Current trend

Prices for benchmark Brent Crude Oil are correcting at 87.00, regaining ground lost last week amid easing geopolitical tensions between Iran and Israel and a decrease in the number of attacks on ships in the Red Sea.

In addition, positive dynamics are developing after the oil reserves data release. According to the report from the American Petroleum Institute (API), the indicator for the week decreased by 3.230M barrels after growth of 4.090M barrels earlier, although analysts expected an increase of 1.800M barrels. According to the Energy Information Administration of the US Department of Energy (EIA), the value changed by –6.368M barrels compared to 2.735M barrels a week earlier and preliminary estimates of 1.600M barrels. In addition, storage reserves at Cushing decreased by 0.659M barrels after increasing by 0.033M barrels earlier.

In response to the statistics, investor activity fell sharply. According to the Chicago Mercantile Exchange (CME) FedWatch Tool, yesterday’s trading volume in oil contracts was 818.292K, down from 1.253M on Monday, and the options position decreased from 213.4K to 176.16K.

Support and resistance

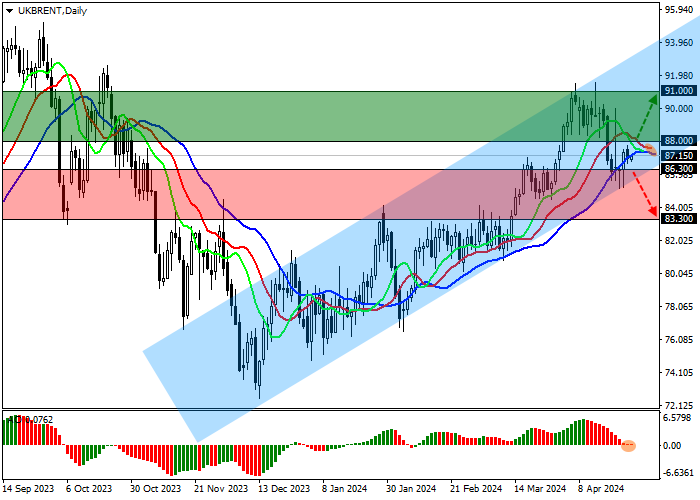

On the daily chart, the price is moving in a corrective trend, retreating from the support line of the ascending corridor 91.00–86.00.

Technical indicators maintain a buy signal: fast EMA of the Alligator indicator are above the signal line, and the AO histogram is forming corrective bars in the buy zone.

Resistance levels: 88.00, 91.00.

Support levels: 86.30, 83.30.

Trading tips

Long positions may be opened after the price rises and consolidates above 88.00, with the target at 91.00. Stop loss – 87.00. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 86.30, with the target at 83.30. Stop loss – 88.00.

Hot

No comment on record. Start new comment.