Current trend

Prices for benchmark Brent Crude Oil are holding just below 89.00, continuing the correction after a significant increase, but high trading volumes in the asset remain.

The market almost did not react to the latest situation between Iran and Israel, believing that there would be no escalation. Investors were much more interested in the recent report of the International Monetary Fund (IMF), which suggests a decline in oil prices in 2024 by 2.5% to 78.61 dollars per barrel, and in 2025 by 6.3% to 73.68 dollars per barrel. Department experts believe that oil demand will not be as high as previously predicted: it may adjust from 3.1% to 3.2% this year, and the sufficiency of supply will be able to compensate for it. Thus, Russia is renewing records for the volume of maritime supplies: according to a Bloomberg report, in the week of April 14, they rose to 3.95M barrels, the high over the past eleven months.

On a local front, weekly crude inventories rose 4.090M, according to the American Petroleum Institute (API), after rising 3.043M earlier. Traders suggest today’s data from the US Department of Energy’s Energy Information Administration (EIA) may rise by 1.600M after 5.841M a week earlier, forming a stable trend for the third week. At the same time, the economic recovery of China, the world’s main oil importer, significantly exceeded forecasts. The Q1 gross domestic product (GDP) amounted to 1.6%, with preliminary estimates of 0.9% and 5.3% YoY instead of 5.0%.

Support and resistance

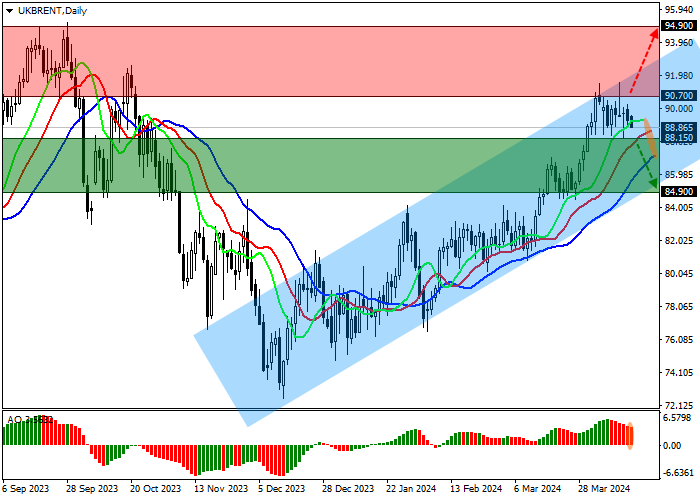

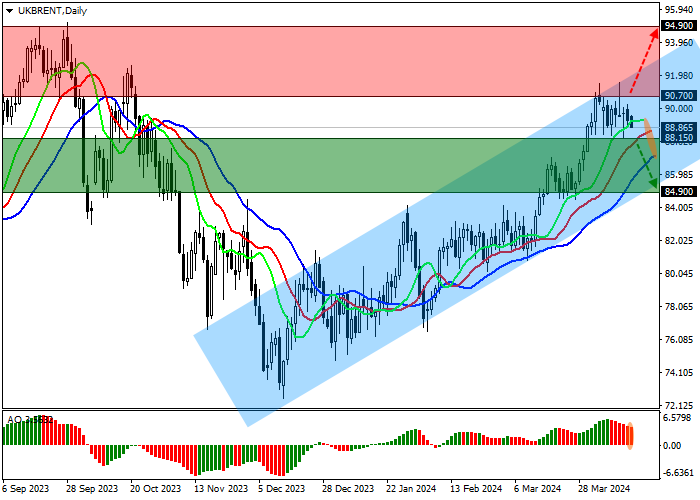

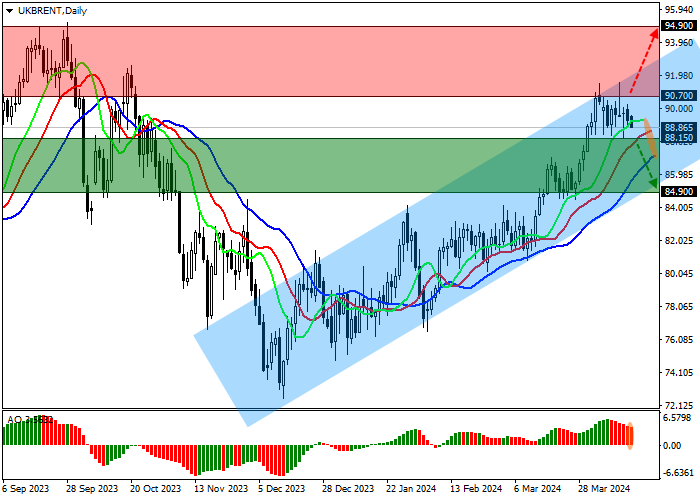

On the daily chart, the trading instrument is moving in a corrective trend, retreating from the resistance line of the ascending corridor 91.00–85.00.

Technical indicators support a local correction, slowing down the global buy signal: fast EMAs of the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars in the buy zone.

Resistance levels: 90.70, 94.90.

Support levels: 88.15, 84.90.

Trading tips

Short positions may be opened after the price declines and consolidates below 88.15, with the target at 84.90. Stop loss – 90.00. Implementation period: 7 days or more.

Long positions may be opened after the price rises and consolidates above 90.70, with the target at 94.90. Stop loss – 88.00.

Hot

No comment on record. Start new comment.