Current trend

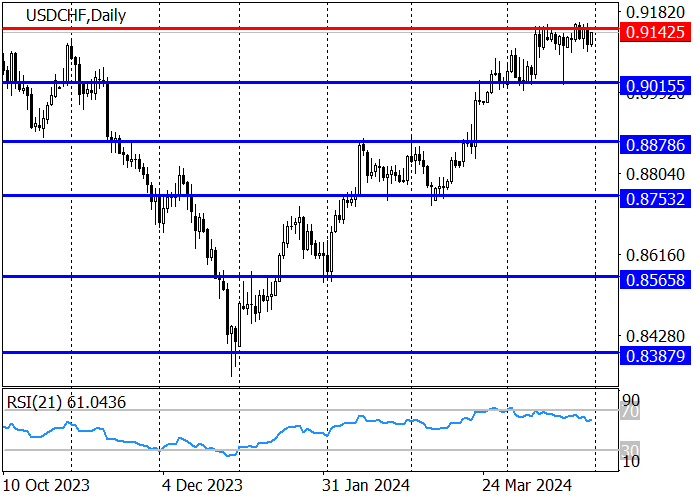

The USD/CHF pair is trading around the 0.9126 level, preparing to test the resistance level of 0.9142 as a result of the weakening of the franc against poor economic statistics.

Today, a leading indicator from the Swiss Economic Institute (KOF) was published, which considers 12 indicators related to consumer confidence, production, new orders, and the real estate market, and also reflects the development outlook for the next six months. In April, the indicator was 101.8 points, which is lower than the forecast of 102.1 points, and the previous value was corrected downward from 101.5 points to 101.4 points. However, the nominal wage index increased by 1.7% in 2023 compared to 2022, amounting to 102.4 points. Relative to the dynamics of inflation (2.1%), wages decreased by 0.4%, and the wage index amounted to 96.9 points, less than the stability level of 100.0 points. In June, the regulator is likely to leave the interest rate at 1.50%, which will be a weakening factor for the national currency in the long term.

The long-term trend is upward: after reaching 0.9142, the price went into a correction and reached the support level of 0.9015 in mid-April. Then the growth continued, and if the resistance level of 0.9142 is overcome, the upward dynamics will continue to the October high of 0.9230, and then to 0.9330. The RSI (21) indicator has left the overbought area, which allows us to consider new long positions.

The medium-term trend is up, with the target at last week’s high of 0.9153 and then in zone 4 (0.9249–0.9224). In the event of a correction to the key support area of 0.8915–0.8892, long positions, with the target at 0.9153 are relevant. If 0.8892 is broken, the trend may change and decline to zone 2 (0.8686–0.8664), which seems unlikely.

Support and resistance

Resistance levels: 0.9142, 0.9230, 0.9330.

Support levels: 0.9015, 0.8878.

Trading tips

Long positions may be opened above 0.9160, with the target at 0.9230 and stop loss 0.9130. Implementation time: 9–12 days.

Short positions may be opened below 0.9075, with the target at 0.9007 and stop loss 0.9108.

Hot

No comment on record. Start new comment.