Current trend

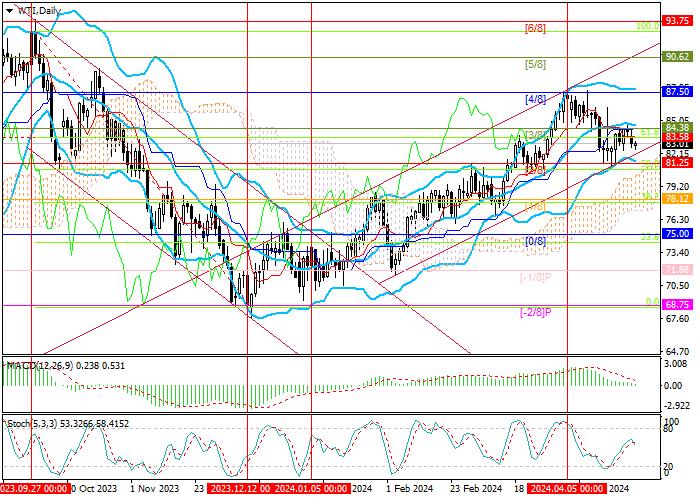

WTI Crude Oil is trading within a long-term ascending channel, but since the beginning of the month it has been attempting a downward correction: the price reversed around 87.50 (Murrey level [4/8]) and reached 81.25 (Murrey level [2/8], 50.0% Fibonacci retracement), which is seen as the key for the "bears". After its breakdown, an opportunity will open for quotes to go beyond the ascending channel and change the current trend. The targets of the decline will be 78.12 (Murrey level [1/8], 38.2% Fibonacci retracement) and 75.00 (Murrey level [0/8], 23.6% Fibonacci retracement). The key for the "bulls" is the 84.38 mark (Murrey level [3/8]), supported by the central line of Bollinger Bands; after consolidation above it, the growth of the trading instrument can resume to the targets of 87.50 (Murrey level [4/8]) and 90.62 (Murrey level [5/8]).

Technical indicators allow for a transition to a medium-term downward movement: Bollinger Bands are reversing horizontally after a long rise, Stochastic is trying to reverse down, MACD is preparing to move into a negative zone.

Support and resistance

Resistance levels: 84.38, 87.50, 90.62.

Support levels: 81.25, 78.12, 75.00.

Trading tips

Short positions can be opened below 81.25 with targets of 78.12, 75.00 and stop-loss around 83.00. Implementation period: 5–7 days.

Long positions can be opened above the 84.38 mark with targets of 87.50, 90.62 and stop-loss around 82.30.

Hot

No comment on record. Start new comment.