Current trend

The USD/CHF pair remains in a corrective trend at 0.9122, failing to change its dynamics even with the support of the positive Swiss macroeconomic statistics.

In March, the trade surplus increased from 2.3B francs to 2.8B francs: exports adjusted by –0.6% to 21.1B francs, and imports by –3.3% to 18.2B francs. Within the exports, there is a decrease in the jewelry sector (–37.2%) and watches (–1.5%), and within imports, the largest drop was recorded in jewelry (–18.1%) and chemical and pharmaceutical products (–6.0%). Thus, due to the active international trade weakening, the Swiss currency is valued lower than its competitors, causing further growth in the USD/CHF pair.

The American dollar is stable, trading at 105.80 in USDX. Investors reacted neutrally, as initial jobless claims stayed at 212.0K, better than the predicted 215.0K. However, existing home sales decreased from 4.38M to 4.19M. As a result, the economic situation remained almost unchanged, so US Fed officials are still waiting for improvements in both indicators to begin discussing the transition to the “dovish” monetary policy course.

Support and resistance

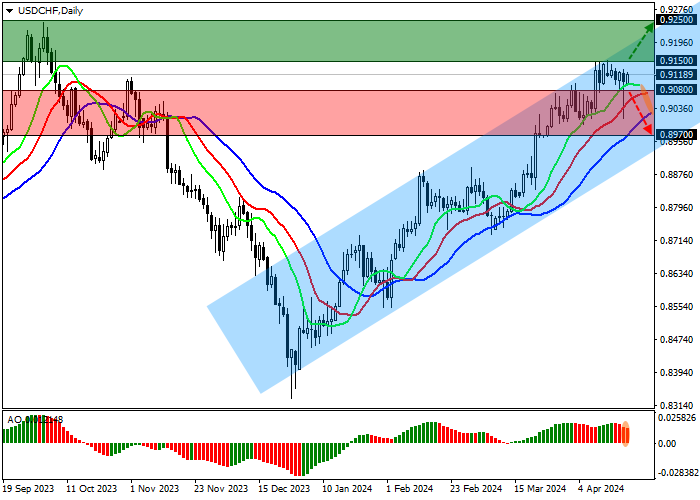

On the daily chart, the price is correcting upward within the ascending channel 0.9200–0.8950, approaching the late September high of 0.9250.

Technical indicators are weakening the buy signal: fast EMA on the Alligator indicator are at a stable distance from the signal line, and the AO histogram is forming ascending bars in the buy zone.

Resistance levels: 0.9150, 0.9250.

Support levels: 0.9080, 0.8970.

Trading tips

Long positions may be opened after the price rises and consolidates above 0.9150, with the target at 0.9250. Stop loss – 0.9100. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 0.9080, with the target at 0.8970. Stop loss – 0.9140.

Hot

No comment on record. Start new comment.