Current trend

The USD/JPY pair rose to 154.38 after the publication of poor inflation data in Japan.

Thus, in March, the consumer price index amounted to 0.2% MoM and 2.6% YoY, lower than the forecast of 2.7% and the previous value of 2.8%. Thus, Bank of Japan officials have less reason to raise interest rates again, which hurts the national currency.

The American dollar is supported by the report on initial jobless claims, which amounted to 212.0K, like a week earlier, better than the predicted increase to 215.0K. However, the total claims reached 1.812M compared to 1.810M earlier, and the average claims was 214.50K like last week. The Philadelphia manufacturing PMI reached 15.5 points, exceeding the forecast of 1.5 points and the previous value of 3.2 points.

Thus, according to fundamental economic data, at the moment, the Japanese yen has no reason to strengthen. The intervention of the Japanese regulator may reduce the USD/JPY rate, but it was not announced, and the upward trend will continue in the long term.

Support and resistance

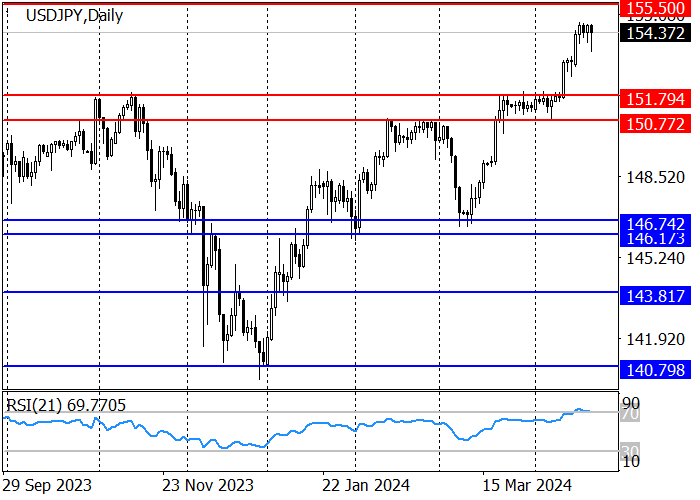

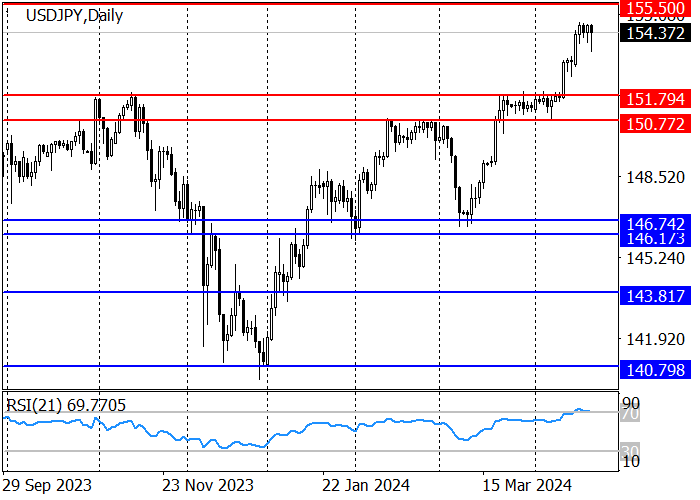

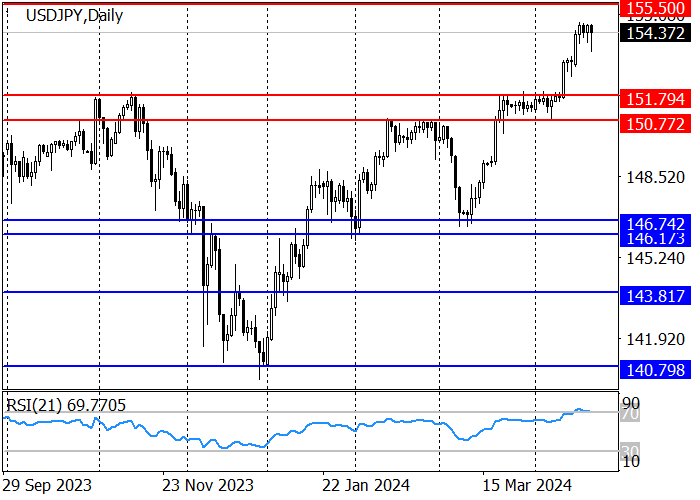

The long-term trend is upward: in mid-April, the trading instrument consolidated above the resistance area of 151.80–150.77, and the next target is the resistance level of 155.50. In the event of a correction to the support zone 151.80–150.77, long positions with the target at 155.50 are relevant. The RSI (21) indicator has reached the overbought zone, reflecting the likelihood of a decline in the medium term.

The medium-term trend is upward: the quotes have overcome zone 3 (154.17–153.70) and move to zone 4 (159.28–158.77). If the price corrects to the area of key trend support 149.96–149.51, long positions with the target at 154.71 are relevant.

Resistance levels: 155.50, 159.72.

Support levels: 151.80, 150.77, 146.74, 146.17.

Trading tips

Short positions may be opened from 155.50, with the target at 152.80 and stop loss around 155.75. Implementation time: 9–12 days.

Long positions may be opened above 155.75, with the target at 159.72 and stop loss around 155.50.

Hot

No comment on record. Start new comment.