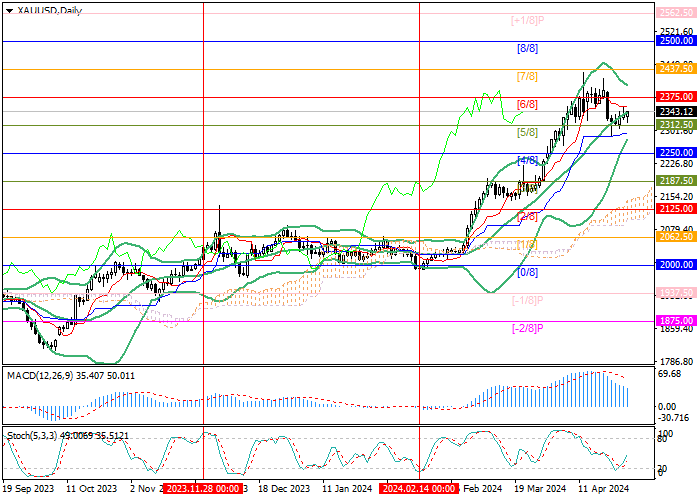

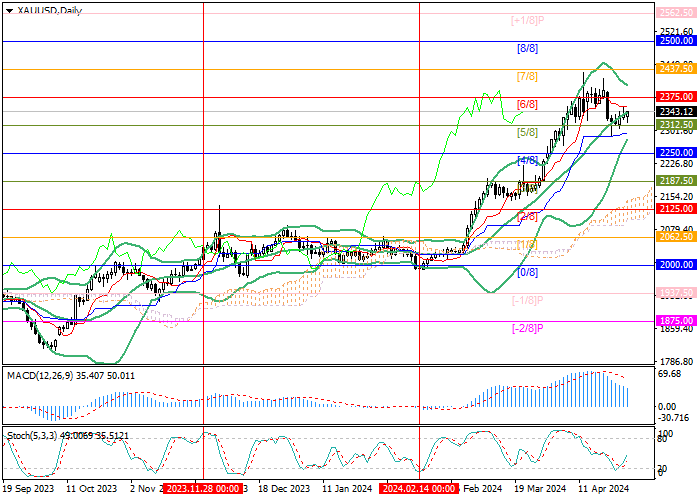

Current trend

The XAU/USD pair is moving within the long-term upward trend: the price has been testing the lower limit of the main Murrey trading range of 2000.00 (Murrey level [0/8]) for a long time but could not break it. In mid-February, the quotes resumed positive dynamics, entered the positive part of the trading range, and reached the pivot point of 2375.00 (Murrey level [6/8]), where they reversed and retreated to 2312.50 (Murrey level [5/8]), supported by the middle line of the bands Bollinger. In case of a breakdown of 2375.00, an increase to the area of 2500.00 (Murrey level [8/8]) and 2562.50 (Murrey level [ 1/8]) is expected. After consolidation below the key “bearish” central mark of the trading range of 2250.00 (Murrey level [4/8]), a decline to the area of 2187.50 (Murrey level [3/8]) and 2125.00 (Murrey level [2/8]) is possible, which seems less likely.

Technical indicators confirm the continuation of the upward trend: Bollinger Bands and Stochastic are directed upwards, and the MACD histogram is decreasing but remains in the positive zone.

Support and resistance

Resistance levels: 2375.00, 2500.00, 2562.50.

Support levels: 2250.00, 2187.50, 2125.00.

Trading tips

Long positions may be opened above 2375.00, with the targets at 2500.00, 2562.50, and stop loss 2330.00. Implementation time: 5–7 days.

Short positions may be opened below 2250.00, with the targets at 2187.50, 2125.00, and stop loss 2295.00.

Hot

No comment on record. Start new comment.