Current trend

The GBP/USD pair has been moving within a downward channel for the second month: last week, the price reached its lower border, corrected upwards, and is now trading at 1.2550. The upward dynamics are seen as temporary and are unlikely to lead to a change in trend since monetary factors support the US currency. Most experts believe that Bank of England officials will begin cutting interest rates in June or August, despite a more serious than expected acceleration in inflation in March (3.2% versus 3.1%), and US Fed economists may begin easing monetary policy no earlier than September. According to the most pessimistic estimates, against accelerating growth in consumer prices, the American regulator may refuse to reduce borrowing costs this year or go for another increase.

In March, the number of approved mortgage loans in the UK amounted to 61.33K, renewing 18-month highs. Consumer lending rose by 1.577M pounds from 1.429M pounds previously, while net private borrowing rose by 1.800M pounds compared to forecasts of 1.700M pounds. The statistic, which confirms the recovery of the construction market, failed to support the national currency as traders took a wait-and-see approach ahead of the US Fed meeting on Wednesday. If regulator officials keep the interest rates, confirming the postponement of the monetary policy adjustment to the fall, the GBP/USD pair will come under pressure.

Support and resistance

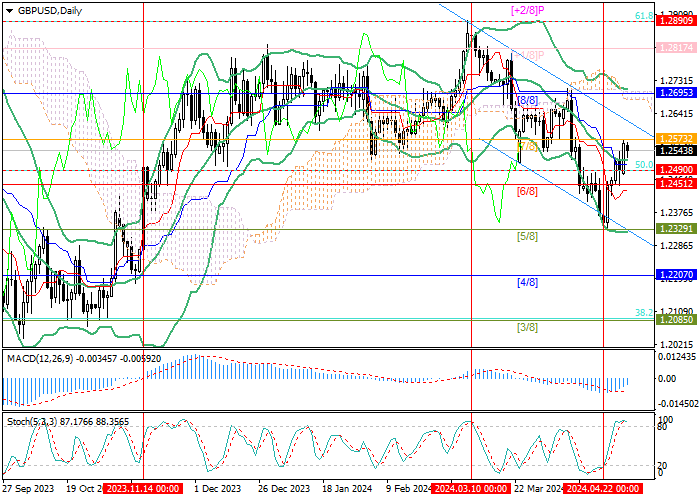

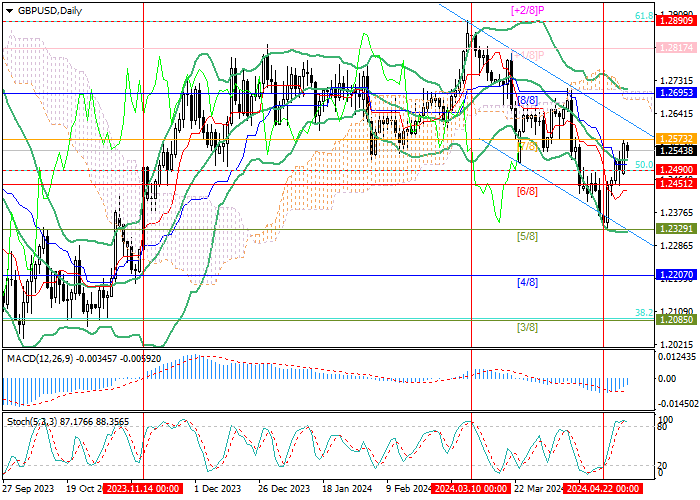

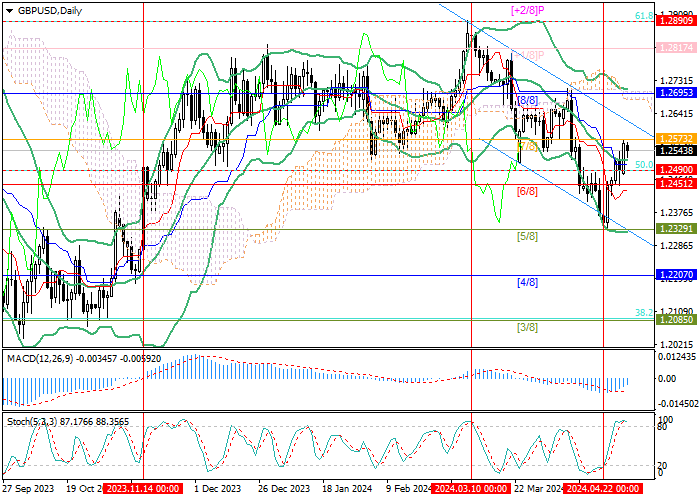

The trading instrument is close to 1.2573 (Murrey level [7/8]), consolidation above which will cause growth to the area of 1.2695 (Murrey level [8/8]) and 1.2817 (Murrey level [ 1/8]). With a reverse breakdown of1.2451 (Murrey level [6/8]), a decline may reach the area of 1.2329 (Murrey level [5/8]), 1.2207 (Murrey level [4/8]) and 1.2085 (Murrey level [3/8], Fibonacci retracement 38.2%).

Technical indicators confirm the continuation of the downward trend: Bollinger bands are directed downwards, the MACD histogram falls in the negative zone, and Stochastic reverses downwards in the overbought zone.

Resistance levels: 1.2573, 1.2695, 1.2817.

Support levels: 1.2451, 1.2329, 1.2207, 1.2085.

Trading tips

Short positions may be opened below 1.2451 or with a reversal at 1.2695, with the targets at 1.2329, 1.2207, and 1.2085 and stop losses at 1.2530 and 1.2750, respectively. Implementation time: 5–7 days.

Hot

No comment on record. Start new comment.