Current trend

Shares of The Boeing Co., one of the largest aviation and space technology manufacturers, are trading in a downtrend at 167.00.

S&P Global analysts have downgraded the emitter's stock rating for the second time in a month, this time from "stable" to "negative", amid increased pressure on the company due to the recent incident with the explosion of the cabin panel of the new Boeing 737 MAX aircraft. Experts believe that The Boeing Co. will not be able to fulfill all contractual obligations on time, which will make it impossible to cover the 5.0 billion dollars debt planned for 2024. Analysts at Citigroup Inc., despite all the problems of the aircraft manufacturer, maintained a "buy" rating, but lowered the target price from 252.0 dollars to 224.0 dollars after the announcement of the company's financial results for the first quarter, which exceeded consensus estimates.

The financial report of The Boeing Co., which was published the day before yesterday, reflected revenue of 16.57 billion dollars, which exceeded analysts' expectations of 16.5 billion dollars, but was below 17.92 billion dollars over the same period a year earlier. The loss per share decreased from -1.27 dollars to -1.13 dollars, also turning out to be better than the forecast of -1.63 dollars.

Support and resistance

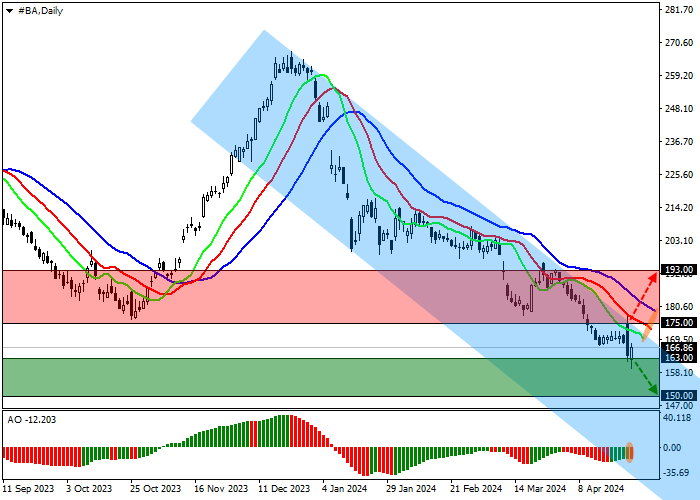

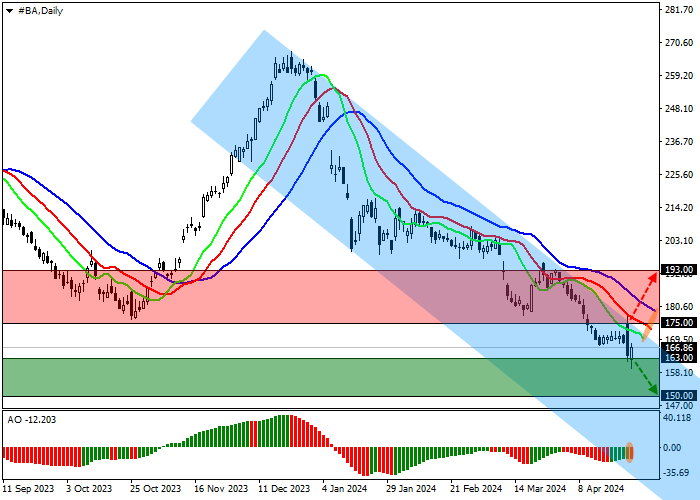

On the D1 chart, the price is trying to move away from the resistance line of the descending corridor with borders of 175.00–150.00.

Technical indicators keep a stable sell signal: the range of EMAs fluctuations on the Alligator indicator remains quite wide, and fast EMAs are below the signal line, while the AO histogram has been in the sales zone for a long time, forming new correction bars.

Support levels: 163.00, 150.00.

Resistance levels: 175.00, 193.00.

Trading tips

If the asset continues to decline and the price consolidates below the minimum of 163.00, one can open short positions with the target of 150.00 and stop-loss of 170.00. Implementation time: 7 days and more.

If the asset continues to grow and the price consolidates above the maximum of 175.00, one may open long positions with the target of 193.00 and stop-loss of 165.00.

Hot

No comment on record. Start new comment.