Current trend

The USD/JPY pair shows mixed dynamics, holding near record highs and 154.70. "Bullish" activity remains muted as investors expect new drivers to emerge throughout the week.

Trading participants are in no hurry to open new long positions amid concerns about possible currency intervention by the Bank of Japan. Last month, the regulator decided to abandon negative interest rates, which, however, had virtually no effect on the national currency. Moreover, the yen continued to weaken when it became clear that the US Federal Reserve would not rush to reduce borrowing costs and the likelihood of easing monetary policy in June is extremely low. Against this background, Japanese monetary authorities accused speculators of an unreasonable depreciation of the national currency and announced retaliatory measures, which they had already resorted to in 2023.

April business activity data will be published in the US and Japan on Tuesday. Forecasts for the Japanese Manufacturing PMI suggest a reduction from 48.2 points to 48.0 points, while in the US, indicators may remain around previous values: 51.7 points in the services sector and 51.9 points in the manufacturing sector.

Also, at the end of the week, the Bank of Japan will meet, and April inflation statistics in the Tokyo region will be updated. It is assumed that the Consumer Price Index in April will remain at the same level of 2.6%. No changes in the regulator's monetary policy are also expected; however, investors are counting on updated comments from officials in connection with the further weakening of the yen.

Support and resistance

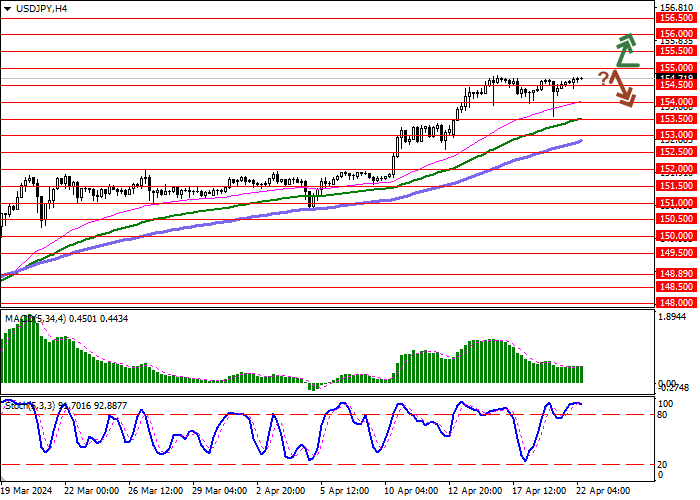

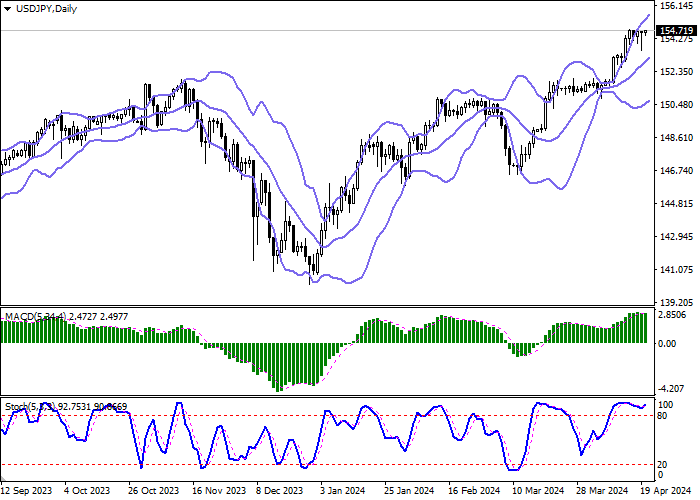

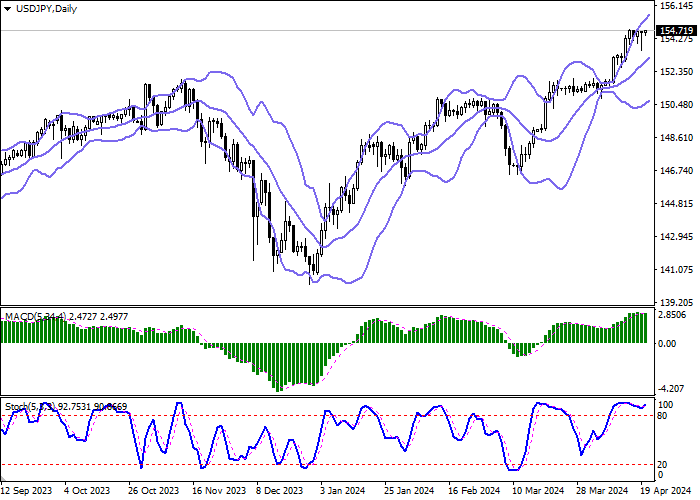

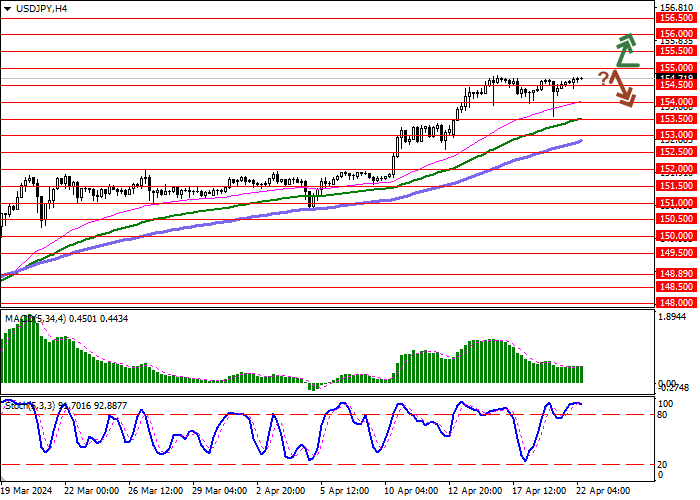

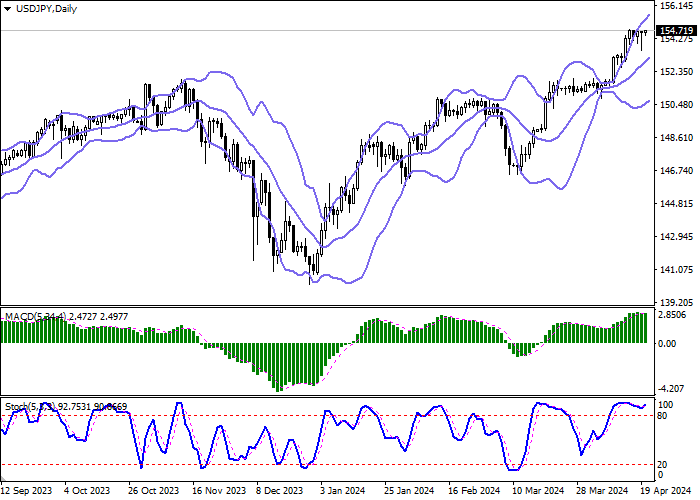

Bollinger Bands on the daily chart show a steady increase. The price range expands, freeing a path to new record highs for the "bulls". MACD indicator tries to reverse downwards and is forming a new sell signal (the histogram is about to consolidate below the signal line). Stochastic maintains a weak upward direction, located near its highs, still reflecting the strong overbought US dollar in the ultra-short term.

Resistance levels: 155.00, 155.50, 156.00, 156.50.

Support levels: 154.50, 154.00, 153.50, 153.00.

Trading tips

Long positions can be opened after a breakout of 155.00 with the target of 156.00. Stop-loss — 154.50. Implementation time: 2-3 days.

A rebound from 155.00 as from resistance, followed by a breakdown of 154.50 may become a signal for opening of new short positions with the target at 153.50. Stop-loss — 155.00.

Hot

No comment on record. Start new comment.