Current trend

The AUD/USD pair is showing moderate growth, developing the "bullish" momentum of the previous trading session, when the instrument managed to retreat from the local lows of November 14, 2023. Quotes are testing 0.6445 for a breakout, while trading participants analyze the March report on the Australian labor market published on Thursday.

The Employment Change fell by 6.6 thousand jobs after a sharp increase of 117.6 thousand in the previous month, while analysts expected 7.2 thousand. At the same time, Full-Time Employment increased by 27.9 thousand, and Part-Time Employment decreased by 34.5 thousand. The Unemployment Rate rose from 3.7% to 3.8% against expectations of 3.9%, and the Participation Rate corrected from 66.7% to 66.6%.

The American currency received some support after speeches by US Federal Reserve Chairman Jerome Powell in previous days. The official did not indicate the exact timing of the launch of the program to reduce the cost of borrowing, but emphasized that the national economy will need a little more time for inflation to reach target levels of 2.0%. Against this backdrop, investors again began to revise their forecasts for the first interest rate adjustment this year. The most likely scenario seems to be an easing of monetary policy in September, but it is also possible that the regulator will decide to change its course at the end of 2024. In total, no more than two reductions in the rate are expected this year.

Support and resistance

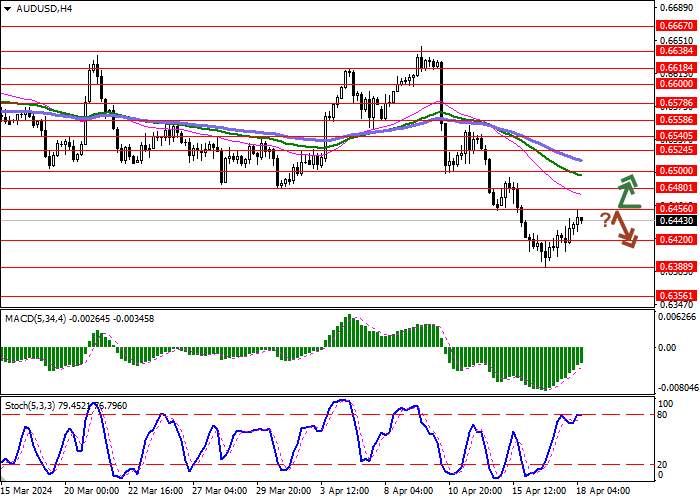

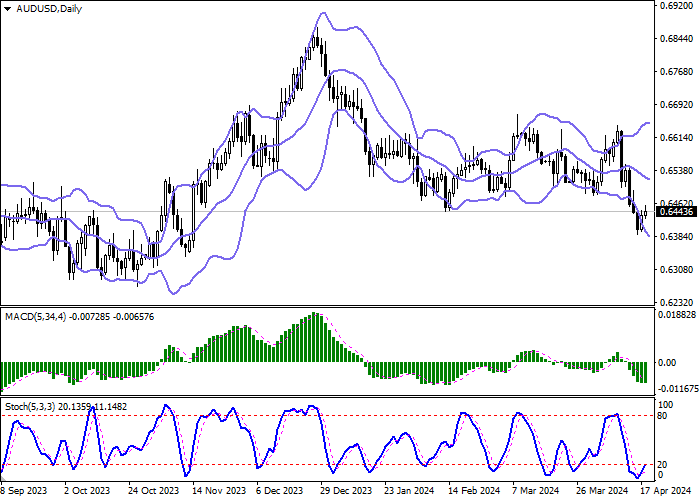

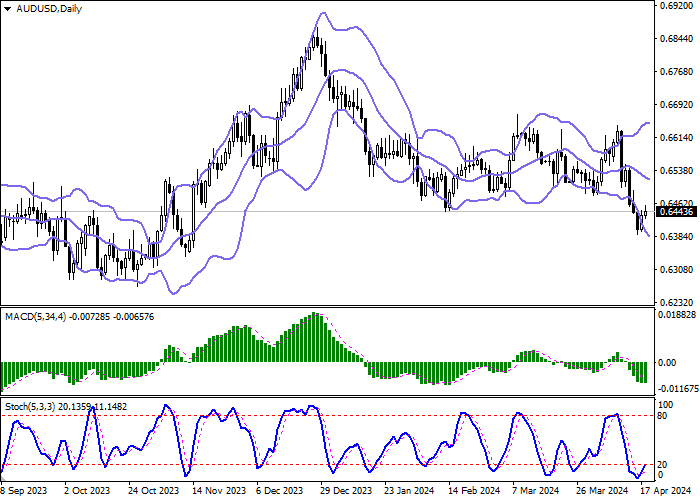

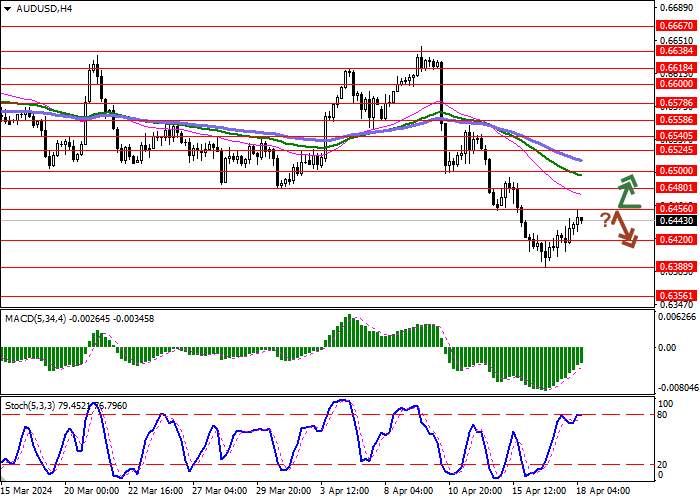

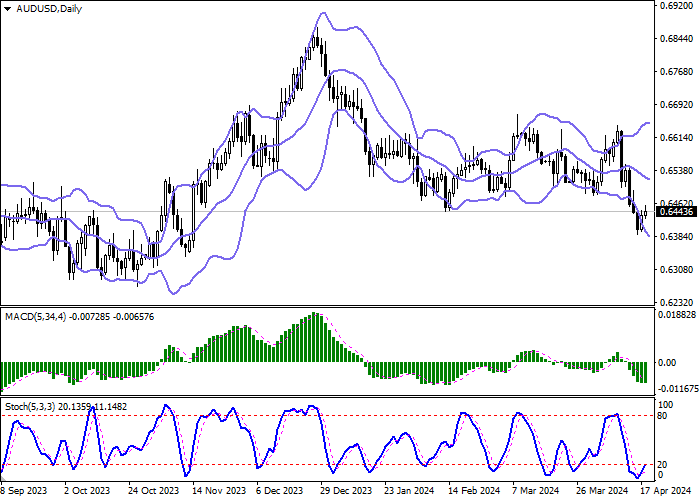

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range expands from below, making way for new local lows for the "bears". MACD is trying to reverse upwards keeping a previous sell signal (located below the signal line). Stochastic, having retreated from its lows, reversed into an ascending plane, signaling in favor of the development of corrective growth of the instrument in the near future.

Resistance levels: 0.6456, 0.6480, 0.6500, 0.6524.

Support levels: 0.6420, 0.6388, 0.6356, 0.6300.

Trading tips

Long positions can be opened after a breakout of 0.6456 with the target of 0.6524. Stop-loss — 0.6420. Implementation time: 2-3 days.

A rebound from 0.6456 as from resistance, followed by a breakdown of 0.6420 may become a signal for opening of new short positions with the target at 0.6356. Stop-loss — 0.6456.

Hot

No comment on record. Start new comment.