Current trend

During the Asian session, the XAU/USD pair traded at 2377.0, correcting within the uptrend.

The upward trend may resume on May 1 after the US Fed meeting on monetary policy: according to preliminary estimates, the probability of maintaining interest rates in the range of 5.25–5.50% is 98.1%. Note that in March, the head of the department, Jerome Powell, said that clarity regarding further actions may appear in May, so now experts are awaiting the announcement of specific dates for the transition to the “dovish” course. According to the Chicago Mercantile Exchange (CME) FedWatch Instrument, the possibility of softening the regulator’s rhetoric in June is at 15.0% amid rising inflation in the country, and if borrowing costs do not begin to decline, precious metals will receive an even greater driver for growth than now. Thus, analysts at Bank of America Corp. raised the target price of an ounce of gold this year from 2.400.0 dollars to 3.000.0 dollars.

In the derivatives market, the demand for contracts on the asset remains high. However, on April 12, the indicator renewed the historical record for the gold options contracts volume of 227.1K positions compared to this year’s average of 87.0–102.0K positions, reflecting increasing investor interest.

Support and resistance

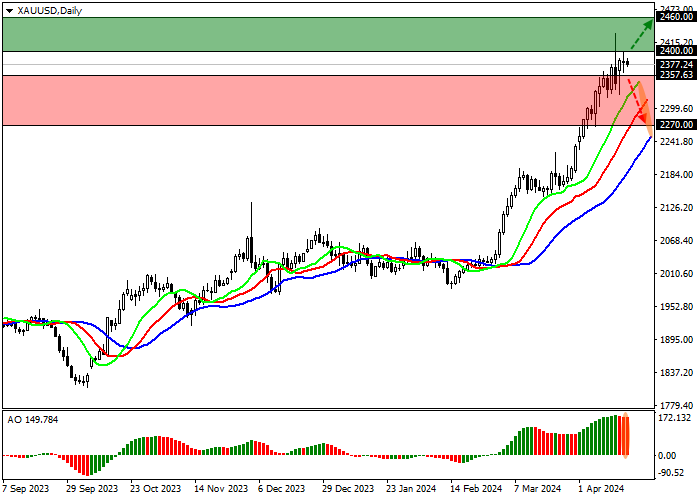

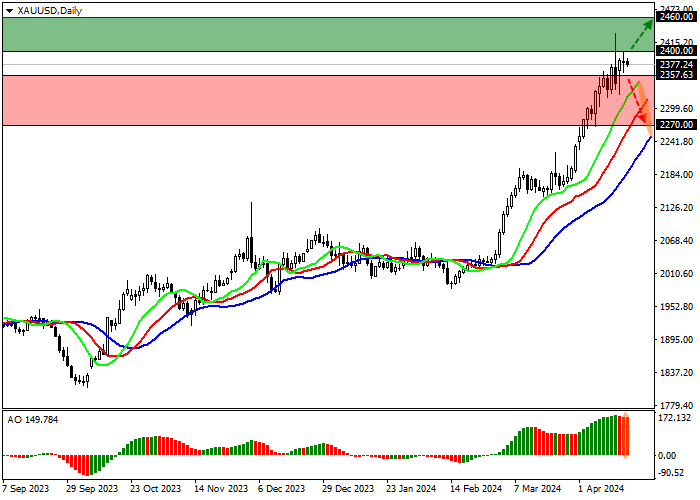

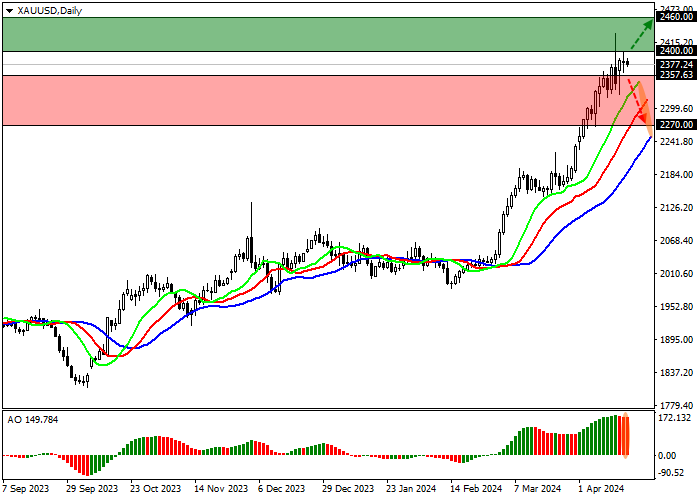

On the daily chart, the trading instrument moves upward from the resistance line of the ascending channel 2270.0–2100.0.

Technical indicators maintain a buy signal: fast EMA on the Alligator indicator are above the signal line, keeping a wide range of fluctuations, and the AO histogram forms corrective bars above the transition level.

Resistance levels: 2400.0, 2460.0.

Support levels: 2357.0, 2270.0.

Trading tips

Long positions may be opened after the price rises and consolidates above 2400.0, with the target at 2460.0. Stop loss – 2360.0. Implementation period: 7 days or more.

Short positions may be opened after the price declines and consolidates below 2357.0, with the target at 2270.0. Stop loss – 2400.0.

Hot

No comment on record. Start new comment.