Current trend

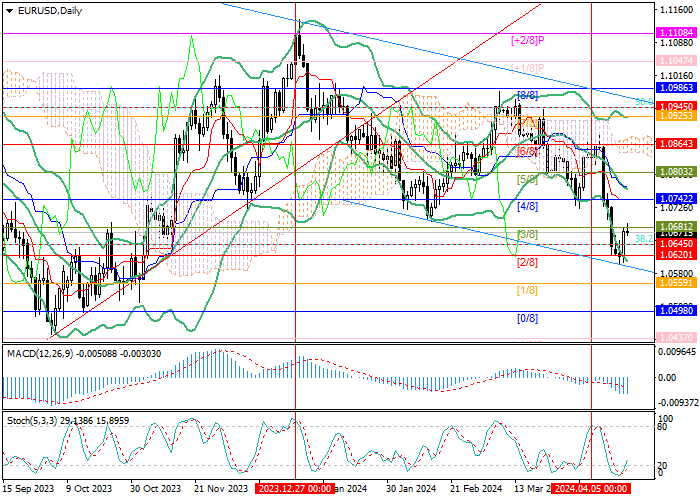

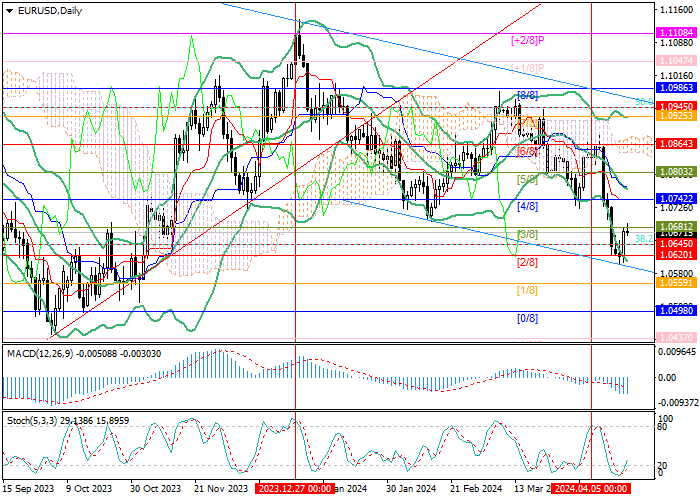

The EUR/USD pair is declining within the long-term downward channel: yesterday, the price reached its lower limit around 1.0600, after which it adjusted to 1.0681 (Murrey level [3/8]), where it is currently trading.

Long-term fundamental factors contribute to the decline of the instrument: investors expect a reduction in interest rates by the European Central Bank (ECB) in June, while a correction in the monetary policy of the US Federal Reserve is now projected no earlier than September. This scenario is confirmed by economic statistics: published yesterday, the Eurozone consumer price index (CPI) for March decreased from 2.6% to 2.4% YoY and the base indicator – from 3.1% to 2.9%. At the same time, inflation in the United States resumed over the same period: the CPI increased from 3.2% to 3.5%, while the base indicator remained at 3.8%. The rhetoric of officials also convinces the market that monetary policy easing in the European economy will begin earlier than in the American one. Most ECB members have already openly announced the June interest rate cut and are ready to postpone it only in case of emergency, for example, a significant aggravation of the geopolitical situation in the Middle East, which may lead to an increase in energy prices.

Members of the board of the US Federal Reserve, on the contrary, take a more cautious position amid increased inflationary pressure: they do not abandon their intention to ease monetary policy this year, but also do not name a specific time frame. The last to speak on this topic was the head of the Cleveland Federal Reserve Bank (FRB), Loretta Mester, who confirmed yesterday that interest rate cuts would be possible only when consumer prices begin to move steadily towards the 2.0% target.

Under these conditions, the resumption of the downward movement of the EUR/USD pair in the near future seems most likely.

Support and resistance

Technically, the price remains within the descending channel: a breakdown of the 1.0645 mark (38.2% Fibonacci retracement) will allow the quotes to resume their decline towards the targets of 1.0559 (Murrey level [1/8]) and 1.0498 (Murrey level [0/8]). The key for the "bulls" is the level of 1.0742 (Murrey level [4/8]), supported by the central line of Bollinger Bands, after consolidation above which growth can resume to the targets of 1.0864 (Murrey level [6/8]) and 1.0925 (Murrey level [7/8]).

Technical indicators confirm the continuation of the downtrend: Bollinger Bands are reversing down, MACD is increasing in the negative zone, and the upward reversal of Stochastic does not exclude a corrective growth to the area of 1.0742, but it is unlikely to lead to a trend change.

Resistance levels: 1.0742, 1.0864, 1.0925.

Support levels: 1.0645, 1.0559, 1.0498.

Trading tips

Short positions should be opened below the level of 1.0645 or after a price reversal around 1.0742 with targets of 1.0559, 1.0498 and stop-losses of 1.0700 and 1.0790, respectively. Implementation period: 5–7 days.

Hot

No comment on record. Start new comment.