Daily thread to exchange ideas and to share your thoughts

Happy Monday, everyone! Hope you all had a great weekend and that you're all primed for the new week. It's been a quiet start to the day with little movement among major currencies with risk assets in general looking a bit more subdued.

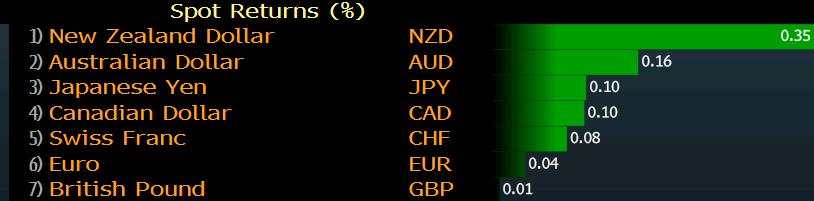

The kiwi is leading gains but not by much on the back of a slight recovery in NZ yields and that's a similar case for the aussie as well. The dollar is mostly steady as markets are still digesting the moves from Friday awaiting more Fedspeak to come later this week.

The greenback is near flat levels against almost all other major currencies at the moment as narrow ranges continue to prevail in the European morning. US equity futures are down by 0.2% with 10-year yields down by just 1 bps now to 2.023%.

That's not really helping to give much fresh direction to traders to start the week but so far there hasn't been anything to suggest a reversal or break in key technical levels from a continuation from Friday. Let's see what the next few sessions will have to offer but the focus now remains on the Fed narrative.

Were markets silly to ever consider a 50 bps rate cut? Is a 25 bps rate cut even justifiable now? What are your views on the market right now? Share your thoughts/ideas with the ForexLive community here.

Reprinted from Forexlive,the copyright all reserved by the original author.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Like this article? Show your appreciation by sending a tip to the author.

Leave Your Message Now