Current trend

The NZD/USD pair is showing weak growth, developing the "bullish" signal formed the day before, when the instrument managed to retreat from the local lows of November 2, 2023. The quotes are testing 0.5920 for a breakdown, while trading participants expect new drivers to appear on the market.

The focus of investors today will be on statistics on jobless claims in the United States: Initial Jobless Claims for the week ended April 12 may increase from 211.0 thousand to 215.0 thousand, and Continuing Jobless Claims for the week ended April 5 are expected to remain around the same level of 1.817 million. Also, during the day, data on Philadelphia Fed Manufacturing Survey will be published, the forecast for which suggests a decrease in the indicator in April from 3.2 points to 1.5 points.

Trading participants also evaluate the speeches of US Federal Reserve Chairman Jerome Powell this week, who again noted that it will take a longer time to stabilize price pressure. If earlier the official stated that the Fed is almost confident that inflation will steadily approach the target level of 2.0%, now macroeconomic statistics indicate that it will take more time to slow down the growth rate of consumer prices, and in conditions of a strong labor market there is no need to adjust the monetary policy. In turn, this means that the regulator is unlikely to rush to reduce borrowing costs and may limit itself to just one interest rate adjustment in 2024. Analysts suggest a possible easing of monetary parameters only in September.

Meanwhile, inflation data from New Zealand also put pressure on the instrument: in the first quarter, the Consumer Price Index slowed sharply from 4.7% to 4.0% in annual terms, and corrected from 0.5% to 0.6% in the quarterly terms.

