Current trend

The USD/CHF pair remains at 0.9109, and one of the reasons for such weak dynamics is macroeconomic statistics, which do not justify analysts’ forecasts.

The Swiss Nominal Wage Index increased by 1.7% in 2023 compared to 2022, amounting to 102.4 points. Relative to the dynamics of inflation (2.1%), wages decreased by 0.4%, and the Wage Index amounted to 96.9 points, which was below the stability level of 100.0 points.

In turn, US dollar quotes remain in a corrective trend, being around 105.300 in USDX. Statistics from the end of last week were perceived neutrally by investors, as the Core Personal Consumption Expenditures - Price Index in March added 0.3%, which in annual terms indicated an increase of 2.8%, as in the previous period. Personal Income increased by 0.5%, as analysts expected, and Personal Spending increased by 0.8%, exceeding the forecast of 0.6% and matching the February figure. The University of Michigan Consumer Expectations Index fell to 76.0 in April from 77.4 points, and the Consumer Sentiment Index dropped to 77.2 points from 79.4 points.

Support and resistance

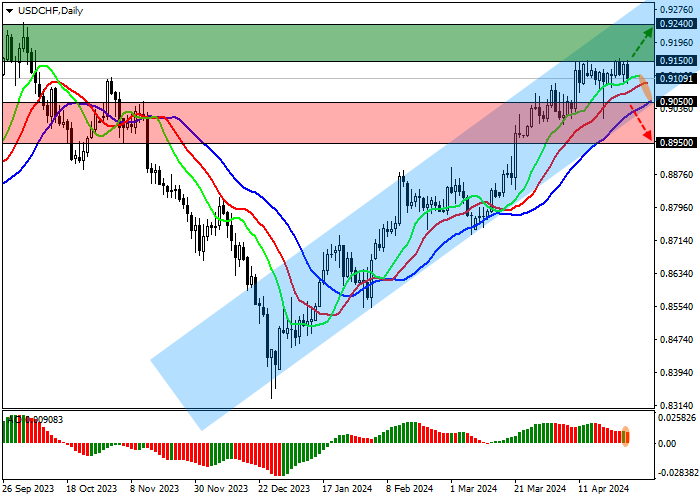

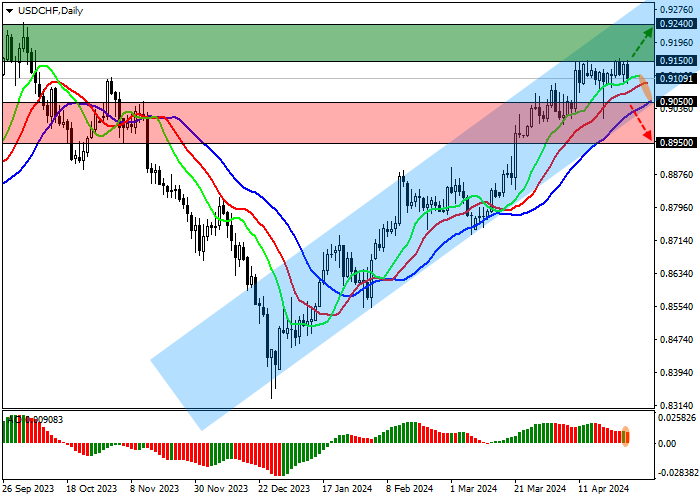

On the daily chart, the price is held within the ascending channel 0.9240–0.9050 near the September high of 0.9250.

Technical indicators maintain a buy signal, which has weakened somewhat recently: fast EMAs on the Alligator indicator are at a stable distance from the signal line, and the AO histogram, being in the buy zone, is forming ascending bars.

Support levels: 0.9050, 0.8950.

Resistance levels: 0.9150, 0.9240.

Trading tips

If the asset continues to grow and consolidates above the resistance level of 0.9150, buy positions with a target of 0.9240 will be relevant. Stop-loss — 0.9100. Implementation time: 7 days and more.

If the asset reverses and declines, and the price consolidates below the local support level at 0.9050, short positions can be opened with the target at 0.8950. Stop-loss — 0.9100.

Hot

No comment on record. Start new comment.