Current trend

Last week, the ETH/USD pair had ambiguous dynamics, as did the entire cryptocurrency market: at first, the asset fell to the level of 2860.00 amid sales caused by the escalation of the military conflict between Iran and Israel, as well as increased risks of maintaining the US Federal Reserve interest rate at high levels, but then the quotes regained lost positions, returning to the central line of Bollinger Bands around 3250.00.

ETH was supported by the approval by the Hong Kong authorities of the launch of spot ETF funds based on the first and second world cryptocurrencies. Now three leading Chinese asset management companies are ready to start working with them: Harvest Fund Management, Bosera Asset Management, and China Asset Management. Bloomberg experts believe that the launch of cryptocurrency ETFs in Hong Kong will expand the opportunities for investing in digital assets, however, they note that the volume of the new market will be small. Most likely, the investments that will be attracted will not exceed 500.0 million dollars, since most Chinese citizens will not be able to participate in them due to the ban on the purchase of virtual assets.

It should be noted that the halving on the Bitcoin network that took place over the weekend did not provide significant support to the cryptocurrency market. Moreover, its consequence may be a decrease in the overall investor interest in digital assets. Actually, this process has already begun last week, when 206.0 million dollars was withdrawn from cryptocurrency investment funds. At the same time, there also remains the factor of postponing the start of monetary policy easing in the United States for the autumn, which negatively affects assets alternative to the dollar. All this may soon lead to a resumption of the decline in quotes and a significant downward correction of the ETH/USD pair.

Support and resistance

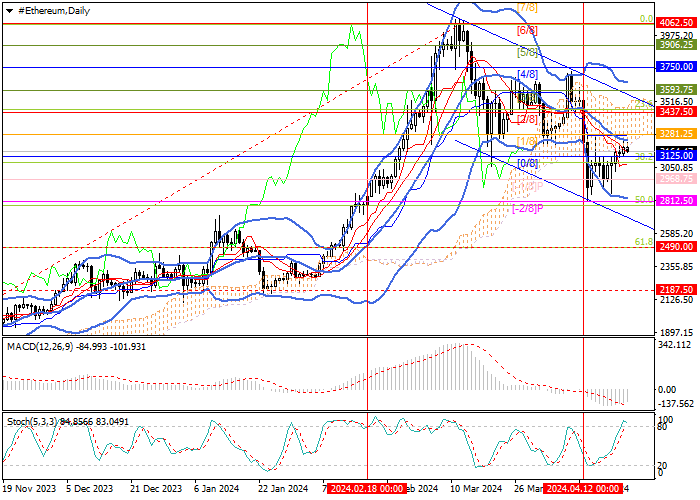

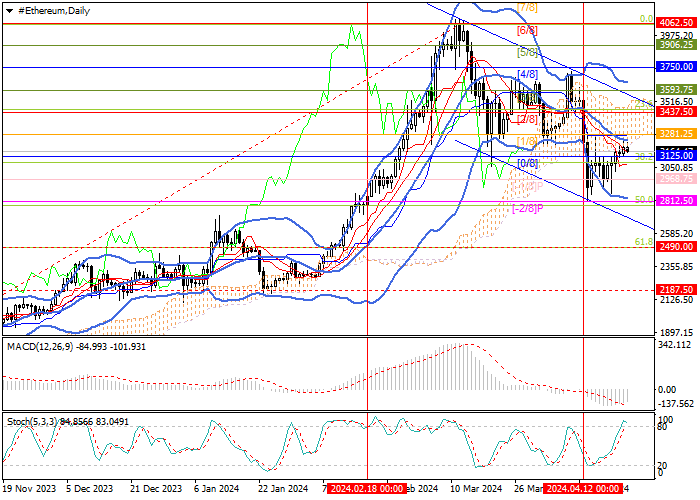

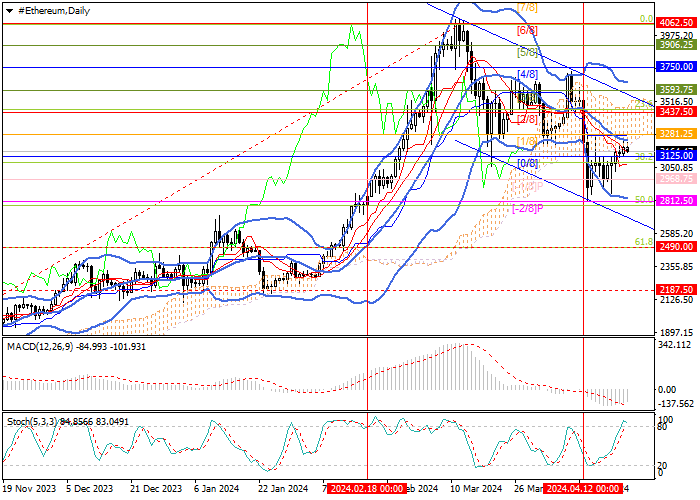

The ETH/USD pair is trading within the descending channel: the price is close to the 3281.25 mark (Murrey level [1/8]), supported by the central line of Bollinger Bands, the breakout of which will allow growth to continue towards the targets of 3437.50 (Murrey level [2/8], 23.6% Fibonacci retracement), 3750.00 (Murrey level [4/8]). The key for the "bears" is the level of 2812.50 (Murrey level [-2/8], 50.0% Fibonacci retracement), with a breakdown of which the decline will be able to develop towards the targets of 2500.00 (Murrey level [4/8], W1, 61.8% Fibonacci retracement) and 2187.50 (Murrey level [3/8], W1).

Technical indicators indicate the continuation of a downtrend: Bollinger Bands are pointing downwards, MACD is declining in the negative zone, and Stochastic is reversing down from the overbought zone.

Resistance levels: 3281.25, 3437.50, 3750.00.

Support levels: 2812.50, 2500.00, 2187.50.

Trading tips

Short positions can be opened below the 2812.50 mark with targets of 2500.00, 2187.50 and stop-loss of 3000.00. Implementation period: 5–7 days.

Long positions can be opened above the level of 3281.25 with targets of 3437.50, 3750.00 and stop-loss of 3180.00.

Hot

No comment on record. Start new comment.