low of 16.8%, down from 28% in 1999. But it remains the third most actively traded currency. The report notes that the decline in turnover in 2019 was mostly a reflection in the decline of the JPY/USD cross “amid low volatility.”

但是,日元在外汇市场的成交量占比自2016年以来流失了5%,创下16.8%的历史新低,远低于1999年的28%,但仍守住了全球第三大交易货币的角色,该报告认为2019年日元交易量占比的下降很大程度上体现的是在“低波动率的环境中”日元/美元交易份额的流失。

Brexit or not, the British pound’s share has remained at 12.8%, approximately flat since 2010:

不管脱欧与否,英镑在全球外汇市场的成交量占比仍保持在12.8%,2010年以来基本上没啥变化。

The chart below shows the percent share of the top currencies. Combined, the emerging market currencies weigh in with 24.5%, but individually, their share is small, with the CNY coming out at the top with a 4.3% share. The Mexican peso and the Turkish lira lost share:

下图显示的是成交量居前的几个货币的占比情况。新兴市场货币加在一起的份额为24.5%,但分开来看的话,任何一个新兴市场货币的份额都很小,人民币的份额最多,为4.3%,墨西哥比索和土耳其里拉的份额出现了下降。

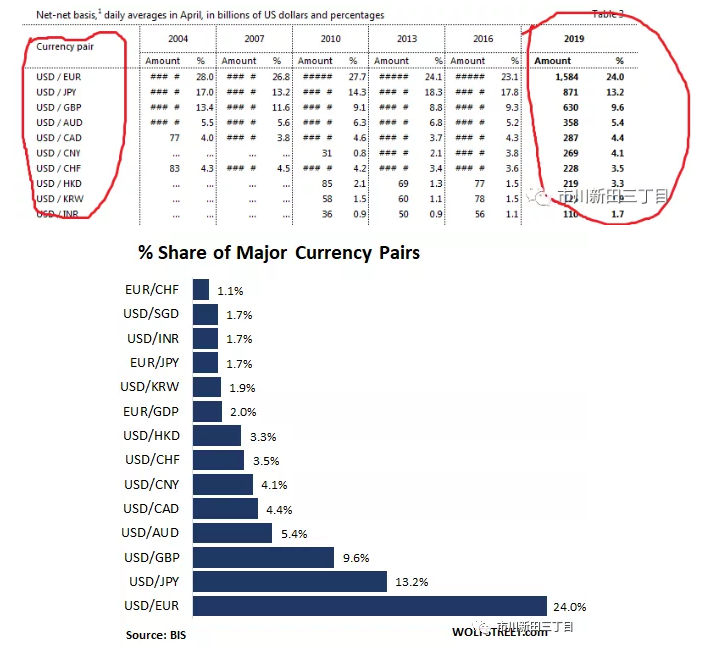

In terms of trading pairs, the USD/EUR was by far the most popular trade, with 24% share of the total FX turnover, followed by the USD/JPY:

从货币对方面来看,美元/欧元的成交量远远超过其他货币对,在全部外汇交易总量中的占比为24%,其次是美元/日元。

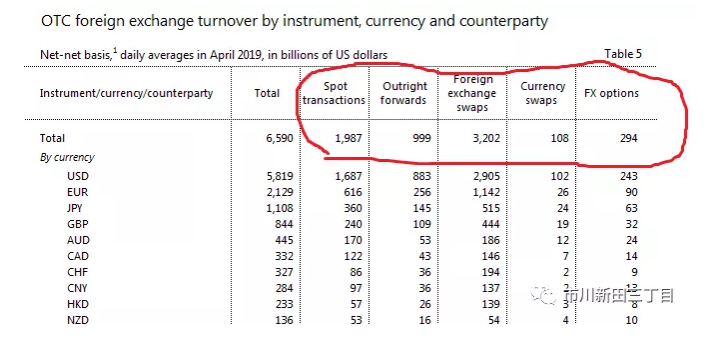

Turnover grew in all categories:

各类外汇交易的成交增长状况:

The bulk of the growth in FX trading came from FX swaps, which jumped by 35% since 2016, to $3.2 trillion per day in April 2019, for a share of 48.6% of total FX market turnover. FX swaps are mostly used to manage funding liquidity and hedge currency risk. The USD was on one side of 91% of all FX swap transactions.

大部分外汇交易的增量来自外汇互换,2016年以来外汇互换的成交量增长了35%,到2019年四月已升至3.2万亿美元/天,在外汇交易总量中的占比为48.6%,外汇互换是最常用的融资流动性管理以及对冲汇率风险的金融工具,在所有的外汇互换交易总量中美元作为货币对中一方货币的成交量占比为91%。

The turnover in spot trades also grew, but only by 20% over the three-year period, to $2.0 trillion per day, and its share fell to 30.2%.

即期外汇交易的成交量也在增长,但过去三年的增幅只有20%,日成交量增至2万亿美元,在全部外汇交易总量中的占比降至30.2%。

Trading of outright forwards soared by 43% to $1 trillion per day, with a large part of the increase reflecting the surge of non-deliverable forwards (NDFs). This gave them a share of 15.2%.

纯远期交易的交易总量大增43%,日成交1万亿美元,增量中有很大一部分是来自非交割远期成交量的增加,纯远期成交量在总外汇交易量的占比为15.2%。

Trading in FX options and other products rose to $294 billion a day, for a share of 4.5%

外汇期权和其他产品的成交量升至每天2940亿美元,在全部外汇交易量中的占比为4.5%。

Trading in currency swaps ticked up to $108 billion a day for a share of 1.6%.

交叉货币互换的日均成交量为1080亿美元,在全部外汇交易量中的占比为1.6%。

Where the heck does this data come from? The survey “involved central banks and other authorities in 53 jurisdictions,” which collect data from around 1,300 banks and dealers in their jurisdictions and reported it aggregated by country to the BIS. “Turnover data are reported by the sales desks of reporting dealers, regardless of where a trade is booked, and are reported on an unconsolidated basis, i.e. including trades between related entities that are part of the same group.” Yes, trillions of dollars per day.

这些数据到底从何而来?来自“相关的央行和其他53个机构”的调查,该调查中的数据来自各个国家或地区的约1300家银行和交易中介机构,并按所在国家和地区分类后上报给国际清算银行。“交易量数据由交易中介机构的销售部门上报,不管交易在哪里成交都不做任何加工直接上报,其中来自同一控股集团的关联机构之间的交易也包括在内。”是的,外汇市场的成交量达到了每天数万亿美元。

Reprinted from 今日头条,the copyright all reserved by the original author.

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

No comment on record. Start new comment.