Current trend

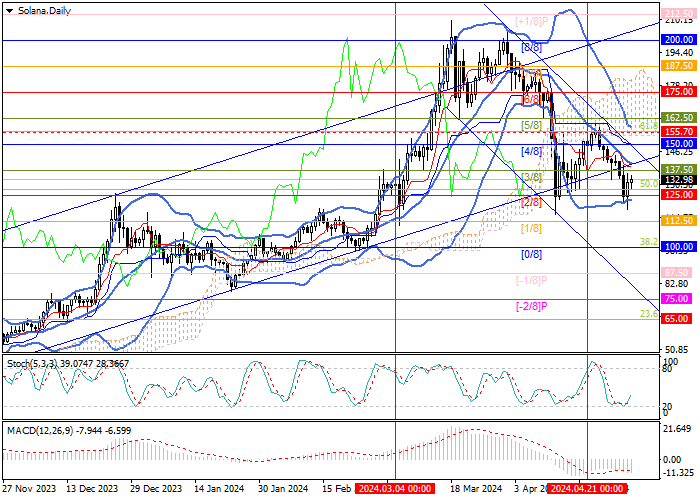

Last week, the SOL/USD pair resumed its decline within the general market trend and fell to 125.00 (Murrey level [2/8]).

The SOL token, like other leading digital assets, came under pressure after the halving on the Bitcoin network on April 20. Investors have lost their previous interest in the cryptocurrency market and have focused on monetary factors. This is evidenced by the trend towards outflow of funds from bitcoin ETFs, which began last Wednesday and continues to this day: more than 213.0 million dollars of investments were withdrawn from the funds this week alone.

Yesterday, the price attempted a correction, rising to the area of 135.00 against the background of the statement by the head of the US Federal Reserve Jerome Powell during a press conference following the meeting of the regulator that a new increase in the cost of borrowing looks unlikely. Nevertheless, this growth in SOL is seen as temporary, since officials also do not announce an imminent easing of monetary policy. The head of the department pointed out that the macroeconomic data of the current year do not inspire confidence in a steady decline in inflation to the target level of 2.0%, therefore, the current "hawkish" position of the regulator may persist for a long time. These comments increase the likelihood of postponing the first interest rate cut to fall, if it takes place at all this year, and until then, the US currency may continue to strengthen against alternative assets, including digital ones.

Support and resistance

The price continues its negative dynamics, forming a new downward channel. Currently, the quotes are at 125.00 (Murrey level [2/8]), the breakdown of which will lead to a decrease to the targets of 100.00 (Murrey level [0/8], 38.2% Fibonacci retracement), and 87.50 (Murrey level [-1/8]). The key for the "bulls" is the level of 155.70 (61.8% Fibonacci retracement), the breakout of which can cause growth to 175.00 (Murrey level [6/8]) and 200.00 (Murrey level [8/8]).

Technical indicators confirm the possibility of continuing the decline in quotes: Bollinger Bands are pointing downwards, MACD is increasing in the negative zone, and Stochastic is reversing up from the oversold zone, which does not exclude corrective growth, but is unlikely to lead to a change in the current trend.

Resistance levels: 155.70, 175.00, 200.00.

Support levels: 125.00, 100.00, 87.50.

Trading tips

Short positions can be opened below 125.00 with targets of 100.00, 87.50 and stop-loss of 140.00. Implementation period: 5–7 days.

Long positions can be opened above the 155.70 mark with targets of 175.00, 200.00 and stop-loss of 142.00.

Hot

No comment on record. Start new comment.