Current trend

After an eight-day decline, the AUD/USD pair adjusted to the nearest resistance level of 0.6450, but further growth is likely to be limited.

Having reached the level of 0.6362 last week, the quotes continued their upward movement after the publication of relatively positive statistics on the Australian labor market: the change in employment was -6.6 thousand, turning out to be better than the forecast of 7.2 thousand, however, the previous indicator was adjusted upward from 116.5 thousand to 117.6 thousand, and unemployment was fixed around 3.8% with preliminary estimates of 3.9%. On Wednesday, data on the dynamics of consumer prices in Australia will be presented: current forecasts suggest a correction in the index from 0.6% to 0.8% QoQ and from 4.1% to 3.4% YoY. The Reserve Bank of Australia (RBA) core inflation index for the first quarter, calculated using the truncated mean method, is expected to grow by 0.9% QoQ and by 4.2% YoY.

Bidders are confident that during the May meeting, the interest rate in the United States will be maintained at 5.50%, and, according to the Chicago Mercantile Exchange FedWatch Tool, its first decrease may occur only in September (the probability of this scenario is estimated at 45.5%).

Support and resistance

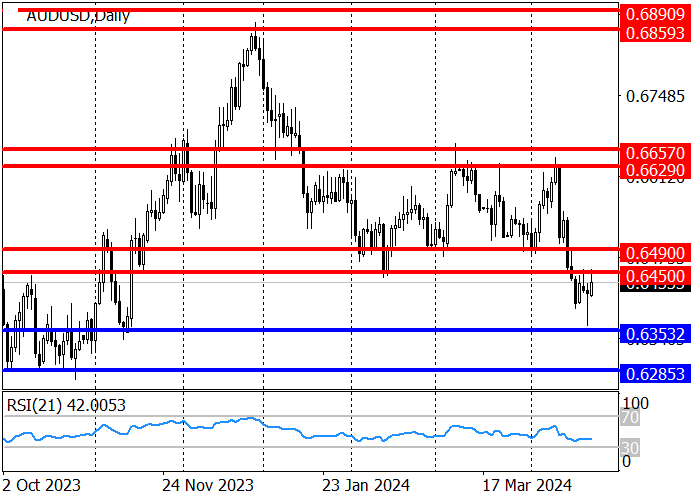

The instrument is trading in a long-term downtrend. On April 16, the market participants broke through the 0.6450 support level, and the next sales target is the 0.6353 mark. Today, the price has adjusted to the level of 0.6450, from which new sales can be considered. If the 0.6450 level is broken out, the correction will continue to the next resistance level of 0.6490, from which short positions can be opened.

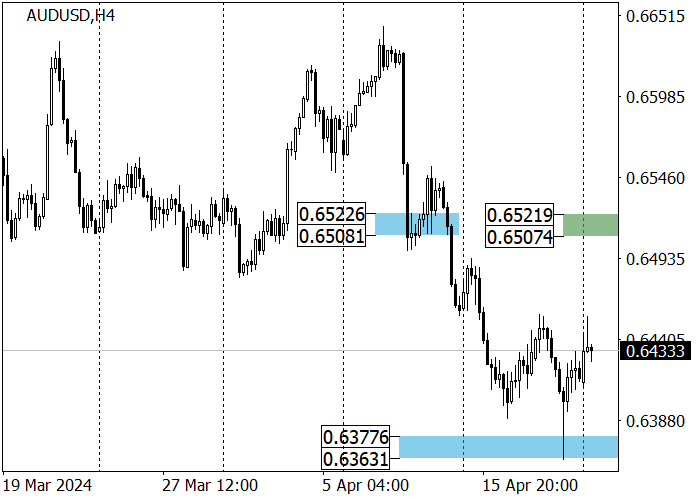

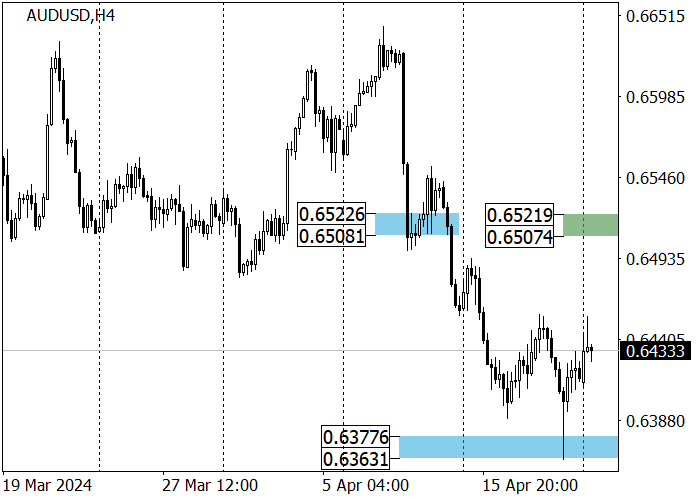

The medium-term trend is downward. Last week, the traders reached the target zone 2 (0.6377–0.6363), after which the price went into correction. If it continues to the key trend resistance at 0.6521–0.6507, new sales can be considered with the target at last week's low of 0.6363. For the change in the trend and purchases in the instrument, a breakout of the 0.6521 mark and consolidation above it are necessary.

Resistance levels: 0.6450, 0.6490, 0.6629.

Support levels: 0.6353, 0.6285, 0.6185.

Trading tips

Short positions can be opened from the 0.6450 mark with the target of 0.6353 and stop-loss around 0.6480. Implementation time: 9–12 days.

Long positions can be opened above the level of 0.6480 with the target of 0.6629 and stop-loss around 0.6430.

Hot

No comment on record. Start new comment.