Current trend

The EUR/USD pair shows moderate growth, developing the "bullish" momentum formed at the end of last week. The instrument is testing 1.0665 for a breakout, while trading participants await the emergence of new drivers. At the same time, the fundamental background today will remain quite calm, and only the speech of the President of the European Central Bank (ECB), Christine Lagarde, and the monthly report from the Bundesbank will attract attention. One can also note the upcoming publication of April data on the level of Consumer Confidence in the eurozone: a weak increase in the indicator is predicted from -14.9 points to -14.0 points.

Tomorrow, April business activity statistics from S&P Global will be presented. In the eurozone, the Manufacturing PMI is expected to rise from 46.1 points to 46.5 points, and the Services PMI - from 51.5 points to 51.8 points. Similar figures from the US could also increase from 51.7 points in the services sector and 51.9 points in the manufacturing sector.

Investors evaluate the March data on the German Producer Price Index, published last Friday: the indicator added 0.2% in monthly terms after -0.4% in February, while analysts expected zero dynamics, and in annual terms, producer inflation decreased by 2.9% after -4.1% a month earlier.

Support and resistance

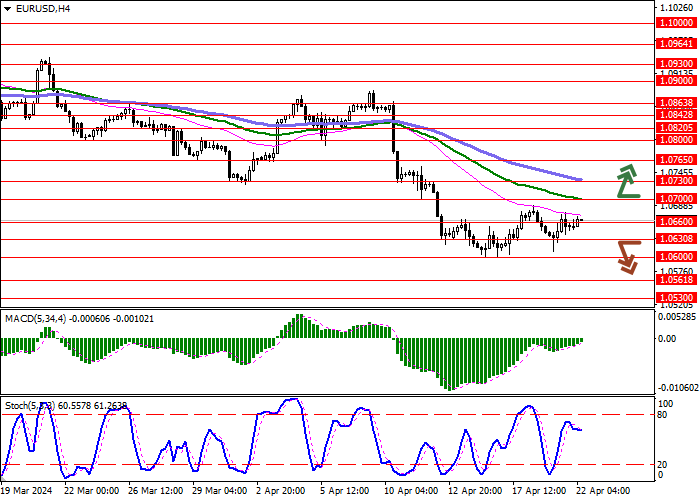

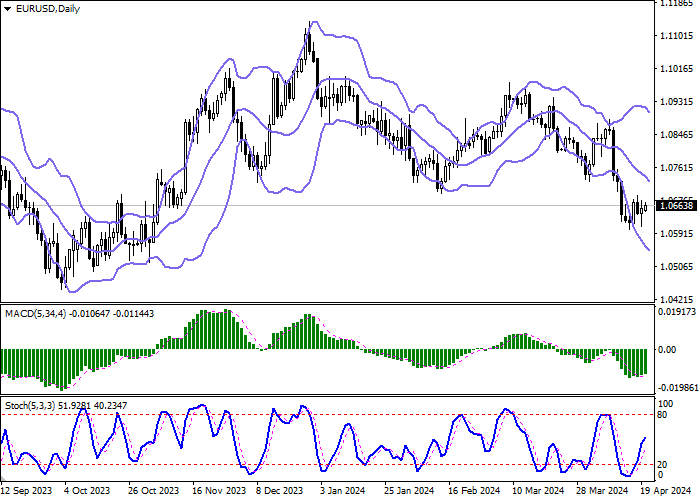

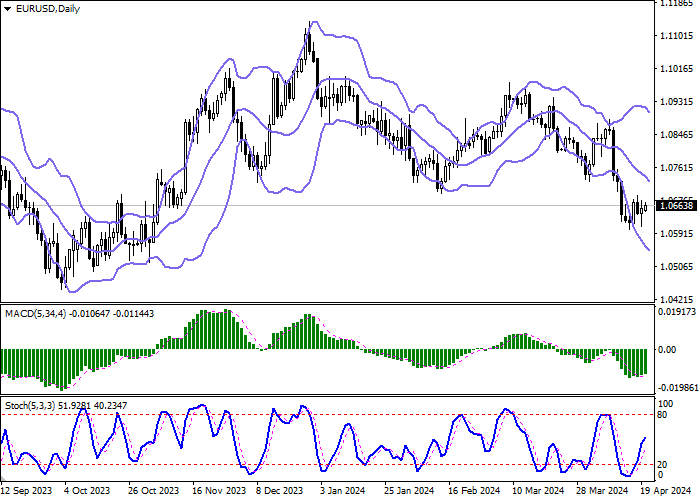

Bollinger Bands on the daily chart show a steady decline. The price range expands from below, making way for new local lows for the "bears". MACD is growing preserving a weak buy signal (located above the signal line). Stochastic is showing a more active growth and is located in the middle of its area.

Resistance levels: 1.0700, 1.0730, 1.0765, 1.0800.

Support levels: 1.0660, 1.0630, 1.0600, 1.0561.

Trading tips

Long positions can be opened after a breakout of 1.0700 with the target of 1.0800. Stop-loss — 1.0660. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 1.0630 may become a signal for new short positions with the target at 1.0561. Stop-loss — 1.0670.

Hot

No comment on record. Start new comment.