Current trend

Against the unstable American dollar exchange rate, the NZD/USD pair is correcting around 0.5926.

The New Zealand dollar is supported by macroeconomic statistics: the Q1 unemployment rate rose from 4.0% to 4.3%, meeting forecasts, and the wage dynamics index added 0.8% QoQ and 3.8% YoY, below 3.9% previously.

The American dollar is trading at 105.50 in USDX after the US Fed decided to keep interest rates at 5.25–5.50% and the head of the regulator, Jerome Powell, noted that inflation is consistently held above 2.0%, preventing monetary easing. Given early forecasts for the consumer price index, the index may miss the target this year, minimizing the likelihood of a soon shift to the “dovish” rhetoric.

Under these conditions, continued local decline in the NZD/USD pair looks most likely.

Support and resistance

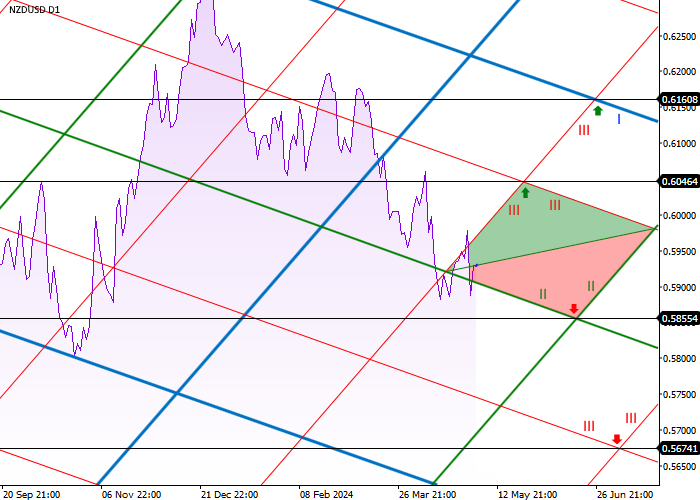

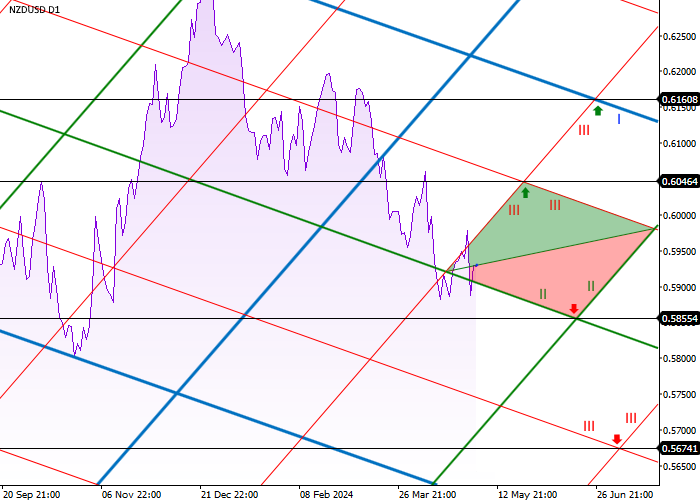

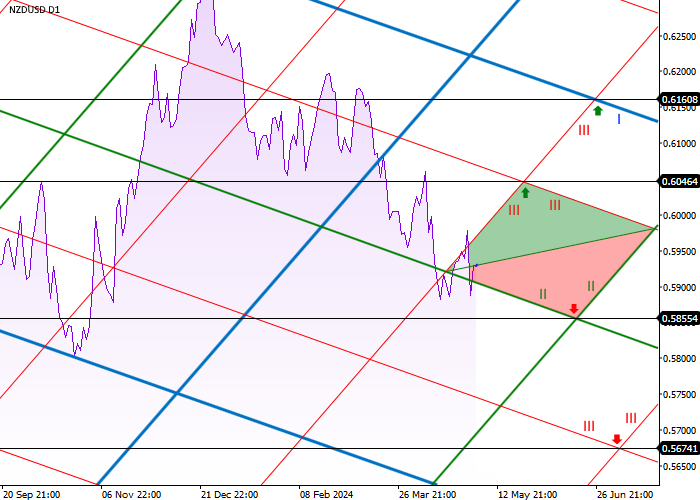

On the daily chart, the trading instrument moves within a global range between first-order levels (I). After reaching the second-order left support level (II) at 0.5890, it continues the correction. The most likely scenario now is a decline towards the crosshairs of right second-order support (II) and left second-order support (II) at 0.5855, after which it is possible to reach the crosshairs of left third-order support (III) and right third-order support (III) at 0.5674.

If growth continues, the local crosshair of the right third-order resistance (III) and the left third-order resistance (III) at 0.6046 will become the nearest target and the long-term crosshair between the left third-order resistance (III) and the right first-order resistance (I) at 0.6160.

Resistance levels: 0.6046, 0.6160.

Support levels: 0.5855, 0.5674.

Trading tips

Short positions may be opened after the consolidation below 0.5855, with the target at 0.5674. Stop loss – 0.5920. Implementation period: 7 days or more.

Long positions may be opened after the consolidation above 0.6046, with the target at 0.6160. Stop loss – 0.6000.

Hot

No comment on record. Start new comment.