Current trend

During the Asian session, the EUR/GBP pair is recovering after yesterday’s correction, as a result of which it could not consolidate at the highs of April 9, and is trading at 0.8564 against macroeconomic statistics.

In March, the German producer price index adjusted from –0.4% to 0.2% MoM, although analysts expected zero dynamics, and from –4.1% to –2.9% YoY. In February, output in the EU construction sector increased by 0.4% YoY, after falling 0.3% earlier, and by 1.8% MoM, after rising only 0.2% last month. According to the European Central Bank (ECB), the seasonally adjusted February current account surplus fell from 39.3B euros to 29.5B euros, compared with forecasts for an increase to 45.2B euros.

Meanwhile, in the UK, March retail sales showed zero dynamics after growing by 0.1% last month instead of the expected increase of 0.3% MoM and accelerated from –0.3% to 0.8% YoY. Over the same period, the consumer price index slowed from 3.4% to 3.2% YoY, slightly above preliminary estimates of 3.1% and remained at 0.6% MOM, and the core value changed from 4.5% to 4.2% relative to the estimated 4.1%.

Former head of the US Federal Reserve, Ben Bernanke, believes that the Bank of England should change the main economic forecasting model. A team led by the official has been reviewing the UK regulator’s practices since the summer, and the report’s recommendations should improve and support its forecasting infrastructure, data management, software, and economic models. Thus, experts note that the efficiency and accuracy of the department’s preliminary calculations have deteriorated significantly over the past few years. On the other hand, the period was characterized by a series of major shocks that were difficult to assess in advance, such as the COVID–19 pandemic and its economic and political consequences, as well as the sharp rise in prices for oil, gas, and other commodities against the Russian-Ukrainian conflict.

Support and resistance

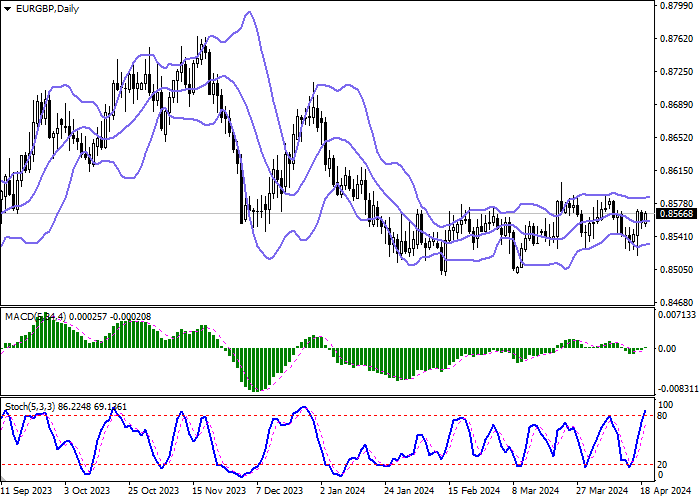

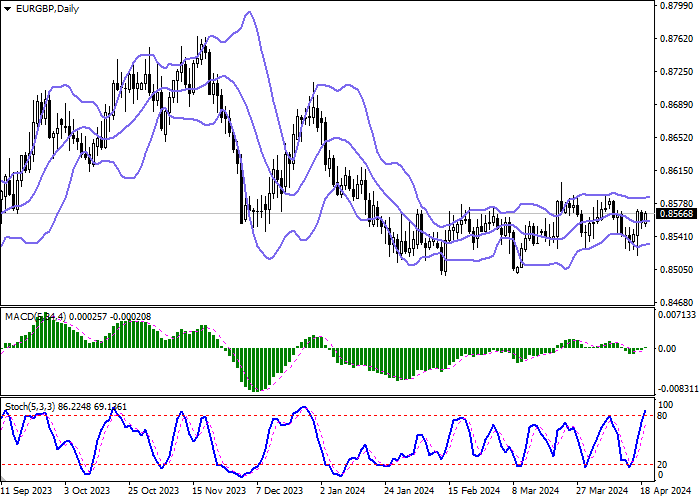

On the daily chart, Bollinger Bands are moving flat: the price range changes slightly, remaining quite wide for the market activity. The MACD indicator is growing, keeping the buy signal: the histogram is above the signal line. Stochastic is quickly approaching its highs, indicating that the euro may become overbought in the ultra-short term.

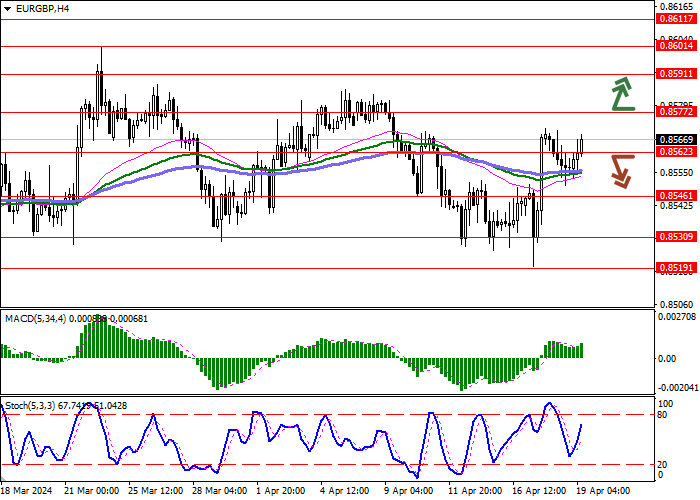

Resistance levels: 0.8577, 0.8591, 0.8601, 0.8611.

Support levels: 0.8562, 0.8546, 0.8530, 0.8519.

Trading tips

Long positions may be opened after a breakout of 0.8577, with the target at 0.8601. Stop loss – 0.8562. Implementation time: 2–3 days.

Short positions may be opened after a breakdown of 0.8562, with the target at 0.8546. Stop loss – 0.8570.

Hot

No comment on record. Start new comment.