Current trend

One of the leading indices of the European economy, the CAC 40, is being adjusted at 8025.0 amid mixed corporate reports and local growth in the bond market.

Yesterday, the financial results of the LVMH Moet Hennessy Louis Vuitton SE fashion brand were published, according to which the company recorded revenue of 20.694 billion euros in the first quarter, compared with 21.035 billion euros in the previous period due to more restrained growth in the luxury clothing category.

Today, statistics from three major market players will be presented, which can affect the index quotes. Analysts assume that the revenue of the cosmetics manufacturer L'Oréal SA will amount to 10.92 billion euros, exceeding the figure of the previous quarter at around 10.61 billion euros. Growth is also expected from EssilorLuxottica SA, which manufactures sunglasses and corrective glasses: the forecast for the first quarter is 6.42 billion euros, which is higher than the 6.25 billion euros shown in Q4 2023. In turn, the revenue of the food company Danone SA may amount to 6.76 billion euros after 6.66 billion euros in the previous period.

Bonds also continue to grow: 10-year securities are trading at a rate of 2.979%, which exceeds last week's figure of 2.913%, and the yield of 20-year bonds is 3.333%, which is the highest value since the beginning of December last year, after 3.310% shown earlier.

The growth leaders in the index are LVMH Moet Hennessy Louis Vuitton SE ( 2.84%), Hermes International ( 2.74%), Danone SA ( 1.60%).

Among the leaders of the decline are Teleperformance SE (-2.70%), Cap Gemini SA (-1.13%), ArcelorMittal SA (-0.46%), EssilorLuxottica SA (-1.03%).

Support and resistance

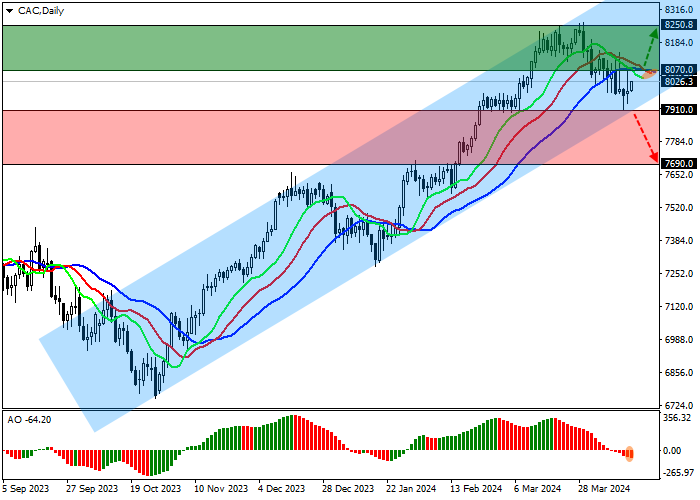

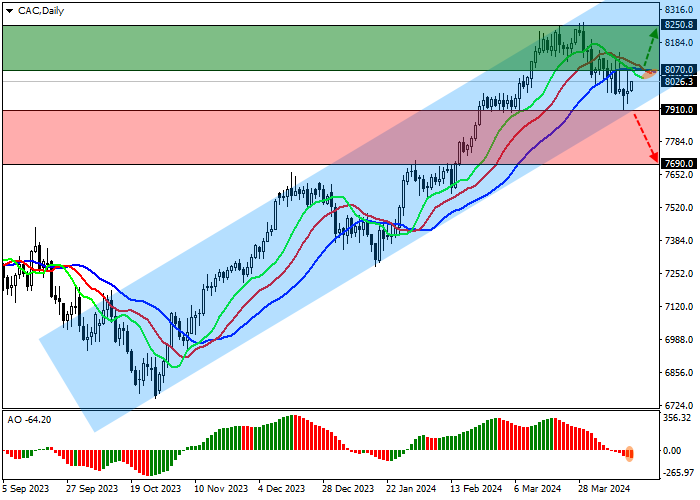

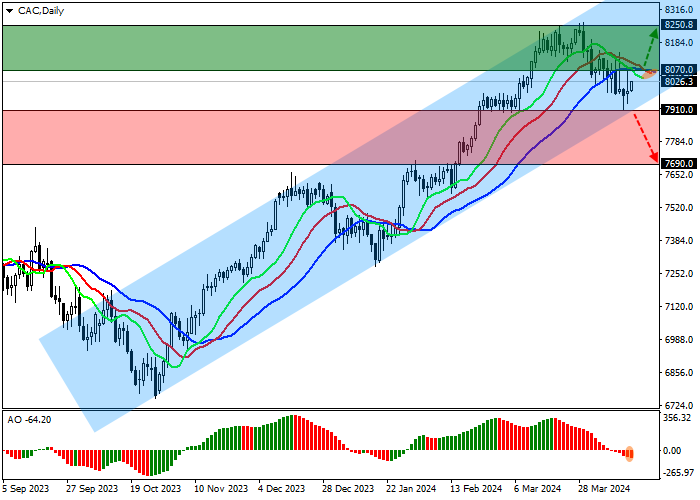

On the D1 chart, the quotes continue to grow, holding near the support line of the ascending channel of 8300.0–7900.0.

Technical indicators show a downward correction: the fast EMAs on the Alligator indicator remains close to the signal line, narrowing the range of oscillation, and the AO histogram, being below the transition level, continues to form corrective bars.

Support levels: 7910.0, 7690.0.

Resistance levels: 8070.0, 8250.0.

Trading tips

In the event of a reversal and continued growth of the asset, as well as price consolidation above the resistance level of 8070.0, buy positions with the target of 8250.0 and stop-loss of 8000.0 will be relevant. Implementation time: 7 days and more.

In the event of a reversal and continued decline of the asset, as well as price consolidation below the support level of 7910.0, sell positions with the target of 7690.0 will be relevant. Stop-loss – 8000.0.

Hot

No comment on record. Start new comment.