The euro strengthened above $1.19 on Wednesday. The US posted slower-than-expected retail sales in December, while a separate report showed growth inlabour costs unexpectedly slowed in Q4.

Eurozone inflation is expected to stabilise at the 2% target after dipping below it this year, but the environment remains uncertain, ECB President Christine Lagarde said on Monday.

Analysts at UBS lifts its Eurozone GDP growth forecast for 2026 by 0.2 percentage points to 1.3%, while keeping 2027 and 2028 forecasts unchanged at 1.4% and 1%, respectively.

Over the coming two years, stronger fiscal policy is likely to offset the negative impact of Europe's profound demographic change that is already working in the background.

German exports rose more than expected in December thanks to a rise in shipments to the US and China but industrial output fell during the period, highlighting continued uncertainty over recovery.

Last year, the EU and China are open to a diplomatic reset, which collapsed after Beijing imposed broad restrictions on rare earth exports. However, Europe's increasing trade deficit with China remains a sore spot.

The single currency is trading within an ascending channel, but a daily close above $1.2 was still absent. If it consolidates below the level for an extended of time, a bearish reversal is in the cards.

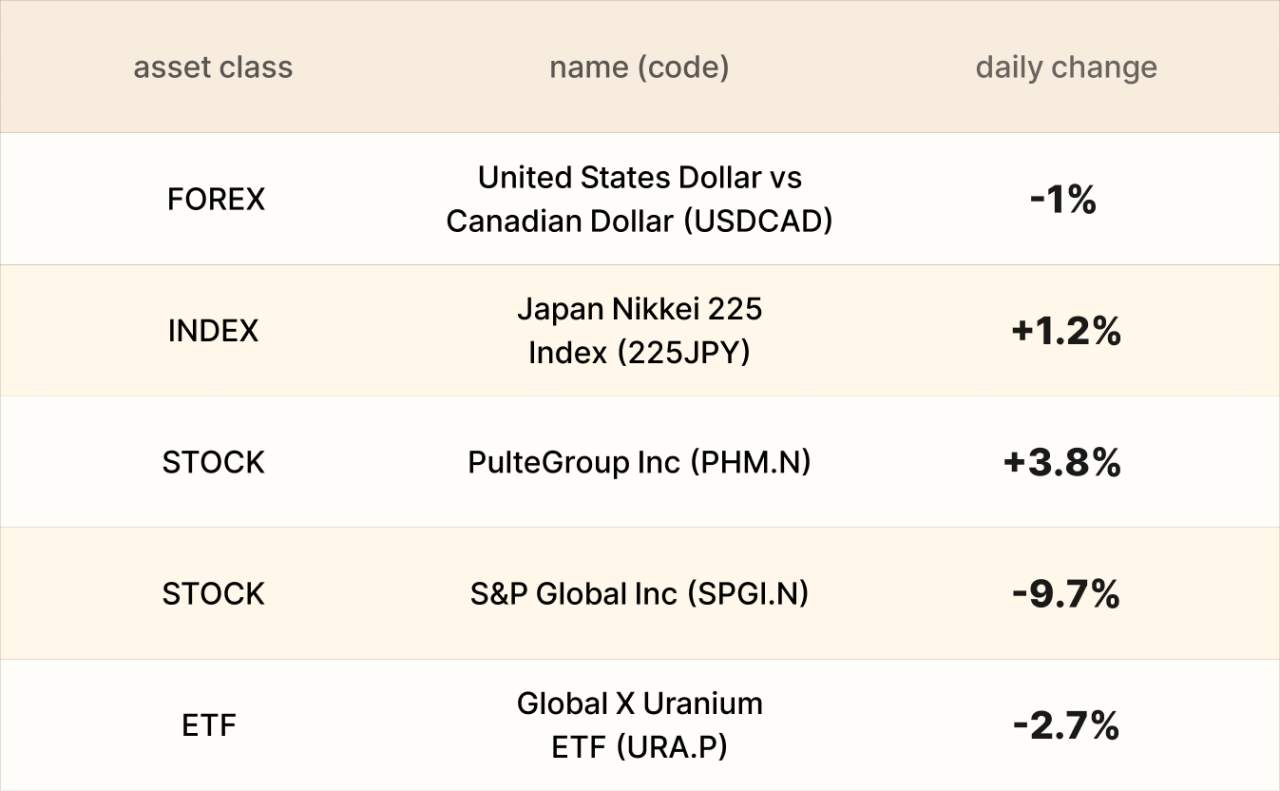

Asset recap

As of market close on 10 February, among EBC major products, PulteGroup shares led gains. Several institutional investors and hedge funds also recently added to or reduced their stakes in the homebuilder.

S&P Global plunged after issuing weaker-than-expected 2026 earnings guidance, overshadowing solid Q4 results. Moody's and S&P Global face sector pressure from AI-driven fears.

Despite the Canadian dollar's underperformance, investors appear to have cut it some slack by shifting from net short bets to net long bets for the first time since August 2023, said Bank of Nova Scotia.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Disclaimer: The views expressed are solely those of the author and do not represent the official position of Followme. Followme does not take responsibility for the accuracy, completeness, or reliability of the information provided and is not liable for any actions taken based on the content, unless explicitly stated in writing.

Leave Your Message Now