Today, we present you a mid-term investment overview of WTI Crude Oil quotes.

Tensions in the Middle East have eased somewhat, but the long-term outlook remains uncertain. Against the background of stabilization of the situation, the International Monetary Fund (IMF) has published an updated forecast of the situation on the energy market, which assumes the complete cancellation of the OPEC oil production reduction agreement by early 2025. Experts believe that the gradual lifting of restrictions will begin as early as mid-summer of this year, which is confirmed by new reports from China, which in March increased purchases from Saudi Arabia and the Russian Federation: in March, 13.0% more oil was exported from Russia to China compared to the same period last year, totaling up to 28.528 million tons.

The positive trend is also confirmed by the spread between the WTI Crude Oil and Brent Crude Oil brands, the difference in the cost of which has been held in a very narrow range of 4.10–4.50 dollars for a long time with the current ratio of 4.22 dollars.

Investor demand for the asset has remained at a fairly high level for a long time: an increase in trading volume was recorded in early April, when there was a correction from 554.0 thousand to 870.0 thousand contracts, after which the value steadily held above 900.0 thousand positions per day, and on Monday the volume amounted to 1.223 million.

In addition to the underlying fundamental factors, the possible continuation of the growth of quotations in the near future is also confirmed by technical indicators.

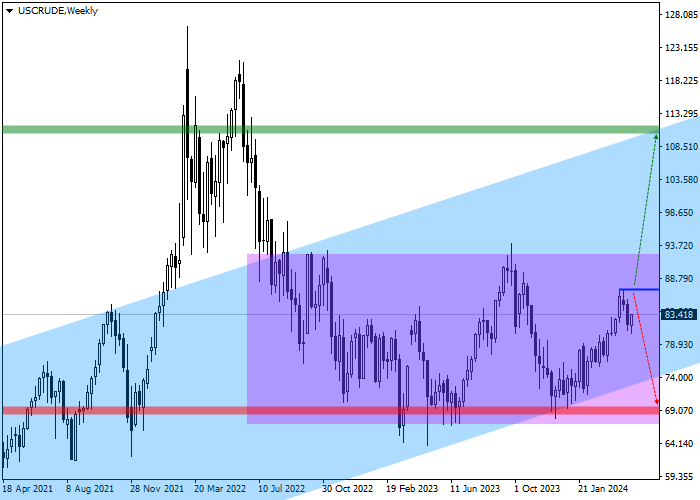

On the M1 chart, quotes are moving within the new upward wave of the channel with dynamic borders of 110.00–74.00, originating back in 2015.

The W1 chart shows that after reaching the channel's support line at 74.00, the price reversed around and formed a new growth wave, which will receive a significant boost after consolidating above the previous maximum of 92.00 from the beginning of autumn 2023.

Key levels can be seen on the D1 chart.

As can be seen on the chart, a new wave of growth is developing within the ascending corridor with dynamic borders of 91.00–82.00, and after reflecting from the support line, the price reverses up again.

At the 69.00 mark, which coincides with the minimum of December 12, there is a zone of cancellation of the buy signal. In case of a reversal and a decrease in the price, followed by reaching this zone, the upward scenario will either be canceled or noticeably delayed in time, and open positions should be liquidated.

A target zone is located around the 110.00 mark, which coincides with the resistance line of the ascending channel; if the price reaches it, profit should be taken on open buy positions.

In more detail, trade entry levels can be evaluated on the H4 chart.

The entry level for purchase transactions was located at 87.00, and a signal can be received as early as this week. Technically, a full-fledged consolidation above the local maximum level of April 5 will be implemented, after which there will be no serious resistance in the price path and purchase positions can be implemented.

Given the average daily volatility of the trading instrument over the past month, which is 1460.0 points, the price movement to the target zone of 110.00 may take approximately 59 trading sessions, however, with increasing volatility, this time may be reduced to 49 trading days.

Hot

No comment on record. Start new comment.