Current trend

The leading index of the London Stock Exchange FTSE 100 shows corrective dynamics at 8148.0 amid unstable corporate reports and continued growth in the bond market.

Quarterly revenue of the biopharmaceutical company GSK Plc. amounted to 7.36 billion pounds, surpassing the 7.06 billion pounds predicted by analysts, as well as 6.95 billion pounds recorded over the same period a year earlier. Earnings per share (EPS) amounted to 0.4310 pounds with expectations at 0.3644 pounds, up from 0.3700 pounds a year earlier.

In turn, the revenue of the healthcare company Haleon Plc. reached 2.92 billion pounds, which coincided with preliminary estimates, but was down from 2.99 billion pounds shown last year. EPS rose to 0.046 pounds from 0.042 pounds, while analysts had expected 0.044 pounds.

Yields on leading bonds are still held at high levels: 10-year securities are trading at a rate of 4.402%, which exceeds last week's figure of 4.235%, 20-year bonds rose to 4.829% from 4.734%, and 30-year securities rose to 4.861% from 4.807%.

The growth leaders in the index are GSK Plc. ( 1.91%), Unite Group Plc. ( 1.29%), DCC Plc. ( 1.28%), Severn Trent Plc. ( 1.26%).

Among the leaders of the decline are JD Sports Fashion Plc. (-2.98%), Ashtead Group Plc. (-2.88%), Ocado Group Plc. (-2.83%).

Support and resistance

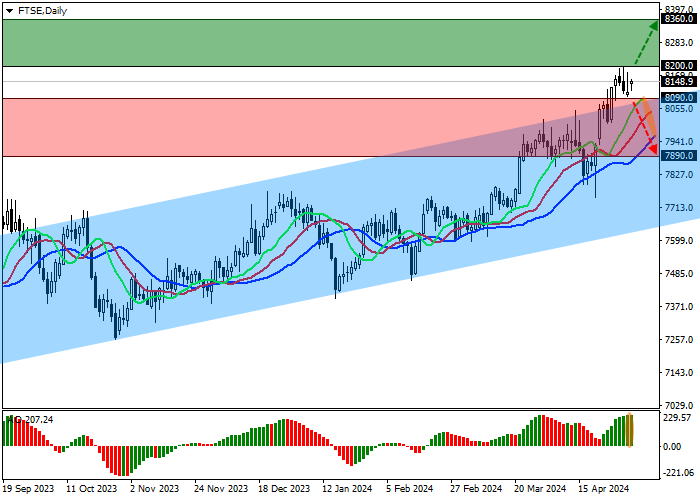

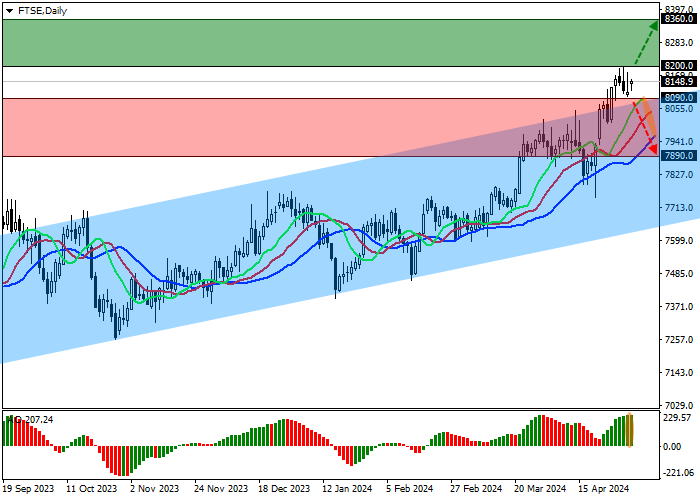

On the D1 chart, the index quotes continue their local correction, holding above the resistance line of the ascending channel of 8100.0–7600.0.

Technical indicators are in the state of a buy signal, which has begun to strengthen: the range of EMAs fluctuations on the Alligator indicator is expanding, and the AO histogram is forming new correction bars, increasing in the purchase zone.

Support levels: 8090.0, 7890.0.

Resistance levels: 8200.0, 8360.0.

Trading tips

In case of continued growth of the index and price consolidation above the resistance level of 8200.0, buy positions with the target of 8360.0 and stop-loss of 8150.0 may be opened. Implementation time: 7 days and more.

In the event of a reversal and continued decline in the index, as well as price consolidation below the support level of 8090.0, sell positions with the target of 7890.0 can be opened. Stop-loss – 8150.0.

Hot

No comment on record. Start new comment.