Support and resistance

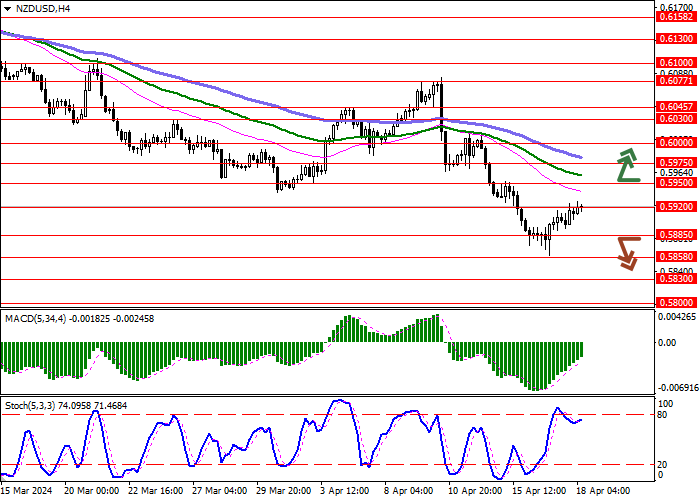

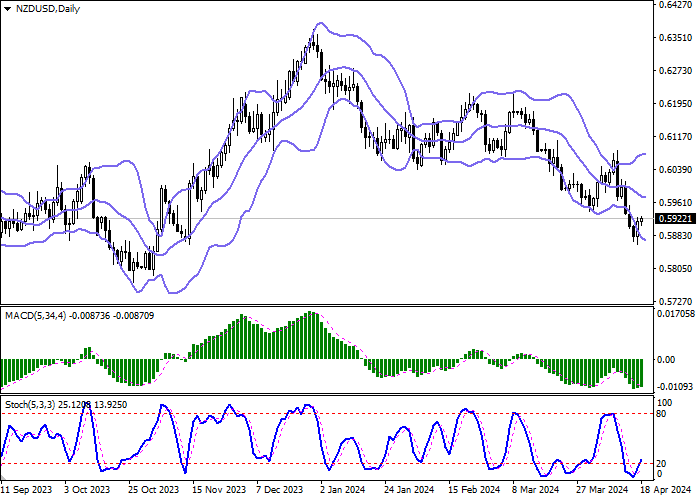

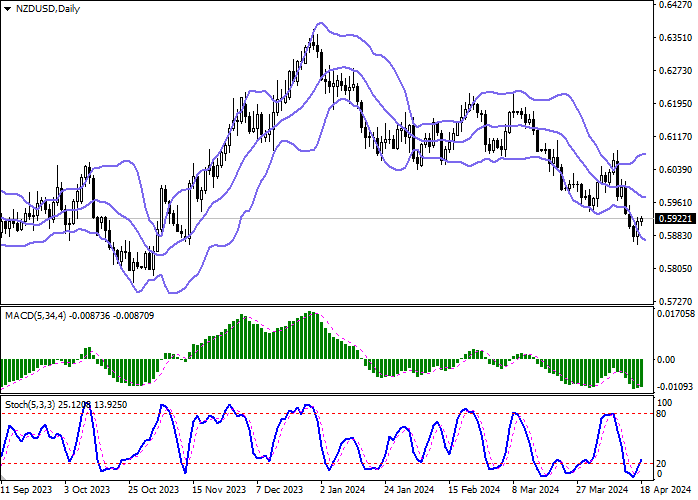

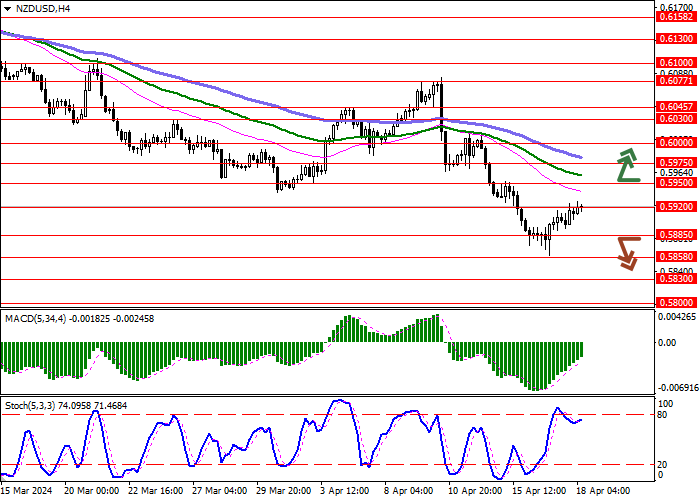

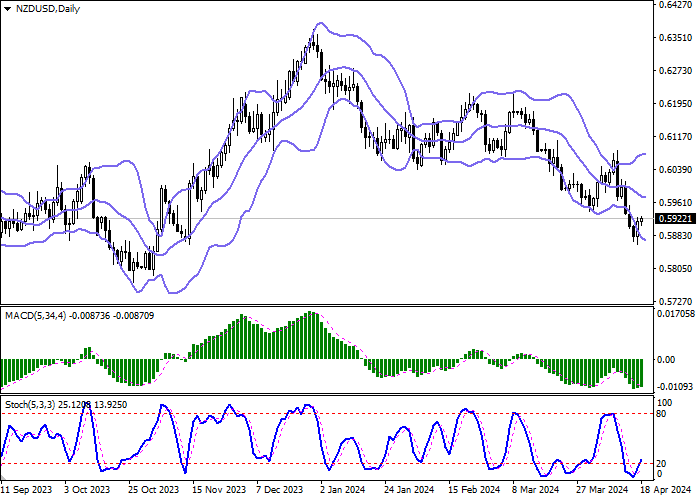

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is expanding, being spacious enough for the current activity level in the market. MACD is trying to reverse into an upward plane, preparing to form a new buy signal (the histogram is above the signal line). Stochastic is showing more active "bullish" dynamics and is currently preparing to leave the resale area, signaling in favor of the development of corrective growth in the near future.

Resistance levels: 0.5920, 0.5950, 0.5975, 0.6000.

Support levels: 0.5885, 0.5858, 0.5830, 0.5800.

Trading tips

Long positions can be opened after a breakout of 0.5950 with the target of 0.6000. Stop-loss — 0.5920. Implementation time: 2-3 days.

The return of a "bearish" trend with the breakdown of 0.5885 may become a signal for new short positions with the target at 0.5830. Stop-loss — 0.5920.

Hot

No comment on record. Start new comment.