Current trend

During the Asian session, the USD/JPY pair retreated from record highs near the resistance level of 154.80. Analysts tried to assess the risks of the Bank of Japan’s intervention in the market situation. Thus, representatives of the regulator reported on possible measures without defining clear boundaries for their application. However, investors are confident that the price breaking the 155.00 mark could act as a catalyst for such steps. Last year, the government allocated about 60.0B dollars to support the national currency.

The positive dynamics of the yen are developing against stable levels of foreign trade. In March, exports adjusted by 7.3% after 7.8% previously, and imports by –4.9% after 0.5%. Thus, the trade balance deficit amounted to –0.70T yen, slightly higher than the deficit of the previous period of –0.57T yen. According to investment flow estimates from the Ministry of Finance, there is a significant outflow of foreign bond purchases of 1.005T yen. While investment in Japanese stocks stands at 1.740T yen. In March, service PMI increased from 0.3% to 1.5%, while analysts expected 0.8%.

The American dollar fell to 105.60 in USDX after the Mortgage Bankers Association (MBA) 30-year mortgage rate increased from 7.01% to 7.13%, the highest since December, which could cause weakness in the sector. On Thursday, the focus of investors’ attention is the secondary housing market sales. According to preliminary estimates, the March figure may change from 4.38M. At 14:30 (GMT 2), initial jobless claims for the week of April 12 will be published: the volume may increase from 211.0K to 215.0K.

Under these conditions, continued growth of the asset looks most likely.

Support and resistance

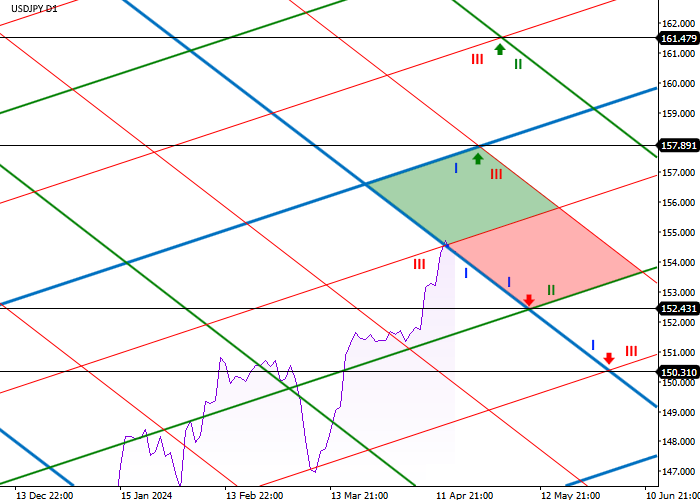

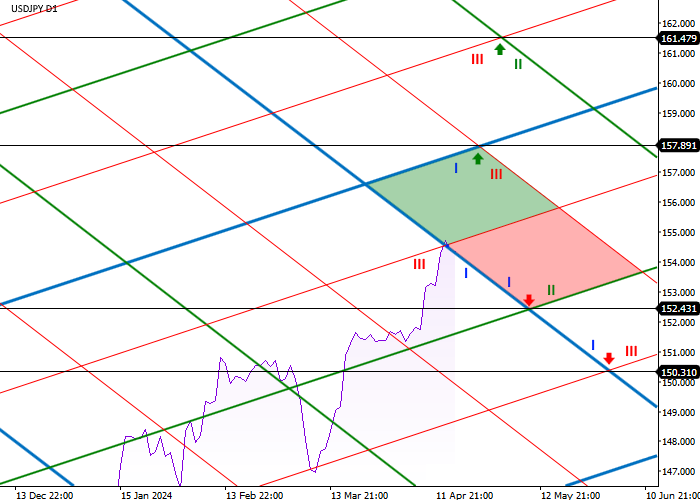

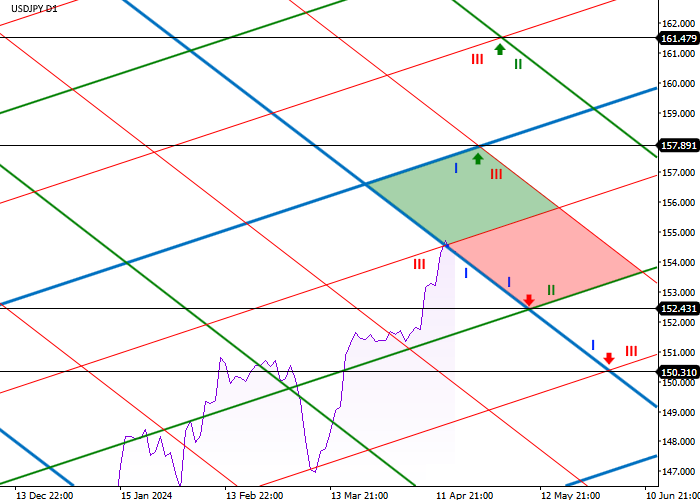

On the daily chart, the trading instrument has reached the key crosshair of the period between the right resistance of the first order (I) and the left resistance of the third order (III) at 154.48, after overcoming which the probability of further growth will increase significantly.

Further dynamics will continue to develop in a stable upward trend, where the main scenario will be an increase to the crosshair of the left resistance of the first order (I) and the right resistance of the third order (III) around 157.89, after which it is expected to reach the crosshair of the left resistance of the third order (III) and right resistance of the second order (II) at 161.47.

If the quotes fail to consolidate above the current crosshair, a decline to the local crosshair of the first order left support (I) and the second order right support (II) at 152.43 in the short term is possible and to the crosshair between the first order left support (I) and the third order right support order (III) at 150.31 – in the long term.

Resistance levels: 157.89, 161.49.

Support levels: 152.43, 150.31.

Trading tips

Long positions may be opened after the consolidation above 157.89, with the target at 161.47. Stop loss – 156.30. Implementation period: 7 days or more.

Short positions may be opened after the consolidation below 152.43, with the target at 150.31. Stop loss is around 153.10.

Hot

No comment on record. Start new comment.