Current trend

The GBP/USD pair fell to 1.2360 after the publication of the poor macroeconomic data.

The March consumer index amounted to 3.2% YoY, above analysts’ expectations of 3.1% and below the previous value of 3.4%, and increased by and added 0.6% MoM, as earlier. With gross domestic product (GDP) contracting by 0.2%, rising inflation is negative for the pound. In addition, retail sales volumes showed zero dynamics after growing by 0.1% last month, while analysts expected 0.3% MoM and strengthened by 0.8% YoY after contracting by 0.3% in February. The indicator excluding fuel adjusted by –0.3 %MoM and 0.4% YoY, putting pressure on the pound. Statistics on business activity in the manufacturing and services sectors are due tomorrow. According to preliminary estimates, the April service PMI sector will change from 53.1 points to 53.0 points, and the manufacturing PMI will remain at 50.3 points.

The American dollar, in turn, is strengthening on expectations that the US Fed will keep the interest rates at high levels of 5.50% longer than expected. More regulator officials believe there is no need to rush to reduce the rate. On Friday, the Chairman of the Federal Reserve Bank (FRB) of Chicago, Austan Goolsbee, said that progress in reducing inflation in the United States has slowed down, and it is worth waiting before the transition to the “dovish” rate.

Thus, with further weakening of the British economy and strengthening of the US economy, the GBP/USD pair will decline in the long term.

Support and resistance

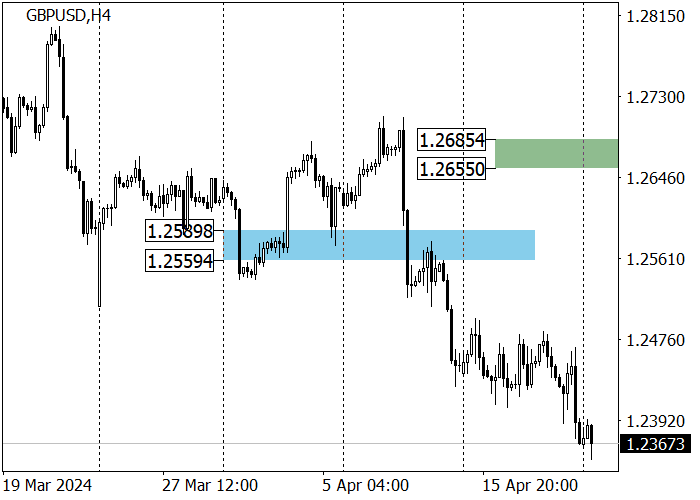

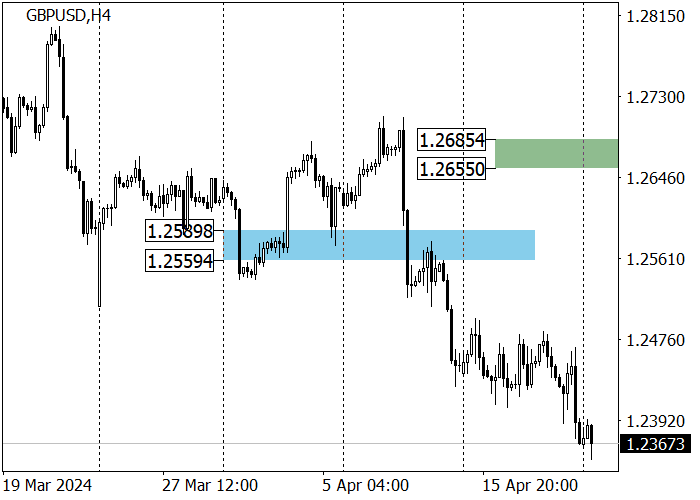

The long-term trend reversed downwards on April 12, when the price broke through the key support level of 1.2525, and is now approaching the next support level of 1.2322, after which the target will be 1.2050. If the level of 1.2322 is kept, an upward correction to 1.2525 is expected.

The medium-term trend is downward: in early April, the quotes crossed the key support zone of the previous trend of 1.2589–1.2559 and headed toward zone 2 (1.2285–1.2255). In the event of a correction to the resistance area of the new trend 1.2685–1.2655, short positions with the first target at the current week’s low of 1.2357 are relevant.

Resistance levels: 1.2525, 1.2698, 1.2875.

Support levels: 1.2322, 1.2050.

Trading tips

Short positions may be opened from 1.2525, with the target at 1.2322 and stop loss 1.2575. Implementation time: 9–12 days.

Long positions may be opened above 1.2575, with the target at 1.2698 and stop loss 1.2525.

Hot

No comment on record. Start new comment.